By Stephen Mayne

Copyright crikey

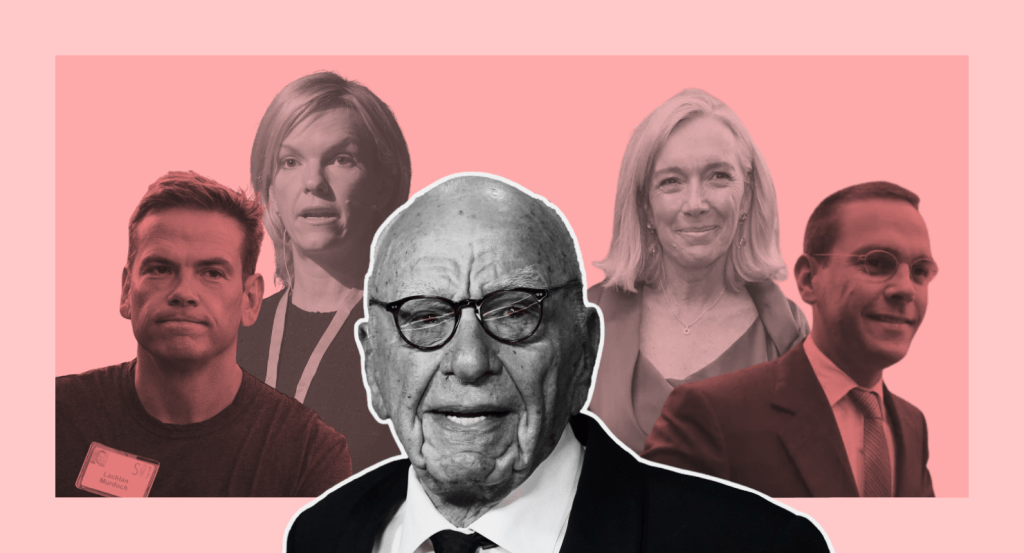

After the blockbuster $5 billion Murdoch family succession settlement, Rupert, 94, is now likely permanently estranged from three of his adult billionaire children — James, Elisabeth and Prudence. But at least he’s aligned and able to do deals with two of his three living ex-wives, Wendi Deng and Anna Torv.

For an obsessively secretive family — one that has long required its outlets to avoid seriously covering their affairs — the past two years have been a disaster of leaks, courtroom revelations and disclosure by its competitors, led by the hated New York Times.

So it was fitting the outlet was once again fully briefed with the complete package of insights when the joint News Corp and Fox Corp press releases dropped at 6am Sydney time and 4pm New York time yesterday, coinciding with the close of trade on Wall Street.

And what a blitzkrieg it was, with an immediate fire sale of US$1.37 billion worth of voting stock in Fox Corp and News Corp.

The transaction and reputational costs of the Murdoch family fight have been incalculable. The world’s most powerful and famous corporate family has been split in half, with the Lachlan and Rupert faction — now contractually aligned with second wife Deng and her two daughters with Rupert, Grace and Chloe — seemingly estranged from Rupert’s three more progressive adult children, James, Elisabeth and Prudence.

Through the discovery process in Nevada, after Team Lachlan attempted to unilaterally rewrite the rules of the family trust in his favour, perhaps the most telling insight to emerge was Rupert’s email to second wife Anna in 2023.

Fox and our papers are the only faintly conservative voices against the monolithic liberal media. I believe maintaining this is vital to the future of the English-speaking world.

So vital that the Lachlan-Rupert faction has now united with Team Wendi, hocked themselves in debt and reduced their voting power over the two public companies to fund a US$3.3 billion (A$5 billion) cash buyout.

The settlement arrived as shares in both Fox Corp and News Corp were trading near record highs. The exiting children fetched US$913 million for the 16.8 million Fox Corp shares, which were sold at US$54.25 a pop, a 4.5% discount to the previous close of US$56.81. Fox Corp shares tumbled 6.67% overnight to finish at US$53.02, so those brave new investors throwing their lot in with Lachlan and Rupert are already down $US20.7 million after one day.

The sale exacerbates the Murdoch family’s gerrymandered control of two public companies worth a combined $67 billion, to be directed from Rupert’s winery home in Los Angeles and Lachlan’s beachside Sydney mansion in Bronte, where his wife and three children prefer to live.

The New York Times reported that the dissenting children have settled for an 80% valuation on their 50% stake in the Murdoch Family Trust, or some US$3.3 billion. They’ll each have to pay plenty of tax on their respective $1.7 billion paydays, however.

The controlling five players — aka Team Lachlan, spread across three generations and two wives — also have to come up with US$1.95 billion in cash, having already raised US$1.37 billion in the biggest family share sale in history (the US$71 billion 2019 Disney deal was an asset sale).

A cool US$1 billion of that is coming from a giant margin loan over their reduced controlling stake over both companies, which has seen 48.7% of the residual stakes — 30.4 million of the family’s 62.47 million residual News Corp voting shares — pledged to the unnamed financier, according to this fascinating 64-page prospectus lodged with the ASX yesterday.

The remaining US$1 billion is presumably coming from the sale of Disney shares. The details of the Disney deal were never fully clear, but it was widely reported at the time that all six Murdoch children received US$2.1 billion pre-tax in return. While Disney paid for the US$71 billion acquisition with a 50-50 split between cash and shares, the ABC’s Neil Chenoweth reported today that the children all received 100% Disney stock.

If Team Lachlan wants to pay down that US$1 billion margin loan without liquidating all their Disney shares, one option would be demerging News Corp’s 61% stake in REA Group, which is currently worth $19.2 billion. Such a move would deliver Team Lachlan a $3.36 billion direct stake in REA, based on current prices, which could be sold without reducing any of the family’s power and influence.

The time to do that would be when Rupert and Lachlan reheat their 2023 plan to merge News Corp and Fox Corp, which James Murdoch helped stymie at the time but which would now be pursuable, albeit subject to the approval of both boards and both sets of minority shareholders.

The 13,000-word James Murdoch cover story in The Atlantic magazine back in February was arguably the biggest single third-party disclosure about the Murdoch family in history. James spilled his guts, and it caused him problems with his father and brother’s appeal in the Nevada courts, providing a further incentive to settle.

“There’s this tabloid culture that’s contrarian for the sake of it, and delights in poking people in the eye,” James told The Atlantic. “At its worst, it metastasises into something nasty and scary and manipulative … I underestimated the ability of a profit motive to make people do terrible things — to make companies do terrible things.”

Watching the appalling Fox News last night, it’s clear Rupert and Lachlan are now even less likely to abandon the formula that has delivered the world’s most profitable “news” venture in history, pumping out circa US$1.5 billion a year.

But will James be prepared to put down the cudgels, after running what The Atlantic described as effectively a 14-year campaign of revenge against his brother and father, after he felt he was unfairly blamed for the 2011 phone-hacking disaster in the UK? The schism was then magnified by the family’s prominent role in the rise of Donald Trump and the chaos and division he has wreaked.

The settlement agreement includes the following: “The departing beneficiaries will be subject to a long-term standstill agreement preventing them, and their affiliates, from acquiring shares of FOX and News Corporation and taking certain other actions with respect to the companies.”

There’s a 12-year ban on James buying into Fox Corp and News Corp. But does this mean he’s not allowed to compete with the family firms? For instance, what if he backed an AI-driven start-up competitor to REA? Is he banned from slipping me $20k a year to organise maximum mayhem at the News Corp and Fox Corp AGMs each October? Are there non-disparagement clauses, where future cash payments are withheld if he publicly criticises his father and brother? Who will get to speak at Rupert’s funeral?

Only time will tell, but this compelling drama could be far from over, particularly given the challenge for Team Lachlan on riding the bucking bronco that is Trump, who is currently suing News Corp and Rupert Murdoch personally for US$10 billion over the Wall Street Journal’s recent article claiming Trump had composed a crude poem and doodle as part of a collection compiled for Jeffrey Epstein’s 50th birthday.