By Eric Mtemang’ombe

Copyright mwnation

Some commercial banks have reportedly suspended debit card payments for online foreign exchange transactions, sending shockwaves through the business community and sparking worries about the potential long-term fallout.

The measure, intended to preserve scarce foreign currency and redirect them towards essential imports such as fuel and medical drugs, has disrupted e-commerce and online trade, leaving businesses scrambling for alternative payment solutions.

Some commercial banks are notifying their customers of the suspension.

In an email seen by Business News, Standard Bank plc informed a customer that it had rejected their card activation request due to the “temporary suspension of card activation services because of the prevailing foreign exchange scarcity”.

The Malawi Stock Exchange-listed bank apologised to the customer for the inconvenience, promising services would resume “as soon as conditions allow”.

Customers from other commercial banks reported failing to pay for services such as Netflix, Spotify and Showmax, all of which cost less than $15 dollars (about K27 000), indicating that the ban is widespread in all commercial banks.

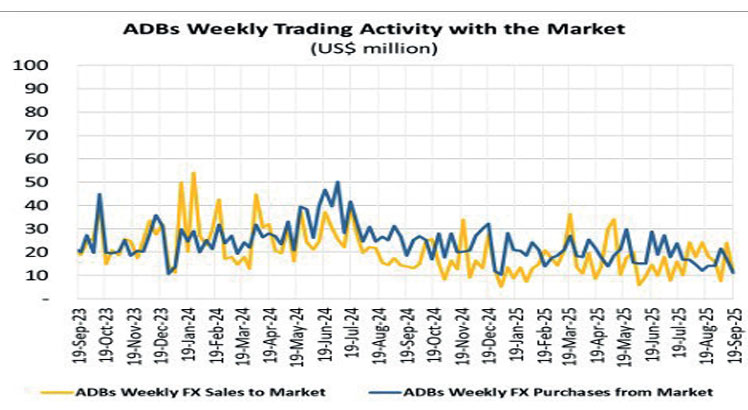

The freeze comes at a time Malawi’s total foreign exchange reserves stand at $607.7 million (about K1 trillion), equivalent to 2.4 months of import cover.

This falls short of the 3.9 months threshold recommended by international financial institutions for credit-constrained economies such as Malawi.

For creative professionals, the impact is already being felt. Filmmaker Khama Mbaula of Afritrix Productions said the measure has blocked him from paying for critical online tools such as dropbox and Google drive.

He said: “That is not ideal or sustainable. Important income-generating activities are stalling due to lack of access to forex for amounts as small as $20 [about K35 000].

“At least having a pre-approved amount of about $100 [about K175 000] would help a lot of people.”

Other customers have also reported being unable to pay for websites and professional emails, leaving them unable to communicate with clients.

Bankers Association of Malawi chief executive officer Lyness Nkungula was not immediately available for comment, but in an interview on Monday, Economics Association of Malawi president Bertha Bangara-Chikadza acknowledged the rationale behind the Reserve Bank of Malawi’s decision, but cautioned against prolonged restrictions.

“Restrictions allow the central bank to direct resources to high-priority areas while curbing speculative purchases and reducing imported inflation,” she said.

Scotland-based Malawian economist Velli Nyirongo noted that while the policy can stabilise reserves and reduce inflationary pressures, it also creates uncertainty that weakens business confidence.