By Anthonia Obokoh

Copyright businessday

Nigeria’s crowdfunding sector has transformed from informal savings groups into a multi-billion-naira market that’s putting investment opportunities directly into the hands of ordinary Nigerians.

The breakthrough came in 2021 when the Securities and Exchange Commission (SEC) introduced regulations that legitimised the industry.

This regulatory framework not only attracted licensed platforms and visionary founders, it opened doors for everyday Nigerians to participate in financing opportunities previously reserved for wealthy investors and institutions.

Read also: Former French president, Sarkozy gets five-year jail term in Gaddafi campaign finance scandal

Democratising investment, one small amount at a time

The impact became clear in February 2023 when three SMEs raised ₦100 million within 10 days on Obelix (Monieworx), an SEC-regulated platform. What made this remarkable wasn’t just the speed—it was that 9,324 retail investors participated with average commitments of just ₦10,725. This meant a teacher in Lagos, a trader in Kano, or a civil servant in Port Harcourt could invest alongside larger players in growing businesses.

This growth is unfolding against the backdrop of bold economic reforms aimed at reducing reliance on oil, deepening financial markets, and easing credit constraints for over 40 million small and medium enterprises (SMEs).

From Lagos to Abuja, Ibadan to Port Harcourt, crowdfunding platforms are enabling ordinary Nigerians to move beyond traditional savings accounts and informal investment groups.

They are providing access to opportunities that were once the exclusive domain of banks, venture capitalists, and high-net-worth individuals.

The platform ecosystem

Driving this growth in Nigeria’s alternative finance landscape are five SEC-licensed crowdfunding intermediaries, including Obelix 4.1.1 Alternative Finance Limited (Monieworx), PropCrowdy Limited, GrowthBoosters Intermediary Limited, Maxfund Africa Limited, and Pennytree Business Limited.

These platforms embody a new philosophy: access to capital shouldn’t be reserved for the wealthy or well-connected, but available as a tool for all.

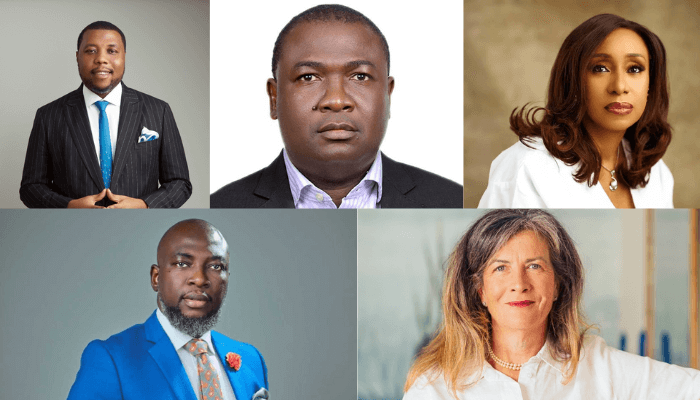

The visionary leaders

Behind this movement are seasoned professionals bringing credibility and experience to position crowdfunding as a serious force within Nigeria’s financial system.

Olumide Soyombo serves as Chairman of the Crowdfunding Association of Nigeria (CfAN) Advisory Council and is widely regarded as the “godfather” of Nigeria’s startup ecosystem. He began with a modest $30,000 investment in Bluechip Technologies, transforming it into a multinational enterprise.

As co-founder of Voltron Capital, he has backed over 60 companies including Paystack (acquired by Stripe for $200 million), Flutterwave, and PiggyVest. A founding member of the Lagos Angel Network, he helped create one of Nigeria’s first structured angel investment platforms. His 2024 appointment to President Tinubu’s Technical Committee on the iDICE programme positions him at the intersection of policy, finance, and innovation.

Ikponmwosa Izedonmwen chairs CfAN’s Board of Trustees, bringing over 25 years of leadership experience across manufacturing, banking, and capital markets. His career spans Procter & Gamble, Citibank, First Bank, FSDH Merchant Bank, and Verdant Capital.

As a Chartered Accountant with expertise in mergers, acquisitions, and corporate finance, he ensures CfAN upholds the governance standards essential for investor trust in an industry where credibility is paramount.

Dr. Roland Igbinoba serves as Vice Chairman of CfAN’s Board of Trustees and founder of PropCrowdy, Nigeria’s leading SEC-approved real estate crowdfunding platform serving over 20,000 investors.

With a doctorate from Cranfield School of Management and Harvard Graduate School of Design alumni status, plus experience as CEO of FHA Mortgage Bank and Deputy President of the Mortgage Bankers Association of Nigeria, he has opened real estate investment opportunities to everyday Nigerians who were previously excluded from property markets.

Ololade Adesola holds the position of 2nd Vice Chairman of CfAN’s Board of Trustees, combining 25+ years in banking and consulting with pan-African development experience. After managing assets exceeding $150 million at Zenith Bank, she founded L.A. Consult, executing projects for GIZ, Mastercard, and Opportunity International. Her advisory work spans the African Development Bank and NEPAD.

As a Fellow of the UK Microfinance Association and its Nigeria country representative, she advocates for crowdfunding as a bridge between investors and underserved entrepreneurs across Africa.

Read also: Accra to host 9th Ghana International Trade & Finance Conference with focus on debt sustainability

Tamsin Freemantle brings international perspective as Vice Chair of CfAN’s Advisory Council and President of the South Africa–Nigeria Business Chamber. Her career spans retail banking, capital markets, and leadership roles at the Johannesburg Stock Exchange where she spearheaded African expansion.

She has worked with the African Crowdfunding Association and FSD Africa, advising on frameworks that attract international liquidity into African markets, helping position Nigerian platforms for regional and global relevance.

This transformation reflects more than just financial innovation,it represents a fundamental shift in who gets to participate in Nigeria’s economic growth.

These platforms and leaders are proving that access to investment opportunities shouldn’t be determined by wealth or connections, but should be available as a tool for all Nigerians looking to grow their savings and participate in their country’s development.