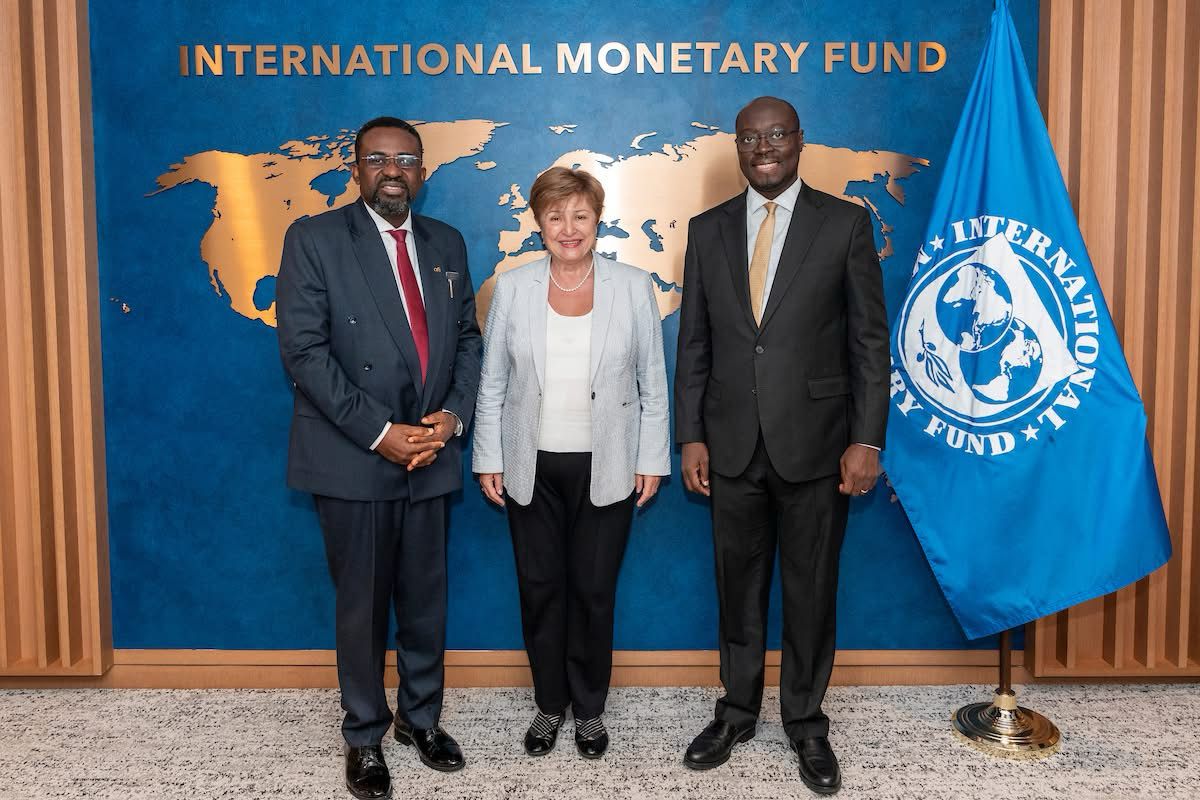

By Abubakar Ibrahim,Mission Chief St

Copyright myjoyonline

The International Monetary Fund (IMF) will today, September 29, begin its fifth review of Ghana’s performance under the Fund Programme.

The full team, led by Mission Chief Stéphane Roudet, arrived in Accra over the weekend. The team will be in the country for two weeks, engaging the technical staff of the Ministry of Finance and the Bank of Ghana.

They will also meet the Governor of the Bank of Ghana, Dr Johnson Asiama, and the Minister of Finance, Dr Ato Forson.

Sources tell Joy Business that unresolved arrears clearance issues will be a key focus. Government is yet to finalise its audit on how much was spent on construction and projects last year.

Concerns are also expected about whether the Bank of Ghana’s recent policy rate cuts are adequate given the sharp fall in inflation, as well as questions on its reserve build-up and dollar interventions.

This review is the penultimate one before Ghana concludes the IMF programme in May 2026.

The final review is scheduled for April 2026. Analysts describe the current review as crucial, warning that Ghana may struggle to maintain fiscal discipline once the programme ends.

Some donor partners are therefore pushing for “shock absorbers” to ensure stability beyond the programme.

Government insists there is no cause for alarm. It maintains that measures are already in place to ensure markets of disciplined expenditure after the IMF exit.

If Ghana passes this review, it is expected to receive about $360 million in October 2025. The country has so far received about $2.3 billion since signing the programme.

Joy Business understands the review will assess Ghana’s economic data up to June 2025. Discussions will focus on inflation trends, reserve sustainability, arrears audits, weak private banks requiring recapitalisation, the state of state-owned banks, revenue shortfalls, arrears build-up in statutory funds, and gaps in social spending.

The IMF Executive Board approved Ghana’s $3 billion Extended Credit Facility in May 2023.

The programme aimed to restore fiscal sustainability through revenue mobilisation and efficient spending, protect the vulnerable, implement structural reforms in tax and energy, and preserve financial stability.

It also sought to curb inflation, rebuild reserves under a flexible exchange rate regime, and create conditions for private investment, growth, and jobs.