By Sajid Salamat

Copyright dailytimes

Published on: September 27, 2025 7:45 AM

“Accountability breeds Response-ability”, the words of Stephen Covey explain the various sustainability reports, ESG reports, UN-SDG mapping, and other publicly available data sources designed to establish an organisation’s environmental & social legitimacy in the eyes of stakeholders. These disclosure mechanisms are one of the best ways to distinguish green management from greenwashing. When a company publishes clear, comparable, third-party-verifiable information about its climate exposures, GHG emissions, transition plans and governance, stakeholders can separate genuine commitments from marketing spin. When a new business ideology enters the market, it is first followed by voluntary disclosure, as some firms lead by example, and over time, disclosure becomes formalised and finally mandatory. Corporate Social Responsibility (CSR) began with voluntary statements, matured into best practice reporting frameworks, and in many countries evolved into mandatory disclosures and governance obligations. The same arc can be witnessed for sustainability and climate change-related policies and initiatives.

Corporate Social Responsibility (CSR) began with voluntary statements, matured into best practice reporting frameworks, and in many countries evolved into mandatory disclosures and governance obligations. The same arc can be witnessed for sustainability and climate change-related policies and initiatives.

Early frameworks such as the Global Reporting Initiative (GRI) focused on broad environmental and social performance; the Task Force on Climate-related Financial Disclosures (TCFD) added a forward-looking, risk-and-scenario lens; and more recently, the IFRS Foundation’s International Sustainability Standards Board (ISSB) has published IFRS S1 & S2 to create a single, investor-focused baseline for sustainability-related financial disclosures. These developments reflect a global shift from voluntary reputational reporting to standardised, decision-useful disclosures intended to be comparable across markets and auditable alongside financial statements. IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures) have been designed to bring investor-focused, decision-useful sustainability information into the mainstream of corporate reporting. The corporate sustainability landscape is also evolving in Pakistan, and the Securities and Exchange Commission of Pakistan (SECP) has issued ESG disclosure guidance, launched an “ESG Sustain” platform to centralise guidance and disclosures, and initiated outreach and surveys on adopting the IFRS sustainability standards. The State Bank of Pakistan (SBP) is working alongside the issuance of SBP’s green banking guidelines, Environmental & Social Risk Management (ESRM) Implementation Manual, and the recent work on a national green taxonomy.

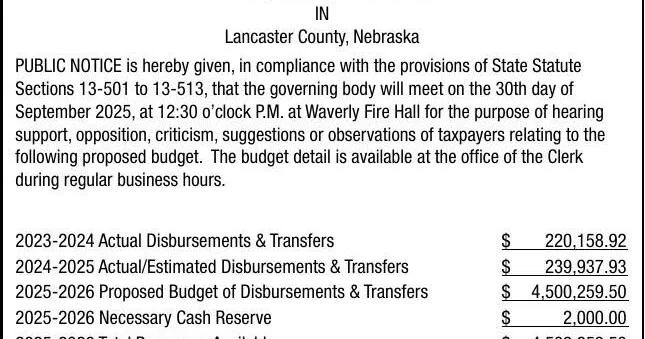

On 31 December 2024, the SECP mandated the application of IFRS S1 and IFRS S2 for listed companies and SECP-licensed non-listed Public Interest Companies through a phased approach. Pakistan has started on the path of sustainable development and disclosure, but several obstacles may impede this green transformation. The first and foremost being capacity shortages and skills mismatch. Preparing IFRS-aligned sustainability reports requires new cross-disciplinary skills, individuals who have knowledge of both finance and sustainability. This green capability gap leads to another issue in the form of data and measurement gaps. IFRS S1 & S2 mostly require entity-level quantitative data such as financed emissions, energy consumption, scope-related exposures, etc. In Pakistan, reliable baseline data, especially on emissions across supply chains (scope 3), is mostly unavailable. Many organisations are lacking both the skill set and the infrastructure to support this type of sustainability disclosure. Implementing IFRS S1/S2 can be expensive since investment in IT systems, consultancy, third-party data purchases and assurance will create significant costs, especially for SMEs. Various industrial sectors in Pakistan are still energy and carbon-intensive, and sustainability disclosure at this point can draw criticism; yet, without affordable transition finance, many firms will be unable to convert disclosure into real decarbonization.

It is required that all the concerned regulators, including the SECP, SBP, and ministries, work closely with the private sector to ensure the required capacity building across industries. The phased approaches announced must be carefully synchronised with capacity building. Furthermore, aligning the SBP green-banking guidance with IFRS S2 climate disclosures will help link lending practices to disclosure needs. Issuance of sectoral annexes describing material topics, suggested metrics, and typical data sources for different sectors, such as textiles, agriculture, power generation, mining, and financial services, will reduce ambiguity. If implemented properly, sustainability disclosure can serve as a campus pointing us towards the path to a more resilient, prosperous, and sustainable future.

Dr Syed Asim Ali Bukhari is working as SVP / Unit Head – ESG at The Bank of Punjab, and Dr Syeda Nazish Zahra Bukhari is working as an Assistant Professor at the University of the Punjab.