By Francis

Copyright thebftonline

The Bank of Ghana’s latest survey suggests that owing to the fall in inflation and overall cedi-appreciation since beginning of the year, businesses and consumers are reporting their strongest levels of optimism in years about the economy.

BoG’s latest survey shows consumer confidence at 116.9 in August, just below a mid-year peak of 119.2 and markedly higher than 81.2 a year earlier.

Similarly, business confidence rose to 107.5 from 88.8 over the same period as most firms met short-term targets and voiced optimism about prospects for their industries.

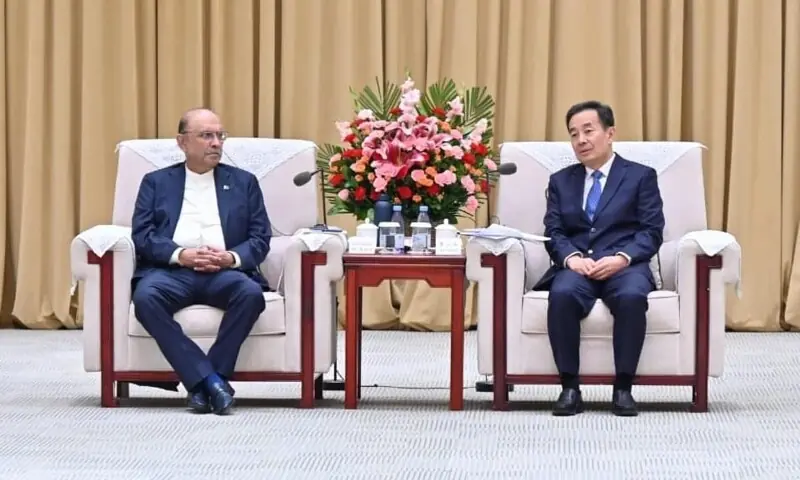

Indeed, Governor Johnson Pandit Asiama noted at the recent central bank 126th Monetary Policy Committee meeting that the economy continues to demonstrate strong growth, driven largely by the services and agriculture sectors.

Gross domestic product expanded by 6.3 percent in second-quarter 2025 compared with 5.7 percent for the same period a year earlier. Non-oil GDP rose by 7.8 percent, with services expanding 9.9 percent and agriculture by 5.2 percent.

High-frequency indicators also point to improving conditions. The Composite Index of Economic Activity recorded annual growth of 6.1 percent in July, up from 1.9 percent a year earlier and reflecting stronger trade, household spending and industrial output. The country’s Purchasing Managers’ Index also increased in August, signalling a rise in new orders.

The disinflation trend has been supported by tighter monetary policy, fiscal consolidation, improved food supplies and a firmer cedi. The currency has gained more than 20 percent against the US dollar this year as foreign reserves climbed to US$10.7 billion, providing 4.5 months of import cover.

Lower inflation has created room for a gradual reduction in interest rates. The Bank of Ghana cut its policy rate by 350 basis points to 21.5 percent, prompting a steep fall in short-term government borrowing costs.

Yields on the 91-day Treasury bill dropped to 10.3 percent in August from 27.7 percent a year earlier, while average commercial lending rates fell to 24.2 percent from 30.8 percent.

Additionally, the banking sector is showing signs of improved resilience as capital adequacy rose to 17.7 percent in August from 10.2 percent a year earlier while non-performing loans fell to 20.8 percent from 24.8 percent.