After the initial shock and awe of Nvidia’s pledge to invest $100 billion in OpenAI, Wall Street stock analysts are debating what it all means. Bulls say it’s more evidence of the booming artificial intelligence infrastructure business. But bears say it is just Nvidia (NVDA) aiding a cash-starved customer.

“Overall, the narrative remains bullish,” Daniel O’Regan, Mizuho Securities managing director of equity trading, said in a client note. “But there are many trying to say the latest move by NVDA is simply vendor financing and circular in nature.”

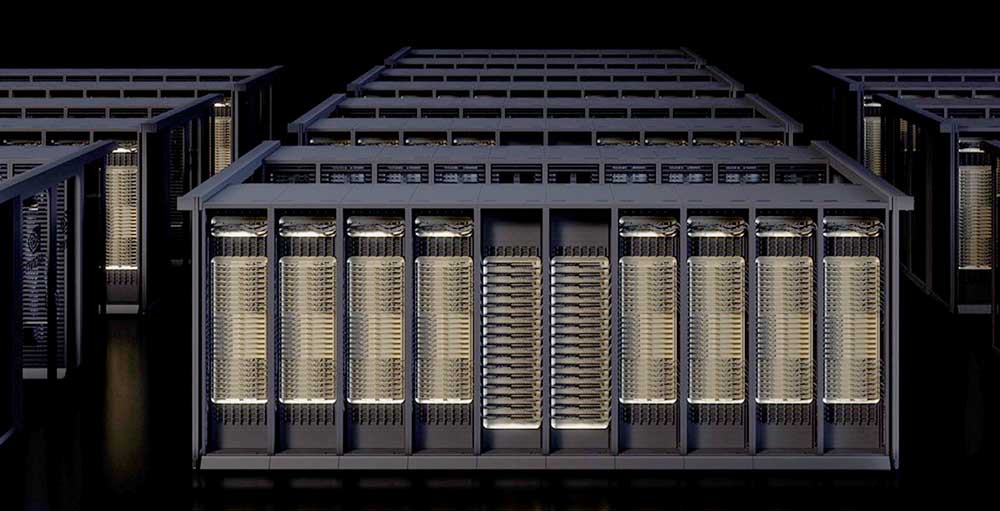

Nvidia announced Monday a strategic partnership with OpenAI. Under the deal, OpenAI intends to procure at least 10 gigawatts of AI data centers running Nvidia processors. Nvidia will invest in OpenAI progressively as each gigawatt of capacity is deployed.

Investment research firm Vital Knowledge weighed the bull and bear arguments for the deal in a report.

“What bulls are saying about the news: this is the latest headline underscoring the gushers of money washing over the AI space as a slew of massive companies race to deploy unprecedented amounts of computing infrastructure,” the firm said.

“What bears are saying about the news: this is nothing more than Nvidia paying to prop up one of its biggest and most prominent customers, providing OpenAI with cash that in turn makes a round-trip back to Nvidia to purchase chips,” Vital Knowledge said.

Nvidia Stock Pulls Back

In morning trades on the stock market today, Nvidia stock slid 1.8% to 180.28. On Monday, Nvidia stock jumped 3.9% to close at 183.61.

DA Davidson analyst Gil Luria kept his buy rating and 210 price target on Nvidia stock after the OpenAI announcement. However, in a client note, he expressed concern that Nvidia has become the “investor of last resort,” bailing out OpenAI’s overextended commitments. He noted that Nvidia previously had to bail out the CoreWeave (CRWV) initial public offering.

Elsewhere on Wall Street, Evercore ISI analyst Mark Lipacis raised his price target on Nvidia stock to 225 from 214 and reiterated his outperform rating.

Meanwhile, Nvidia’s pact with OpenAI raises competitive risks for rival AI chipmakers AMD (AMD) and Broadcom (AVGO), BofA Securities analyst Vivek Arya said in a client note.

Follow Patrick Seitz on X at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

AppLovin’s Ad Product Growing Fast, Taking Market Share

Apple iPhone 17 Sales Getting Boost From Plain Old Upgrade Cycle

IBD 50 Stock SiTime Climbs After Entering Lucrative New Market

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens