By Enoch Yiu

Copyright scmp

Hong Kong’s monetary authority will launch a Renminbi (RMB) Business Facility from next month to support banks in offering yuan loans to companies, a move that aims to promote trade finance and direct investment as the city strengthens its role as an offshore yuan hub.

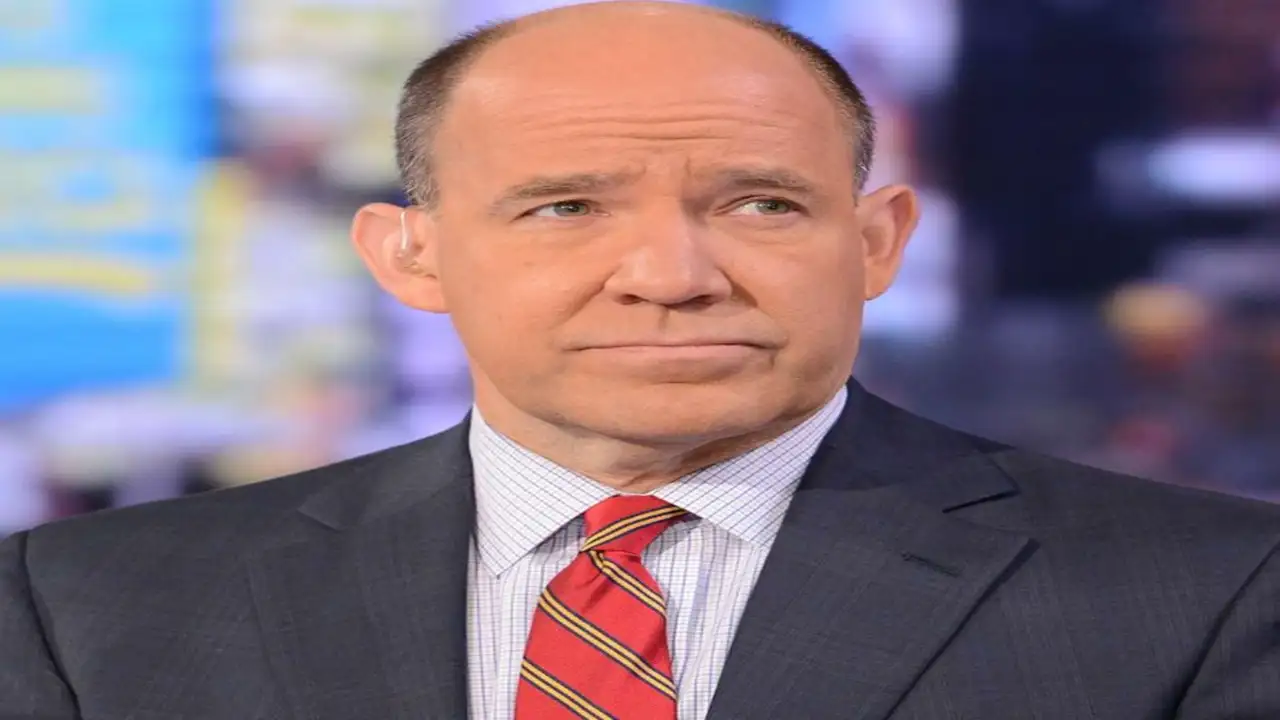

The new facility would replace the 100 billion yuan (US$14 billion) in trade finance liquidity introduced in February, with several major enhancements to be rolled out in the following months, said Eddie Yue Wai-man, chief executive of the Hong Kong Monetary Authority (HKMA).

“The potential usage of the RMB Business Facility by participating banks in the facility is significantly broader than that of the RMB trade-finance liquidity facility, hence further strengthening Hong Kong’s leading position as the global offshore yuan business hub,” Yue told hundreds of bankers at the Treasury Markets Summit on Friday.

He said the facility would encourage more companies in mainland China and other overseas markets to use Hong Kong as a base to manage their corporate treasury activities and their regional business.

Separately, the HKMA and the People’s Bank of China, alongside other mainland authorities, on Friday launched the cross-boundary bond repurchase (repo) business as the latest move to enhance the bond connect scheme.

Under this measure, all overseas institutional investors putting money into the onshore bond market – including those trading via the bond connect scheme – would be allowed to participate in the onshore repo business and to remit the yuan obtained for offshore use.

“This measure will bolster offshore yuan liquidity in Hong Kong, increase overseas investors’ interest in allocating yuan assets, and promote more diversified development of offshore yuan businesses,” Yue said.

HSBC Holdings, Standard Chartered Bank and Bank of China (Hong Kong) are among the 24 lenders with access to the 100 billion yuan trade-financing facility launched in February, allowing them to obtain stable yuan to finance their customers’ trade-financing needs.

Under the current scheme, banks can get funding from the facility at a cost based on the onshore yuan interest rate plus a 25-basis-point premium to support trade settlement for their customers, who can arrange funding for one, three or six months.

Because the scheme had performed smoothly, the authority would introduce the RMB Business Facility as an upgraded version to support more banks in offering more yuan loans, allowing their clients to finance more activities at a lower cost, Yue said.

From October 9, the new facility would remove the 25-basis-point premium, which meant the borrowing cost would be the same as the onshore-yuan interest rate, Yue said.

The tenor would also be extended, allowing corporate customers to choose a one-year loan, in addition to the existing one-, three-, and six-month options, he added.

The new facility would also expand participation by allowing Hong Kong-based lenders to tap into the facility to extend loans through their overseas units, Yue said.

From December 1, the second stage of enhancement would broaden the scope from trade finance to direct investment, Yue said, adding that this was the most important enhancement because it would allow the yuan to support the real economy.

Examples of direct investment would include mainland companies that required yuan loans to invest overseas, or foreign companies that were seeking yuan funding to expand in mainland China, according to a circular issued by the HKMA on Friday.

In the third phase, starting from February 2, the collateral management of repo transactions would be moved from a manual process to a more automated solution, the HKMA said.

The yuan was the second most-used currency in global trade finance as of August, with a 7.6 per cent share, second only to the US dollar at 81.4 per cent, according to Swift, the banking industry’s messaging network system. The yuan’s share was 6 per cent in December and 2.1 per cent four years ago.

Hong Kong is the world’s largest offshore yuan trading hub, with 938.2 billion yuan worth of deposits at local lenders as of the end of July, while the total remittance of yuan for cross-border trade settlement amounted to 1.24 trillion yuan in July, according to data from the HKMA.

The Hong Kong Association of Banks (HKAB), the industry body for local lenders, welcomed the new move.

“The new facility will allow banks to be more flexible in managing their yuan liquidity,” said HKAB chairwoman Mary Huen Wai-yi, who is also Hong Kong head of Standard Chartered.

“HKAB will continue to encourage the industry to explore and expand their offshore yuan business, and to work with regulators to study new use cases, speed up the internationalisation of the yuan and strengthen Hong Kong’s role as the largest offshore yuan trading centre worldwide.”

The facility would provide longer-term yuan funding for companies to settle trade, daily operations and capital expenditures, said Frank Fang, head of commercial banking for Hong Kong and Macau at HSBC, the city’s largest commercial bank.

“Today’s announcement marks another positive step in solidifying Hong Kong’s position as a premier offshore yuan centre and an international funding hub,” Fang said. “The new arrangement, with enhanced terms and an extended scope of eligible yuan financing activities, is expected to be well received by the market.”

The expanded facility would further promote the use of the yuan in business, while banks in Hong Kong would be better able to help mainland enterprises expand globally, he added.