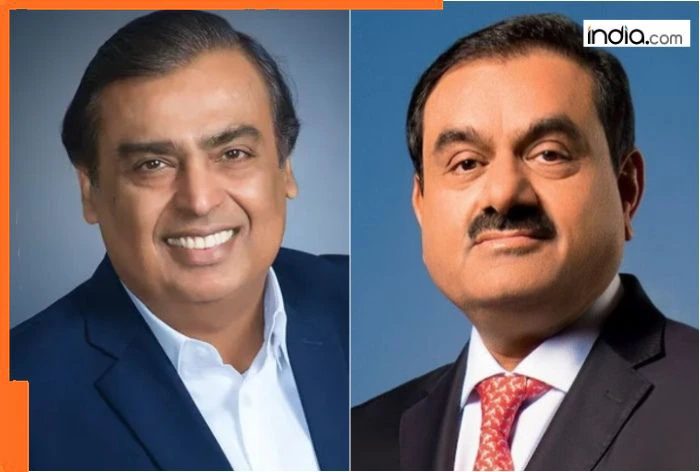

Mukesh Ambani vs Gautam Adani: Ambani and Adani face off near Pakistan border to…, who will win the..

By Analiza Pathak

Copyright india

Mukesh Ambani and Gautam Adani India’s two biggest business tycoons are locked in a fierce competition in the energy sector. Their rivalry has now reached close to the Pakistan border i.e. in the Rann of Kutch Gujarat. Both groups are racing to dominate the new energy business a market worth billions of dollars. Reliance Industries (RIL) led by Mukesh Ambani has acquired 550000 acres of land an area so large it could fit three Singapore cities. Right next to it the Adani Group’s renewable energy companies own 460000 acres of land. Both sides are working to turn this barren land into what insiders call a “green goldmine” which they believe could transform India’s energy landscape.

Reliances Rs. 75000 crore investment

According to The Economic Times Reliance is investing Rs. 75000 crore in the new energy sector. The money will go into solar PV manufacturing battery cells electrolyzers and green hydrogen production. Adani is making similar moves putting money into integrated solar PV manufacturing wind turbines electrolyzers and renewable power generation.

Who will lead?

Nikhil Nigania from Bernstein said that Reliance may take the lead in manufacturing data centers and hydrogen while Adani could stay ahead in renewable energy sales thermal power and transmission.

In fact Jefferies’ analyst Chris Wood has already sold Reliance shares and bought Adani shares signaling a shift in investor confidence.

Big earnings expected for Reliance

Bernstein estimates that if Reliance’s plans succeed producing 3 million tons of hydrogen could generate USD 7-8 billion in EBITDA (earnings before interest taxes depreciation and amortization). In addition a 55 GW solar + BESS (battery energy storage system) setup could bring in another USD 5-6 billion in EBITDA. However achieving this will require massive investments.

Ambani vs Adani: Whos stronger?

Both companies control nearly equal land in the Rann of Kutch. According to Bernstein the next largest player has only one-tenth of their combined land.

In terms of transmission connectivity the Adani Group has the edge.

Reliance benefits from lower borrowing costs.

Adani currently leads in manufacturing but Reliance’s plans are bigger and more ambitious. Bernstein is keenly watching Reliance’s capacity-building moves.

In renewable energy generation and sales Adani is ahead with strong connectivity and attractive PPAs (power purchase agreements). Bernstein notes that Adani could earn higher profits from selling renewable energy while Reliance may face challenges in transmitting electricity from the grid.

Where does reliance leads in renewable energy?

The future of green hydrogen and data centers is uncertain for both companies because it depends on falling hydrogen costs and government policies. However Reliance has an advantage because it can use hydrogen in its refineries. It is already India’s largest user of grey hydrogen.

In data centers Reliance also benefits from partnerships with Google Meta and telecom companies.

Where Adani stands?

Adani has long-standing experience in thermal power and transmission. During the industry downturn it bought distressed thermal assets and secured orders with suppliers like BHEL and L&T.

What are their plans?

Setting up a 10 GW integrated polysilicon-to-module manufacturing plant in Gujarat which could expand to 20 GW.

The plant will focus on HJT technology and eventually use perovskite tandem cells boosting efficiency above 30 per cent.

Planning to start production in 2026 along with a 40 GWh battery gigafactory making it India’s first major company to focus on energy storage at this scale.

Developing 30 GW of renewable capacity out of its 50 GW plan in Green Khavda.

The project schedule aligns with commissioning timelines.

The site has India’s second-best solar radiation levels after Ladakh ideal for solar energy production.