By Contributor,R. Scott Raynovich

Copyright forbes

Every day we are seeing huge numbers being invested in datacenters for AI and the results on stock prices, but the truth is that the development of the AI market is more nuanced than that. While much of the attention is on the huge buildout in supply, less attention has been focused on the demand side.

After all, if you build it, you need to ask how fast they will come. Consumers and enterprises are indeed experimenting with AI in record numbers, but the business models are not fully formed. We have been tracking enterprise deployments in detail and we have gathered enough data to show how it’s being deployed.

Ignore Big Headlines, Focus on Use Cases

First of all, I think you should ignore the large headlines about the investments. In fact, some of the promises are not even guaranteed. And that’s not how technology markets unfold. As the AI bubble builds, the news flow is focused on the hundreds of billions of dollars being deployed in datacenters. But that’s part of the process. Remember, the Internet bubble built and then popped from 1996-2001, but Google went public in 2004 and then cloud was born as an outgrowth of the Internet—many years after the initial surge and burst. Amazon was an online book seller in 1999, but a hyperscaler by 2015. Large tech cycles play out in decades, not years.

There is no doubt that use of Gen AI has gone mainstream—for both consumers and enterprises. But so far, the market adoption rates are still quite small and there are questions about whether large AI firms can turn a profit with the huge cost of delivery. For example, OpenAI has $20 billion a year in estimated annual revenue, but it is estimated to be losing billions of dollars a year (the company is private). Let’s compare that to hyperscaler Microsoft, which has about $300 billion in revenue and $100 billion in annual profit. For these massive infrastructure investments to pay off, demand must scale to consume the massive supply. And here, enterprise demand will be key.

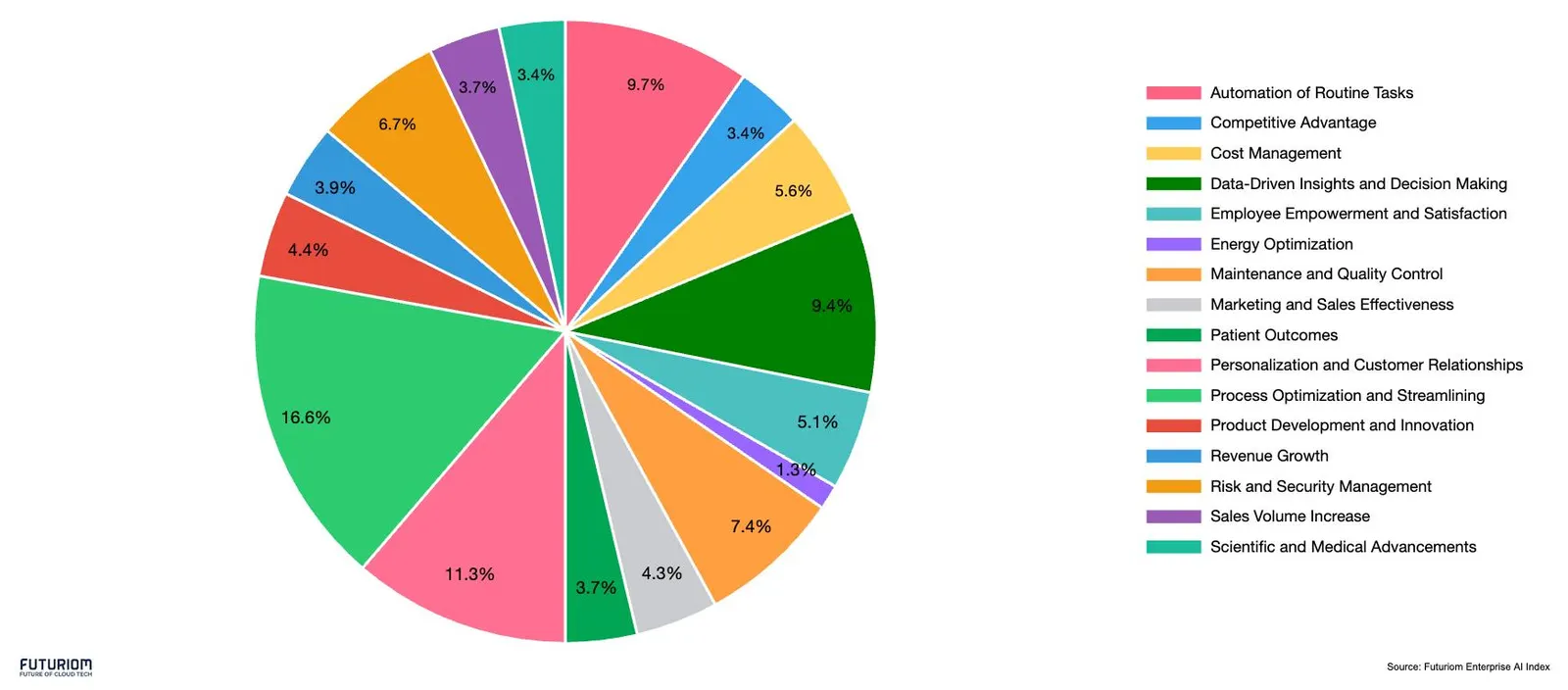

What we have found so far is that enterprises are focused on tactical use cases for AI—automating routine tasks, data-driven decision making, energy optimization, and predictive maintenance, to name just a few. In the chart below, we have tracked the most common AI use cases in 150 enterprise AI case studies we have analyzed. This is part of our AI Enterprise Index database.

The Futuriom Enterprise AI Index shows wide adoption of AI for tactical, specific use cases.

Futuriom Cloud Tracker Pro

MORE FOR YOU

Private Enterprise AI Will Be Big

Another trend is already clear: Proprietary or private AI platforms are taking off in enterprises. Our data shows that it’s the most common approach. The reasons are clear: Organizations want to own and protect their own data. When you slice by industry, this is especially important in data-sensitive industries such as healthcare and financial services.

Enterprises are using many AI services and platforms, but proprietary approaches are the most popular.

Futuriom Cloud Tracker Pro

An example of the trend toward proprietary AI platforms in finance is Bloomberg. The company created its own AI model, BloombergGPT, and it has generated a proprietary platform around it for regulatory compliance and security. The model has added significant features to Bloomberg’s Terminal service, including natural language search, news and earnings report summarization, chat assistants for navigation, and risk and trend analysis. These capabilities are further supported by a BloombergGPT API available to external developers.

Another example: Goldman Sachs. The financial services firm created its own GS AI Platform to ensure centralized control over all its AI applications. The platform serves as a base for development using a variety of vendor-specific or external models, including OpenAI’s ChatGPT-3.5 and GPT-4, Google’s Gemini, Meta’s Llama, and models from Anthropic, Cohere, and Mistral. Having a proprietary platform gives developers a single starting point and context for creating applications and allows them to shift between models securely and in compliance with regulations.

According to our research, the top four top vertical markets for enterprise AI—financial services/insurance, healthcare, retail, and manufacturing—prefer proprietary AI platforms as a group, though other platforms are popular as well, most notably ChatGPT and other OpenAI models.

There are several reasons for this, but as noted above, security and compliance top the list. Companies in healthcare in particular opt for proprietary AI platforms and models to ensure alignment with stringent rules governing confidentiality and patient information in the sector.

The New AI Platform Leaders

Tracking the leaders of the AI platforms is interesting. Every new tech supercycle creates more giants. The cloud brought us Amazon and Google, in addition to tech incumbents such as Microsoft and Oracle. With AI, we have all of those large players and new ones such as Anthropic, CoreWeave, and OpenAI.

It’s clear from our research that the most dominant AI companies, including Amazon, Microsoft, OpenAI, and Google, already have huge share in many of these markets. But it’s also clear that there is a huge number of specialized models and that proprietary and private AI will play a big role in how enterprises deploy the technology.

In our sample of platforms, proprietary AI is leading the charge—which means good things for the large vendors that help them build these platforms, such as Arista Networks, Broadcom, Cisco, NVIDIA, HPE, IBM, and many others. In addition, the major AI services are making their mark. These include Microsoft Azure AI, Amazon Bedrock, OpenAI, NVIDIA, and IBM, to name a few.

Over time, I’ll publish more deep dives from our data about how enterprise AI is evolving. As the AI datacenter market explodes, the key to success will be tracking how enterprises fill up these datacenters with demand.

Editorial StandardsReprints & Permissions