By Our Correspondent

Copyright pakobserver

ISLAMABAD – The Central Directorate of National Savings has announced another decrease in profit rates for its various schemes.

The new rates have come into effect from September 17 as they were decreased by up to 42 basis points.

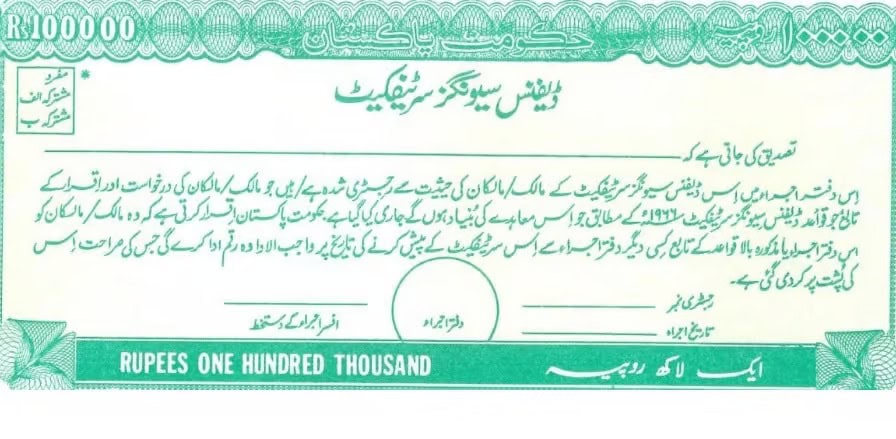

The directorate has revised down the rates of various products including the Defence Savings Certificates.

Defence Savings Certificates

The scheme is specifically designed to help citizens—both in Pakistan and abroad—make the most of their savings over time.

The Defence Savings Certificates are available in a wide range of denominations to suit various financial capacities, including Rs. 500, Rs. 1,000, Rs. 5,000, Rs. 10,000, Rs. 50,000, Rs. 100,000, Rs. 500,000, and Rs. 1,000,000.

This flexibility allows investors to start small or invest larger amounts based on their goals and resources.

The scheme is open to adult Pakistani nationals, overseas Pakistanis, those holding valid NICOP or POC and minors, either independently with a guardian or in joint investments with adults or other minors.

Defence Savings Certificates can be purchased through any National Savings Centre (NSC), authorized branches of scheduled banks and the State Bank of Pakistan (SBP).

Defence Savings New Profit Rates from September 17

The Qaumi Bachat Bank has fixed the profit rate at 11.42 percent compared to previous 11.54%. Following are the profits that a person can earn on investment Rs100,000 until 10 years maturity:

First Year Rs109,000

Second Year Rs119,000

Third Year Rs130,000

Fourth Year Rs143,000

Fifth Year Rs158,000

Sixth Year Rs177,000

Seventh Year Rs200,000

Eighth Year Rs227,000

Ninth Year Rs258,000

Tenth Year Rs295,000

Taxation on Profit

The taxes and Zakat are deducted on the profits in line with the policy of the State Bank of Pakistan. The withholding tax for filers has been fixed at 15 percent while it is 35 percent for non-fielders.

The National Savings has also decreased the profit rates for Short-Term Savings Certificates 10.42%, Serwa Islamic Saving Account to 9.92% and Serwa Islamic Term Account: 9.92%.