Investors with a lot of money to spend have taken a bullish stance on Ondas Holdings (NASDAQ: ONDS).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ONDS, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 20 options trades for Ondas Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 65% bullish and 30%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $65,250, and 19, calls, for a total amount of $796,631.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $5.0 to $12.0 for Ondas Holdings over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Ondas Holdings’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Ondas Holdings’s whale trades within a strike price range from $5.0 to $12.0 in the last 30 days.

Ondas Holdings 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

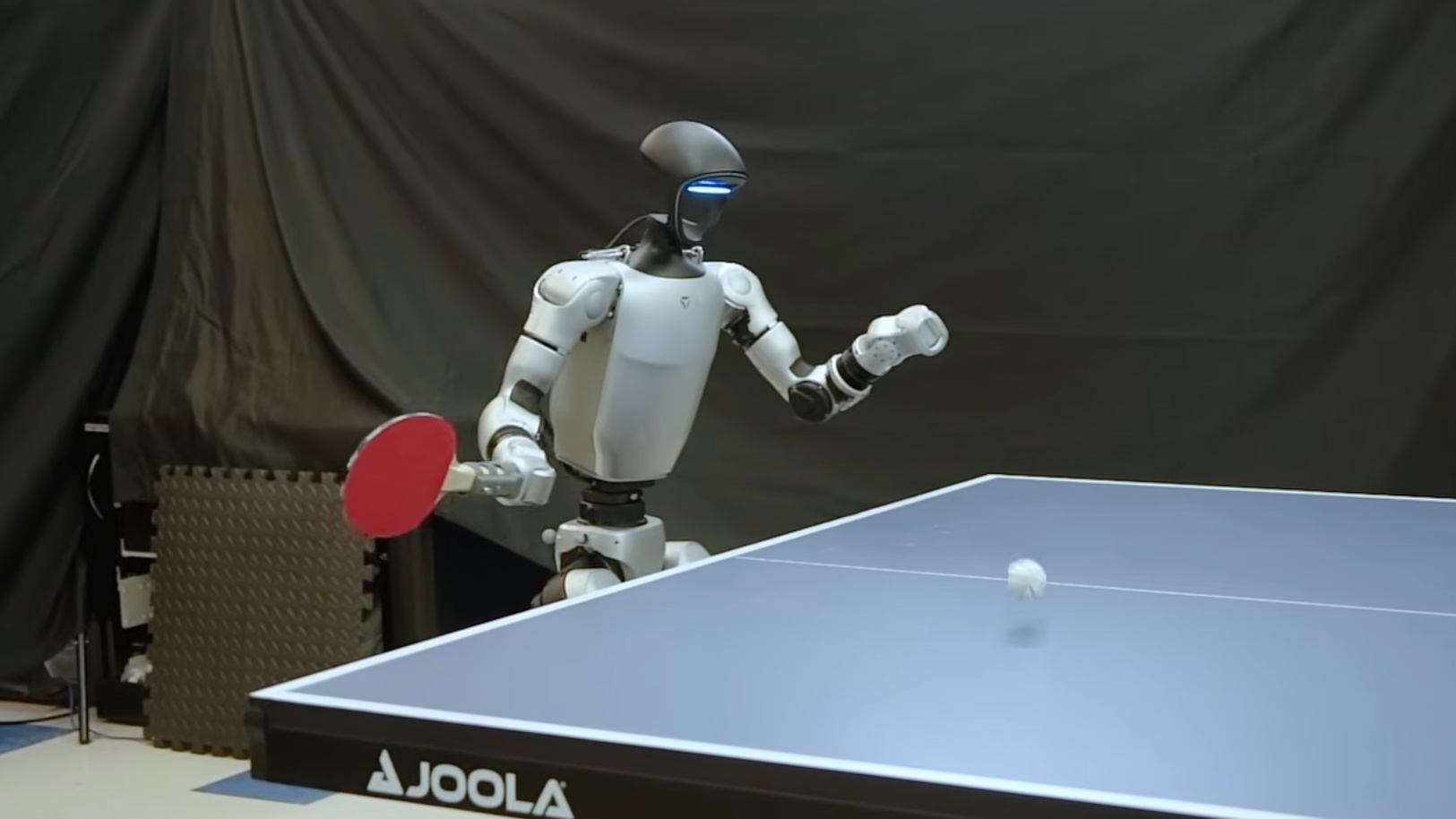

About Ondas Holdings

Ondas Holdings Inc designs, develops, manufactures, sells, and supports FullMAX Software Defined Radio (SDR) technology in the United States, Israel, and India. The company operates in two business segments namely Ondas Networks and Ondas Autonomous Systems. The company generates maximum revenue from Ondas Autonomous Systems through the sales of the Optimus system and separately priced support, maintenance, and ancillary services related to the sale of the Optimus system.

In light of the recent options history for Ondas Holdings, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Ondas Holdings’s Current Market Status

Trading volume stands at 35,927,506, with ONDS’s price down by -4.63%, positioned at $7.01.

RSI indicators show the stock to be may be approaching overbought.

Earnings announcement expected in 47 days.

What Analysts Are Saying About Ondas Holdings

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $8.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Lake Street keeps a Buy rating on Ondas Holdings with a target price of $8.