BAILLIE GIFFORD AMERICAN FUND: Mega rebound from US fund that wants to look tech titans in the eye

By Editor,Jeff Prestridge

Copyright dailymail

The mission of fund Baillie Gifford American is to invest in some of the most exciting growth companies in the United States and generate exceptional long-term returns.

It’s an objective it has fulfilled since launch in mid-1997, although this doesn’t mean the £3.2 billion fund is immune from wobbles.

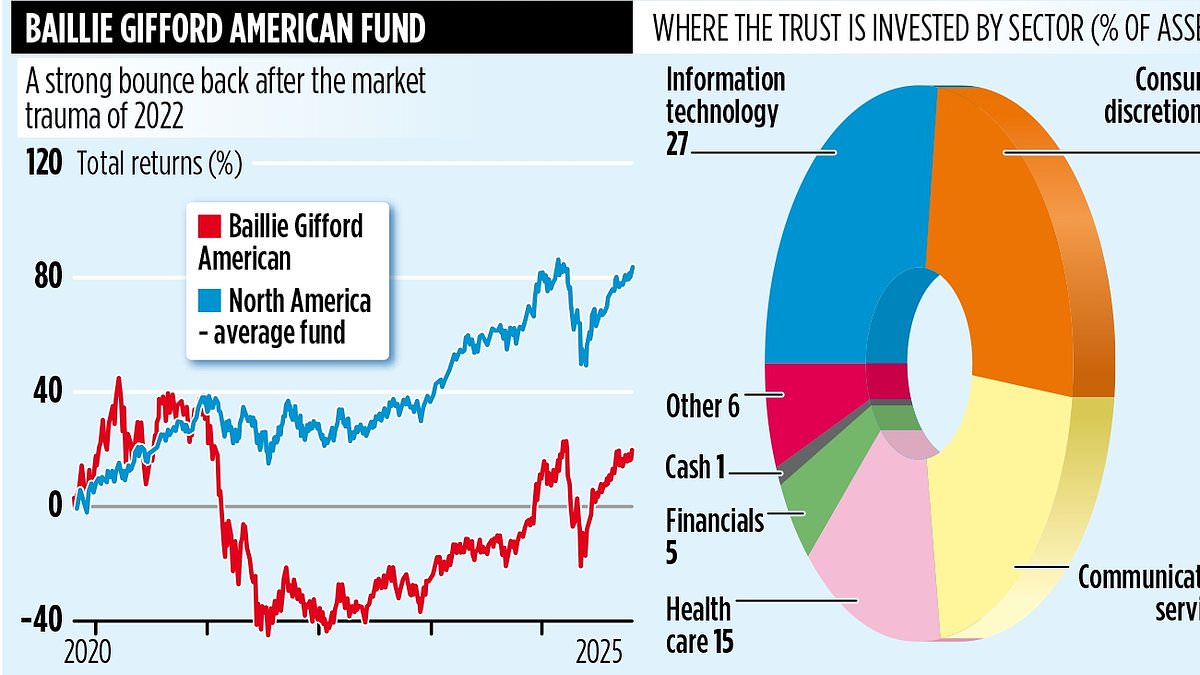

So while ten-year returns of close to 431 per cent are outstanding, the fund’s performance was impaired in 2022 by the rise in US interest rates and inflation – and resulting economic uncertainty.

Shares in many growth-focused US companies fell sharply, although they have bounced back.

The result is that the fund’s five-year returns of 19 per cent are inferior to both the one- and three-year numbers – respective gains of 29 and 73 per cent.

Kirsty Gibson, one of four managers overseeing the 50-stock portfolio, admits its performance is ‘volatile’ and that the fund is best held as a long-term investment.

She adds: ‘When we invest in US businesses, it’s with a five- to ten-year time horizon in mind. Our average holding period for individual stocks is around seven years and investors should look at the fund with a similar perspective.’

Over the past seven years the fund has delivered returns of around 130 per cent.

Its growth focus points it in the direction of some of the US’s mega tech companies – Amazon, Meta and Nvidia are top-ten holdings.

Yet there are other company characteristics which run through the portfolio.

Gibson says: ‘Some 70 per cent of the companies we invest in are either led by their founders or the founders still have a stake in the business. What we like is that these individuals have created a distinct culture and a long-term vision for their businesses, which invariably aligns with our interests as long-term investors.’

Among these founder-led businesses is delivery company DoorDash, one of the fund’s biggest holdings at 4.3 per cent. It’s run by co-founder Tony Xu whom Gibson met earlier this month while attending an investor conference in San Francisco. ‘It’s imperative we get access to key individuals such as Tony Xu so that we can build strategic relationships and better understand the culture of the businesses we are invested in,’ explains Gibson.

‘In the United States, DoorDash is on a mission to deliver everything – be it food, groceries or retail essentials – to anyone who lives in a city.’

Software company Cloudflare, another key holding, is run by co-founder Matthew Prince who Gibson says has a ‘clear vision’ for the business with a big focus on artificial intelligence.

Although the fund’s approach is about identifying long-term opportunities, the managers keep a close eye on the resilience of its holdings when obstacles get in the way– for example, the decision of President Donald Trump to impose tariffs on imports. Concerns over a resulting tail off in US consumer spending has meant the fund trimming – not exiting – some holdings such as Tesla and digital marketing specialist The Trade Desk.

While the fund is managed out of Edinburgh, the investment team regularly crosses the Atlantic to visit companies.

Gibson says: ‘Being based in the city means we have space and time to think and not get too caught up in the excitement that swirls around many of the high-growth companies we invest in.’

All the fund’s holdings are listed companies, unlike sister investment trust Baillie Gifford US Growth which has 36 per cent of assets in unquoteds.

Total annual fund charges are competitive at 0.52 per cent.