By Contributor,Peter J Reilly,Uri Schanker

Copyright forbes

President Trump’s campaign promise of tax-free tips was partly fulfilled in the One Big Beautiful Bill. Rather than an exclusion from all taxes, there is an-above-the line income tax deduction limited to $25,000 for qualified reported tips. There was language to distinguish tips from other sorts of income and a limitation to occupations that had customarily and regularly received tips prior to December 31, 2024. There was also an exclusion of several lines of work from being able to generate income subject to the tips deduction. Now we have a preliminary list of the occupations that are deemed to have customarily and regularly received tips. The list is a lot of fun and it also has me a bit confused. We’ll start with the fun.

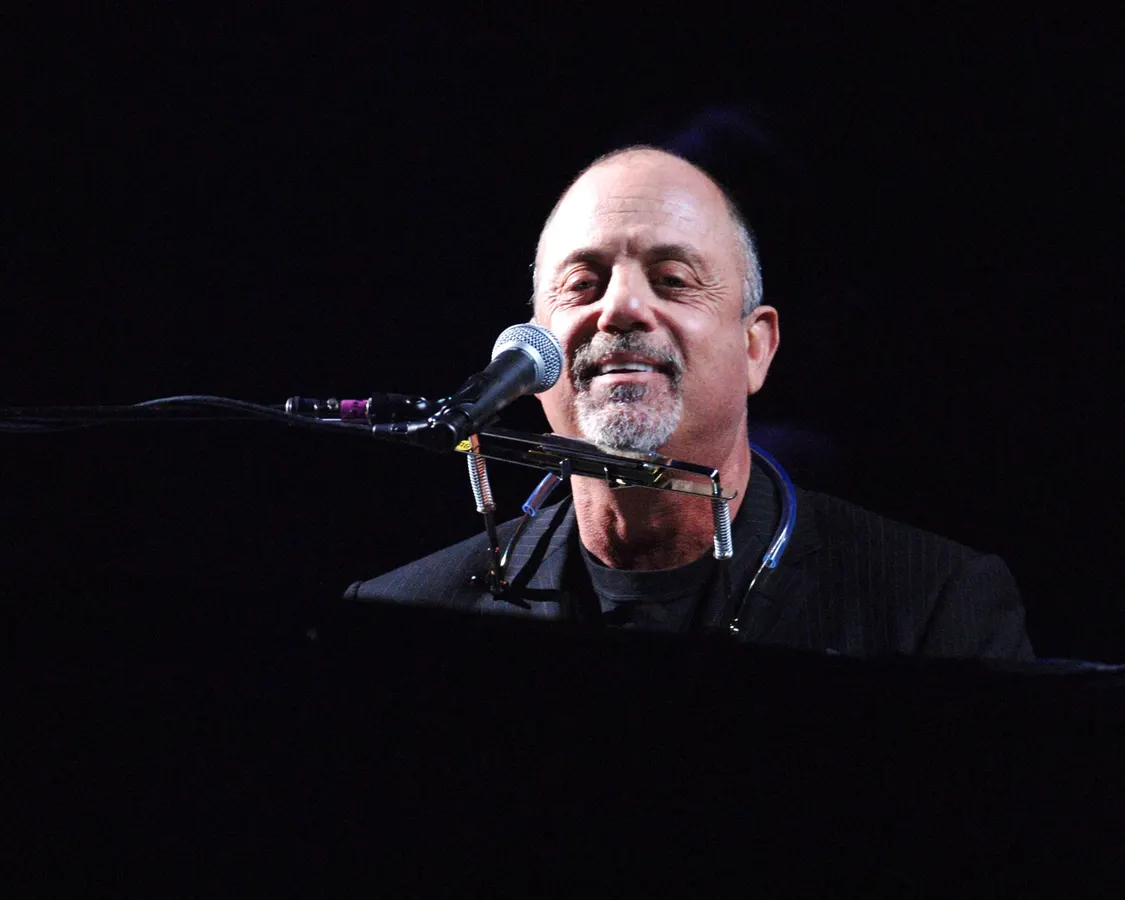

SUNRISE, FL – JANUARY 7: Singer Billy Joel performs at the Bank Atlantic Center on January 7, 2006 in Sunrise, Florida. (Photo by Uri Schanker/Getty Images)

Getty Images

The Occupation Test

My first thought was to check out how the act would have affected two of the most iconic tip recipients who evoke the seventies for me. The tip recipients are John and Bill in the song Piano Man: “Now John at the bar is a friend of mine. He gets my drinks for free. And he’s quick with a joke or to light up your smoke, but there’s someplace that he’d rather be. He says, “Bill, I believe this killing me”, as the smile ran away from his face.”

It is just an assumption on my part that John is a tip recipient, although one grounded in too much anecdotal experience. It is quite explicit when it comes to Bill. “And they sit at the bar and put bread in my jar and say. “Man, what are you doin’ here”. Bill is William Martin Joel, whom we know as Billy Joel. And he is the Piano Man in his song which is based on a brief period where he was escaping a difficult record contract by playing the piano in a bar called The Executive Room in Los Angeles.

How will the John and Bill pairs of today fare when it comes to the qualified tips deduction?

So when it comes to the list John is at the top of it – 101 – Bartenders. We have to go down a bit to find Bill – 206 – Musicians and singers. Among the illustrative examples in that category is lounge singer, so I think we can be confident that Bill meets the occupation test, but there is something else that may make the smile run away from Bill’s face.

MORE FOR YOU

The Trade Or Business Test

Near musicians and singers on the list there are also dancers, entertainers and performers, and digital content creators. You’ve never tipped a digital content creator? Well, I have. None other than Nate The Lawyer. Regardless there is more than an occupation test. There is also a trade or business test. The trade or business in which the individual receives tips while an employee is deemed to be the trade or business of the employer.

Individuals will not qualify for the deduction if the trade or business they are in is a specified trade or business defined in Section 199A(d)(2). I know you are flipping through your copy of the Code right now, but in consideration of the other readers, those businesses are health, law, accounting, actuarial science, consulting, athletics, financial services, brokerages services, any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees and performing arts. I put performing arts last for emphasis.

So it would appear that whether Bill would qualify for the tips deduction may depend on whether he is an employee or an independent contractor. He passes the occupation test in either case. If he is an independent contractor, however, it would seem that the trade or business involved arguably falls under performing arts and hence denies him the deduction.

Some Other Performers

CAMBRIDGE, ENGLAND – JUNE 12: Stormy Daniels poses during her visit to The Cambridge Union on June 12, 2022 in Cambridge, England. (Photo by Nordin Catic/Getty Images For The Cambridge Union)

Getty Images For The Cambridge Union

Dancers, another qualifying occupation, in certain establishments are often independent contractors and prefer it that way according to their most famous advocate Stephanie Clifford (aka Stormy Daniels). It would appear that they have the same problem. For what it is worth, there is case law in the sales tax area that casts doubt on whether what they are doing constitutes art.

An article on Quasa, Unexpected Good News for Creators, speculates that some creators in entertainment-focused niches such as edutainment producers, gaming streamers and those producing artistic videos may have a problem with the trade or business test, The Quasa article cited a Forbes.com piece by Alison Durkee.

Nevada Congressional Delegation To The Rescue ?

Senator Jacky Rosen, a Democrat from Nevada, speaks during a campaign event with US President Joe Biden, not pictured, at Pearson Community Center in Las Vegas, Nevada, US, on Sunday, Feb. 4, 2024. Biden implored Nevada voters to make Republican frontrunner Donald Trump a “loser,” part of a two-day swing designed to gain an advantage in a battleground state he hopes to win again later this year. Photographer: Ian Maule/Bloomberg

© 2024 Bloomberg Finance LP

Tipping is an important part of the Nevada economy so it is not surprising that three out of the four members of Congress and both senators have signed a letter to Treasury Secretary Scott Bessent encouraging taxpayer friendly interpretation of the tips deduction. None of them actually voted for the bill. The one Nevada congressman who did vote for it, Mark Amodei did not sign the letter.

They recommend that “auto-gratuities” for large parties should count toward the tips deduction, despite the language in the bill that appears contrary. They want the deduction to apply to returns where one of the taxpayers has an ITIN rather than a social security number. They also raise the issue of “performing arts” being a specified service trade or business that could preclude the deduction.

“The SSTB restrictions in H.R. 1 were clearly intended to prohibit professionals in fields such as law or finance from reclassifying income from tips, not arbitrarily restrict the deduction from entertainers. A broad reading of the law’s SSTB restriction may inequitably fall on entertainers who rely on tipped income, contrary to the intent of this provision to help workers who traditionally receive tips. We urge Treasury and the IRS to issue regulations that allow, to the extent permitted under the statute, the ability of performing artists to use the deduction when their occupation otherwise has traditionally received tips.”

They also want to do something about the apparent marriage penalty that I covered here. They argue that the statute can be read to call for a $50,000 limit on a joint return, with two separately computed deductions limited to $25,000.

Editorial StandardsReprints & Permissions