By Editor,Mike Sheen

Copyright dailymail

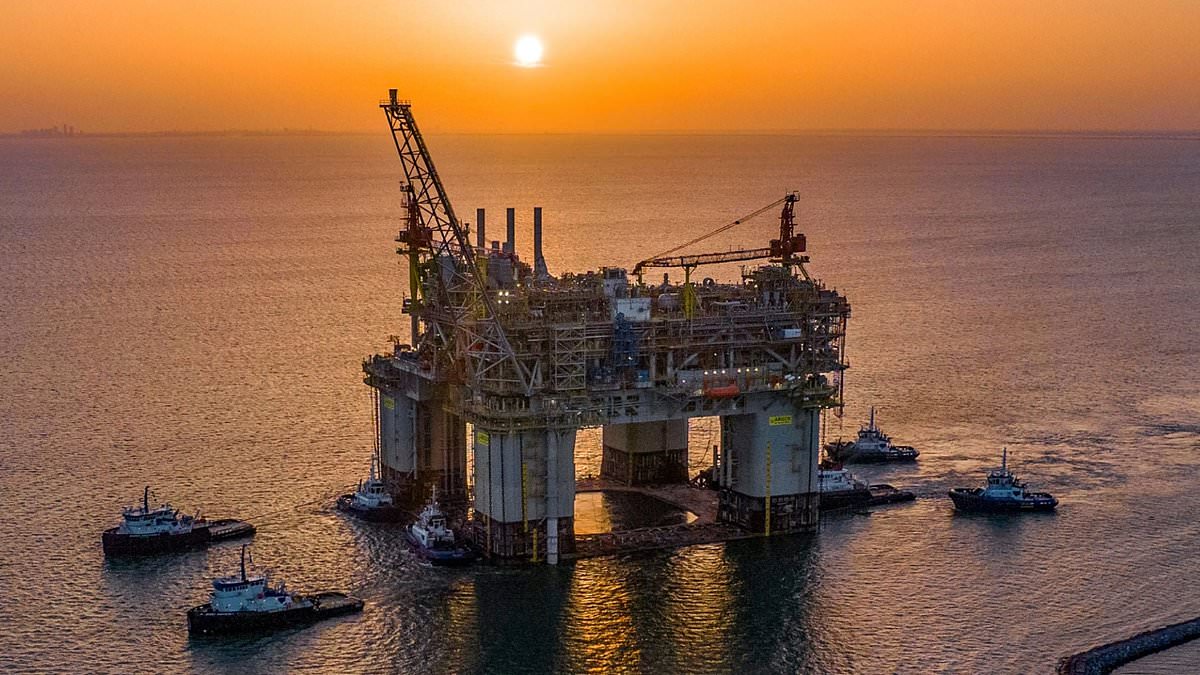

BP will move ahead with a $5billion offshore drilling project as the energy giant continues to re-embrace fossil fuels under chief executive Murray Auchincloss . The group told shareholders on Monday the Tiber-Guadalupe project in the US Gulf of Mexico will have the capacity to produce 80,000 barrels of oil per day when it begins production in 2030.

The new platform will develop the Tiber and Guadalupe fields, located about 300 miles southwest of New Orleans, which are estimated to hold about 350 million barrels of oil equivalent in recoverable resources. It will be BP’s second project in the Gulf to produce from ultra-high pressures of 20,000 pounds per square inch, a breakthrough technological advancement.

BP has been refocusing efforts on its core oil and gas business under Auchincloss as it shuns the course set by his predecessor Bernard Looney, who had ramped-up investment in renewable energy projects like windfarms. The changes come after the energy giant amassed debts and underperformed rivals like Shell and Exxon Mobil in recent years.

It now wants to produce at least 400,000 barrels of oil equivalent per day from the Gulf by 2030, up from 341,000 boepd last year. BP’s annual Energy Outlook, published last week, pushed back the date of expected peak oil demand by five years to 2030 .

The report, which last year predicted demand would peak in 2025, pointed to a slowdown in improvements in energy efficiency that means more oil will continue to be needed.

BP senior vice president Andy Krieger said: ‘Our decision to move forward on the Tiber-Guadalupe project is a testament to our commitment to continue investing in the Gulf of America and expand our energy production from one of the premier basins in the world.

‘Along with its sister project Kaskida, Tiber-Guadalupe will play a critical role in BP’s focus on delivering secure and reliable energy the world needs today and tomorrow.’

BP shares were down 0.9 per cent to 441.65p in early trading, having added around 13 per cent over the last 12 months.