By DC Correspondent

Copyright deccanchronicle

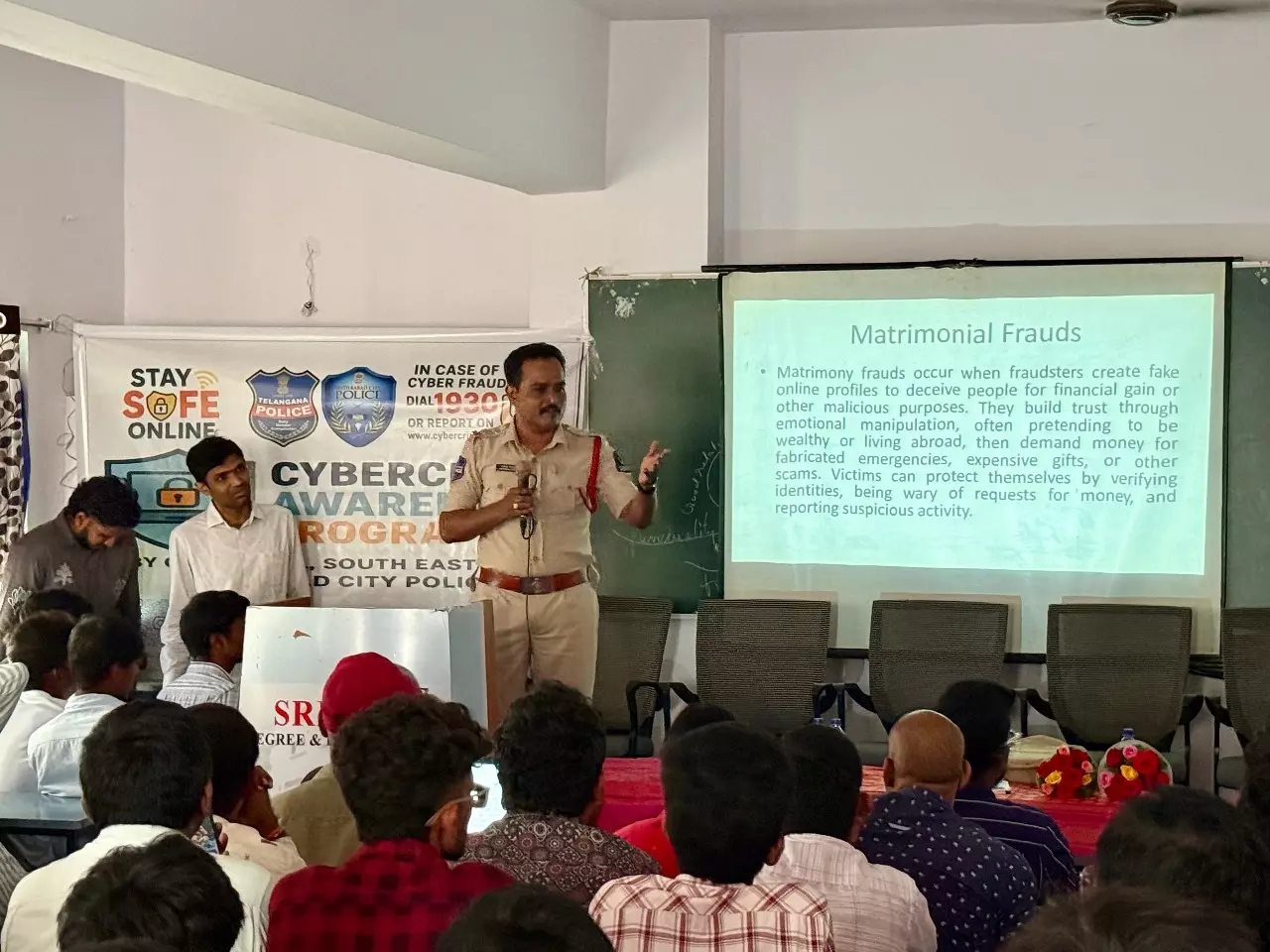

Hyderabad: Bajaj Finance Ltd (BFL) on Thursday a cyber fraud awareness programme in Hyderabad- Knockout Digital Fraud – to inform digital users about different types of threats, and best practices to safeguard finances. The event, conducted at Sri Sai Degree and PG College in Dilsukhnagar, was honored by the presence of distinguished dignitaries including. S Mallesham, Sub-Inspector of Police, Cyber Cell, South-East Zone, and Ch Dilip Kumar Reddy, Principal, Sri Sai Degree and PG College. Their collective experience and insights added immense value to the proceedings. The speakers threw light on various kinds of frauds prevalent in and around Hyderabad. The audience were informed about fake OTP fraud, Phishing Fraud, Digital Arrest, Financial Loan fraud, Pension fraud and other frauds. SI. S Mallesh recounted a recent case from Hyderabad to explain the students how meticulously a fraud is committed. “Falling prey to a cyber scam, a poor family was conned to the tune of Rs 40,000. First, fraudsters convinced victims that they had won a Rs 5-lakh lottery. Next, they manipulated victims to pay registration fees. Only later, did the family realize they were duped,” he revealed. “Fraudsters improvise their strategy based on the victim and their nature,” alerted the cop. During the interaction, the cyber cop had an interesting question for the audience. He asked if there was anyone in the audience who did not have a Facebook or Instagram account. When only a faculty member responded affirmatively, the cop took this opportunity to sound the warning bell. “This is exactly why students and youths often become targets. They share their personal life details on social media without thinking twice, and trust anyone easily.” Offering a word of caution, Mallesh advised, “Keep your social media profiles private. Be mindful of what you share and with whom. Always enable two-factor authentication and use strong, unique passwords to secure your online accounts.” The Knockout Digital Fraud programme aligns with the Reserve Bank of India’s 2024 guidelines on Fraud Risk management for NBFCs, which emphasises early detection, staff accountability, and public engagement to make the digital ecosystem safer for everyone. The programme is focused on drawing citizens’ attention to common financial frauds committed by scammers including fake social media accounts, WhatsApp groups and websites that mimic financial companies, falsely claiming affiliation and impersonating their employees. Speaking on the occasion, a spokesperson from BFL, said, “The financial safety of our consumers is paramount to us. We are constantly issuing online and offline advisories, on social media platforms, as well as through on-ground interactions with citizens, encouraging everyone to be cyber safe.” Knockout Digital Fraud offers the cyber community valuable safety tips on safeguarding personal and sensitive information. This includes refraining from sharing OTPs, PINs, clicking on suspicious emails, SMSs, links, QR codes and downloading applications from unknown sources. It includes a series of interactive workshops, digital awareness drives, and community outreach programs across major cities and towns.