By Contributor,William Dunkelberg

Copyright forbes

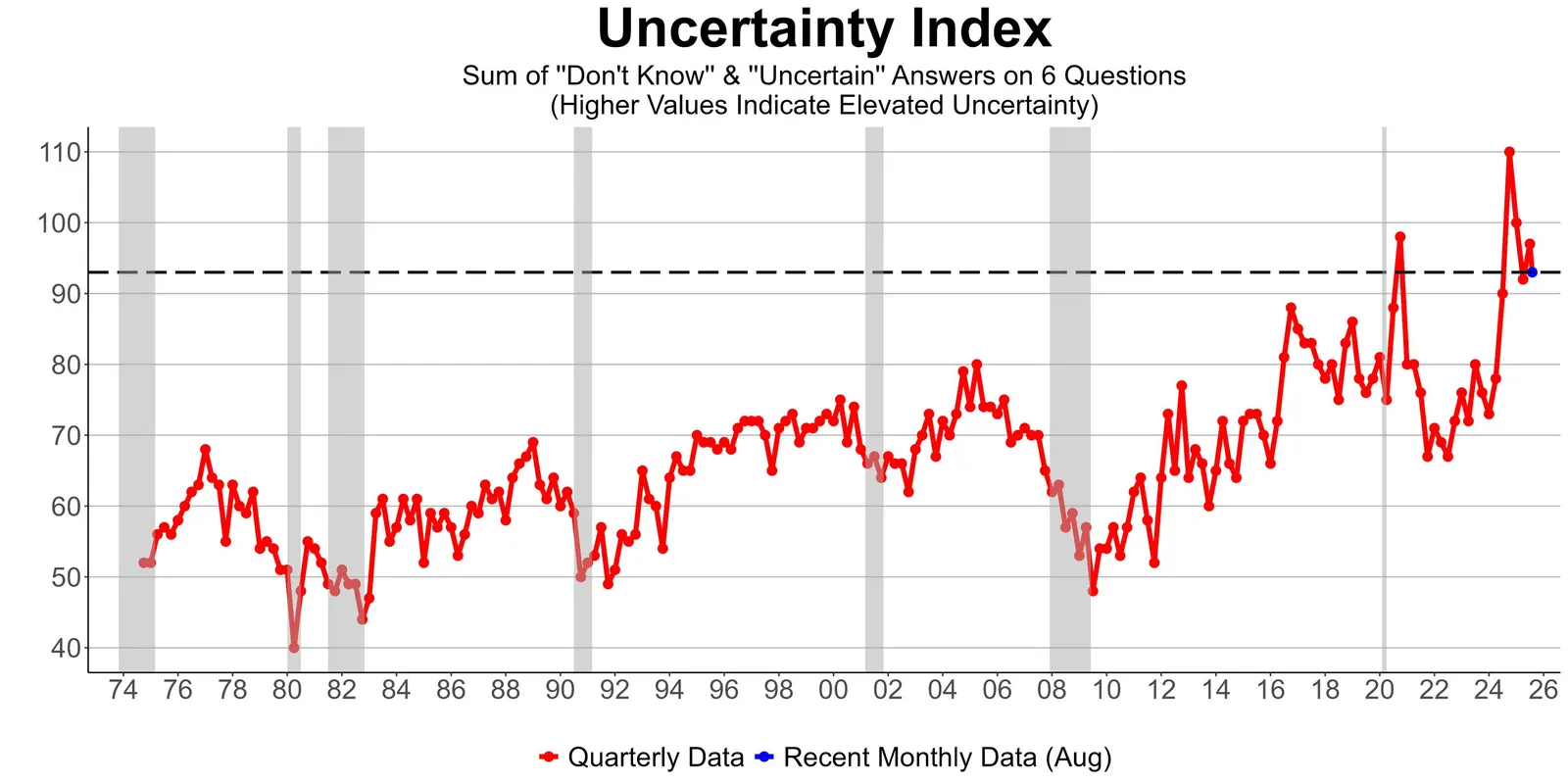

Small business owners are feeling fairly comfortable on Main Street, although their level of uncertainty remains historically very high. NFIB’s Uncertainty Index has averaged 66 since 1974, peaked at 110 in October 2024, and recently dropped to 93. There are many essential policies to resolve, and new tax provisions to implement.

Uncertainty Index. NFIB Small Business Economic Trends

In August, most small business owners (68%) reported that their firm was in decent condition (excellent or good). Twenty-seven percent reported “fair,” and only 4% reported their health as “poor.” Firms in the wholesale trades industry most frequently reported being in excellent health (20%), followed by firms in the service sector and the professional services (18%). Virtually no owners in the finance and professional services industries reported being in “poor” health.

Small Business Health Report for Main Street. NFIB Small Business Economic Trends.

The stock market is at record-high levels, generating substantial capital gains for sellers and boosting consumer spending. Although small firms are not publicly traded, their current condition is driven by the same economic forces (e.g., consumer spending, interest rates, government spending, etc.). The balance of the year will be filled with events, reducing economic uncertainty. Growth may be weak, but a true recession is unlikely to occur.

Editorial StandardsReprints & Permissions