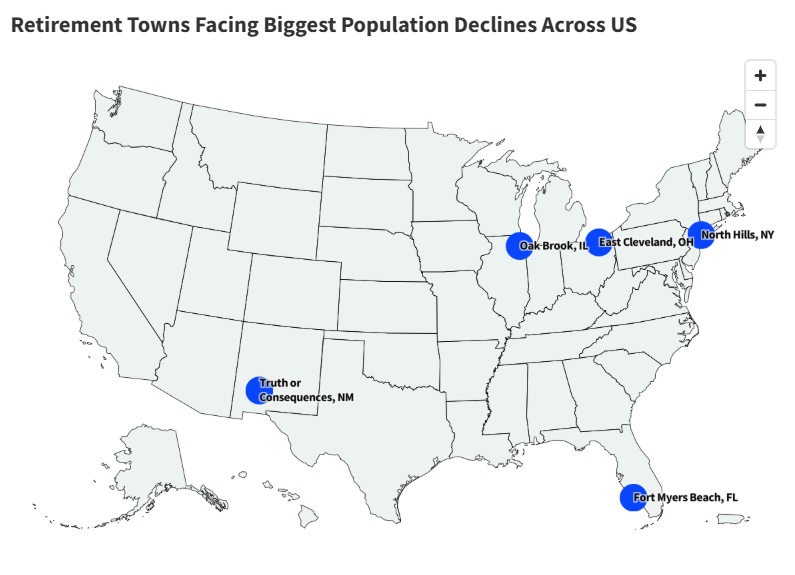

Several retirement towns are facing steep population declines across the country, according to a new report from GOBankingRates.

The report examined retirement towns with the largest senior population decline by analyzing places with a population percentage of at least 20 percent for individuals aged 65 and over and a total population of at least 5,000.

In the number one spot was the New Mexico town of Truth or Consequences.

Why It Matters

Population declines can have significant effects on local economies and also substantially shift the housing market in those areas, as well as in the cities to which people are moving.

A prior report from Northeastern University found that some states, such as Arizona, had up to 70 percent of high-aging communities without sufficient services tailored to seniors.

What To Know

The town of Truth or Consequences, New Mexico, topped the list in a GOBankingRates study, experiencing a 25 percent decrease in its 65-and-over population over five years, from 30.3 percent in 2018 to 22.5 percent in 2023. The city’s overall population changed minimally (+0.97 percent).

North Hills, New York; Oak Brook, Illinois; Fort Myers Beach, Florida; and East Cleveland, Ohio, joined the top five. All experienced declines exceeding 21 percent in their senior populations.

“Fort Myers, Florida definitely stood out,” Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek. “For decades, it was a retiree haven—sunshine, a reasonable cost of living, and a slower pace of life. But now, those same retirees are getting squeezed. Insurance premiums have skyrocketed, and the overall cost of living has jumped, largely because of hurricanes and flooding over the past decade.”

California also stood out for having the most towns ranked in the top 50 for shrinking retiree populations, with La Habra Heights (#21), Big Bear Lake (#25), Coronado (#26), Rancho Mirage (#28), Woodside (#32), Half Moon Bay (#39), and Tiburon (#44) all identified as experiencing substantial declines. Collectively, California towns accounted for 14 percent of the ranking.

“This screams more about affordability than desirability. We’re seeing the 1st generation of retirees who can’t afford to stay where they want to retire,” Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek.

“California dominating this list surprises me, but it’s not because retirees don’t want to live there. With your typical 55-year-old having less than $50,000 in retirement savings, they simply can’t afford the dream anymore. These towns are more a victim of their own success, rather than a failed town.”

By contrast, Florida saw only three locations on the list—Fort Myers Beach, Flagler Beach (#15), and Lauderdale-by-the-Sea (#49)—representing 6 percent of the total, which reinforces the state’s sustained popularity among retirees.

What People Are Saying

9i Capital Group CEO Kevin Thompson told Newsweek: “It really comes down to two things: First, the cost of living. As people age, they want to be closer to good hospital systems and live in places that make travel easier. Second, family. After building equity in their homes, many retirees are choosing to downsize and move closer to their kids and grandkids.”

Finance expert Michael Ryan told Newsweek: “This data signals a fundamental shift to survival retirement. The ‘golden years’ are becoming the ‘get-by years’ for an entire generation. When your nest egg can’t crack the cost-of-living shell, you don’t get to choose where to retire. Geography chooses you.”

What Happens Next

Experts say that more retirees may move out of their homes and opt for more affordable living areas as retirement costs rise.

“While retirement towns have gathered a reputation over the decades for being attractive places for seniors to move to following their working careers, the reality is many retirees stay put in either the town and/or state in which they currently reside,” Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek. “However, as the cost of living has risen in recent years, more retirees are looking at whether states like New York and Illinois can actually be affordable to them on a limited income.

“Even cities like Fort Myers are feeling the financial heat from declining retiree populations, primarily due to the inflated costs of homeownership in the area, from insurance to property taxes. Affordability in retirement is of the utmost importance, and many once-popular locations are no longer able to claim such a trait.”