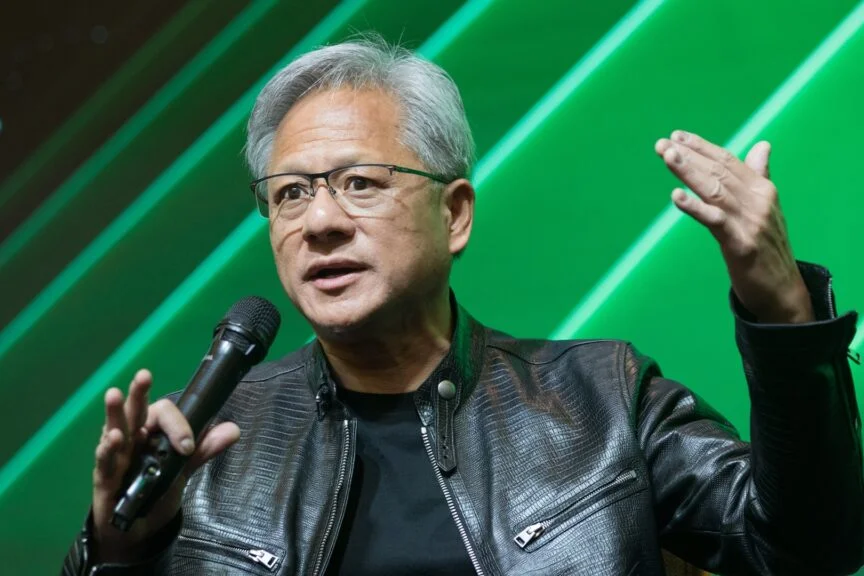

Jensen Huang Calls OpenAI The Next Multi-Trillion-Dollar Hyperscaler As Nvidia Pledges $100 Billion: ‘This Is Some Of The Smartest Investment…’

Nvidia Corporation (NASDAQ: NVDA) CEO CEO Jensen Huang said OpenAI is on track to become the world’s next multi-trillion-dollar hyperscaler, defending his company’s decision to invest up to $100 billion in its infrastructure buildout.

Huang Defends Massive OpenAI Partnership

Speaking on the Open Source podcast with Bill Gurley and Brad Gerstner that was posted earlier this week, Huang described OpenAI as a once-in-a-generation opportunity.

“OpenAI is likely going to be the world’s next multi-trillion-dollar hyperscale company,” Huang said. “If that’s the case, the opportunity to invest before they get there, this is some of the smartest investments we can possibly imagine.”

He explained that Nvidia’s role goes far beyond selling chips.

The company will work with OpenAI “at the chip level, at the software level, at the systems level, at the AI factory level” to help it build and operate hyperscale AI infrastructure.

See Also: Intel Wraps Up Altera Stake Sale In Bid To Streamline Business

Partnership Details: From Azure To Stargate

Huang said Nvidia is already collaborating with OpenAI across multiple projects, including Microsoft Corporation’s (NASDAQ: MSFT) Azure expansion, Oracle Corp’s (NYSE: ORCL) OCI buildout and CoreWeave’s (NASDAQ: CRWV) infrastructure scaling.

The new commitment adds to those deals, supporting OpenAI as it builds self-operated data centers at unprecedented scale.

For the unversed, Nvidia and OpenAI have announced plans to deploy at least 10 gigawatts of Nvidia-powered systems beginning in 2026.

That infrastructure could require up to 5 million GPUs and potentially generate $300 billion to $500 billion in long-term revenue, according to Wall Street estimates.

Skeptics Raise ‘Circular Investment’ Concerns

Some analysts have questioned whether Nvidia’s deal amounts to demand engineering, since OpenAI will buy massive amounts of Nvidia hardware with the help of Nvidia’s funding.

Bernstein analyst Stacy Rasgon acknowledged the “circular” concerns but said demand remains strong enough to ease fears for now.

Bank of America analysts projected Nvidia could earn three to five times its $100 billion investment, while Evercore’s Mark Lipacis boosted his price target to $225, arguing Wall Street still underestimates the company’s growth trajectory.

Nvidia’s market capitalization now stands at $4.33 trillion, with shares gaining 46.73% over the past year and rising 28.83% so far in 2025, according to Benzinga Pro.

Benzinga’s Edge Stock Rankings indicate that NVDA continues to trend higher across short, medium and long-term periods, with additional performance details available here.

Photo courtesy: jamesonwu1972 / Shutterstock.com

Read Next:

Cathie Wood Dumps Palantir As Stock Touches Peak Prices, Bails On Soaring Flying-Taxi Maker Archer Aviation