By Petre Barac

Copyright thediplomat

Norofert, the leading producer of organic agricultural inputs and biotechnology provider for agriculture in Romania, listed on the AeRO market of the Bucharest Stock Exchange, recorded a turnover of RON 19 million in the first half of 2025, a slight decrease compared to last year.

At the consolidated level, the company improved its profitability after three challenging agricultural years. Operating profit increased by 65 percent to RON 6.1 million, while net profit reached RON 3.2 million, approximately 68 percent higher than in the first half of the previous year, driven by operational efficiency, a focus on in-house production, and the results of the Zimnicea farm. Performance is expected to continue to grow this year, supported by the outlook for a good harvest, influenced by the favorable conditions in the first months of 2025.

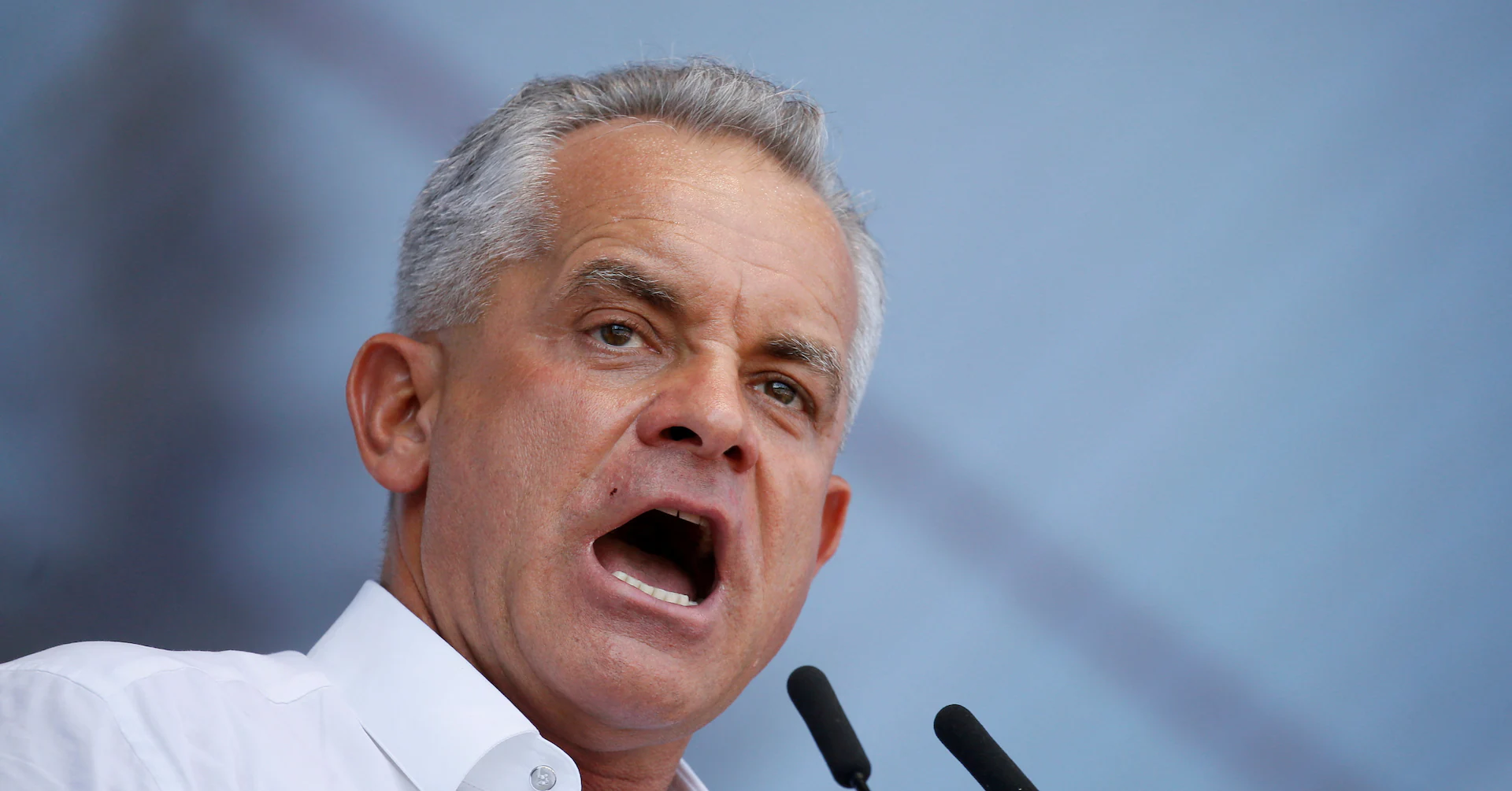

Vlad Popescu, President of the Board, Norofert: „For us, the results from the first half of the year are not just numbers, but the proof that Norofert can stand by farmers and partners even when the sector faces major challenges, as it was over the past three years. Although 2025 will bring a better harvest, it cannot fully offset the difficulties of previous years, which is why our priorities remain efficient production and seizing opportunities in external markets. The fact that our USA subsidiary became autonomous in its very first year and that the project in Brazil is taking shape shows how quickly we can adapt and scale our business models in different markets. At the same time, our investments in research and irrigation systems in Romania provide the stability we need to build sustainably on the long term.”

The project in Chapeco, Brazil, is set to become operational in the second part of the year, marking an important step in Norofert’s international expansion. At the same time, the two factories in the Americas strengthen Norofert’s presence in external markets. For 2025 we estimate that they will contribute approximately 7 percent to the Group’s turnover.

Key consolidated figures for H1 2025:

Fixed assets: RON 30.3 million, up 9.5 percent, mainly due to investments in the research laboratory and in the irrigation system in Zimnicea.

Total liabilities: RON 71.4 million, up 14 percent, driven primarily by investments in external markets, higher financing expenses, and advances to suppliers.

Operating revenues: reached RON 22.2 million, supporting the company’s growth pace.

Operating expenses: RON 16.1 million, down 25 percent, mainly due to lower material costs and improved production efficiency.

Operating result: up 65 percent, reaching RON 6.1 million, supported by contracts for products from the proprietary portfolio and the very strong performance of the Zimnicea farm.

Net profit: reached RON 3.2 million, up 68 percent compared to H1 2024, confirming the effectiveness of the development strategy and the measures taken to overcome the difficult agribusiness.