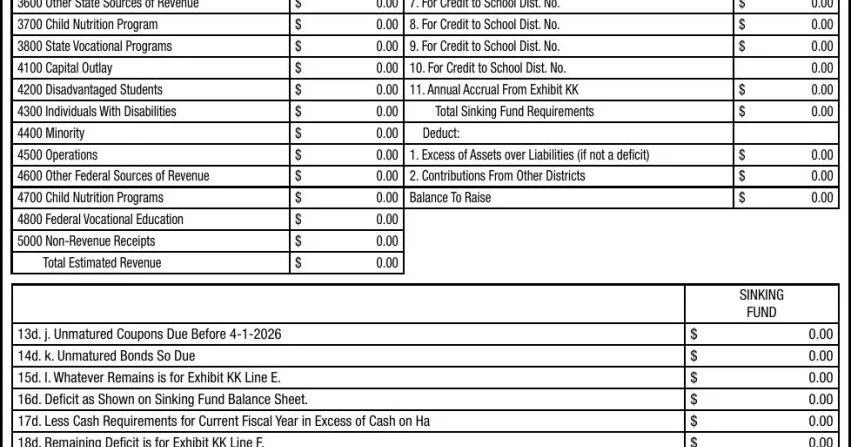

Publication Sheet – Board of Education Financial Statement of the Various Funds for the Fiscal Year Ending June 30, 2025 Estimate of Needs for Fiscal Year Ending June 30, 2026 Tulsa Community College Public Schools, School District No. JC-18, Tulsa County, Oklahoma STATEMENT OF FINANCIAL CONDITION STATEMENT OF FINANCIAL GENERAL FUND BUILDING FUND CO-OP FUND CONDITION AS OF JUNE 30, 2025 DETAIL DETAIL DETAIL ASSETS: Cash Balance June 30, 2025 Investments TOTAL ASSETS LIABILITIES AND RESERVES: Warrants Outstanding Reserves From Schedule 7 TOTAL LIABILITIES AND RESERVES CASH FUND BALANCE (Deficit) JUNE 30, 2025 NUTRITION FUND DETAIL $ $ $ 65,597,920.76 $ 0.00 $ 65,597,920.76 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 0.00 0.00 $ $ $ $ 0.00 0.00 0.00 65,597,920.76 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 $ $ $ $ $ $ $ $ $ $ $ $ ESTIMATED NEEDS FOR FISCAL YEAR ENDING JUNE 30, 2026 SINKING FUND BALANCE SHEET $ Current Expense $ 121,391,830.45 1. Cash Balance on Hand June 30, 2025 0.00 2. Legal Investments Properly Maturing $ Reserve for Int. on Warrants & Revaluation $ $ Total Required $ 121,391,830.45 3. Judgments Paid To Recover By Tax Levy FINANCED: 4. Total Liquid Assets $ 65,597,920.76 Deduct Matured Indebtedness: Cash Fund Balance $ 0.00 5. a. Past-Due Coupons $ Estimated Miscellaneous Revenue $ Total Deductions $ 65,597,920.76 6. b. Interest Accrued Thereon $ 55,793,909.69 7. c. Past-Due Bonds $ Balance to Raise from Ad Valorem Tax $ 8. d. Interest Thereon after Last Coupon $ ESTIMATED MISCELLANEOUS REVENUE: 9. e. Fiscal Agency Commissions on Above $ 1000 Other District Sources of Revenue $ 0.00 10. f. Judgments and Int. Levied for/Unpaid $ 2100 County 4 Mill Ad Valorem Tax $ 0.00 11. Total Items a. Through .f $ 2200 County Apportionment (Mortgage Tax) $ 0.00 12. Balance of Assets Subject to Accrual $ 2300 Resale of Property Fund Distribution $ 0.00 Deduct Accrual Reserve if Assets Sufficient: 2900 Other Intermediate Sources of Revenue $ 0.00 13. g. Earned Unmatured Interest $ 3110 Gross Production Tax $ 0.00 14. h. Accrual on Final Coupons $ 3120 Motor Vehicle Collections $ 0.00 15. i. Accrued on Unmatured Bonds $ 3130 Rural Electric Cooperative Tax $ 0.00 16. Total Items g Through i $ 3140 State School Land Earnings $ 0.00 17. Excess of Assets Over Accrual Reserves **(Page 2) $ 3150 Vehicle Tax Stamps $ 0.00 3160 Farm Implement Tax Stamps $ 0.00 SINKING FUND REQUIREMENTS FOR 2025-2026 3170 Trailers and Mobile Homes $ 0.00 1. Interest Earnings on Bonds $ 3190 Other Dedicated Revenue $ 0.00 2. Accrual on Unmatured Bonds $ 3200 State Aid – General Operations $ 0.00 3. Annual Accrual on “Prepaid” Judgments $ 3300 State Aid – Competitive Grants $ 0.00 4. Annual Accrual on Unpaid Judgments $ 3400 State – Categorical $ 0.00 5. Interest on Unpaid Judgments $ 3500 Special Programs $ 0.00 6. PARTICIPATING CONTRIBUTIONS (Annexations): $ 3600 Other State Sources of Revenue $ 0.00 7. For Credit to School Dist. No. $ 3700 Child Nutrition Program $ 0.00 8. For Credit to School Dist. No. $ 3800 State Vocational Programs $ 0.00 9. For Credit to School Dist. No. $ 4100 Capital Outlay $ 0.00 10. For Credit to School Dist. No. 4200 Disadvantaged Students $ 0.00 11. Annual Accrual From Exhibit KK $ 4300 Individuals With Disabilities $ 0.00 Total Sinking Fund Requirements $ 4400 Minority $ 0.00 Deduct: 4500 Operations $ 0.00 1. Excess of Assets over Liabilities (if not a deficit) $ 4600 Other Federal Sources of Revenue $ 0.00 2. Contributions From Other Districts $ 4700 Child Nutrition Programs $ 0.00 Balance To Raise $ 4800 Federal Vocational Education $ 0.00 5000 Non-Revenue Receipts $ 0.00 Total Estimated Revenue $ 0.00 GENERAL FUND 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 SINKING FUND 13d. j. Unmatured Coupons Due Before 4-1-2026 14d. k. Unmatured Bonds So Due 15d. l. Whatever Remains is for Exhibit KK Line E. 16d. Deficit as Shown on Sinking Fund Balance Sheet. 17d. Less Cash Requirements for Current Fiscal Year in Excess of Cash on Ha 18d. Remaining Deficit is for Exhibit KK Line F. $ $ $ $ $ $ 0.00 0.00 0.00 0.00 0.00 0.00 $ $ $ 0.00 0.00 0.00 $ $ $ $ 0.00 0.00 0.00 0.00 BUILDING FUND Current Expense Reserve for Int. on Warrants & Revaluation Total Required FINANCED: Cash Fund Balance Estimated Miscellaneous Revenue Total Deductions Balance to Raise from Ad Valorem Tax CO-OP FUND Current Expense Reserve for Int. on Warrants & Revaluation Total Required FINANCED: Cash Fund Balance Estimated Miscellaneous Revenue Total Deductions Balance CHILD NUTRITION PROGRAMS FUND $ $ $ 0.00 $ 0.00 $ 0.00 $ 0.00 0.00 0.00 $ $ $ $ 0.00 0.00 0.00 0.00 $ $ $ $ 0.00 0.00 0.00 0.00 Publication Sheet – Board of Education Financial Statement of the Various Funds for the Fiscal Year Ending June 30, 2025 Estimate of Needs for Fiscal Year Ending June 30, 2026 Public Schools, School District No., County, Oklahoma CERTIFICATE – GOVERNING BOARD STATE OF OKLAHOMA, COUNTY OF TULSA, ss: We, the undersigned duly elected, qualified and acting officers of the Board of Education of Tulsa Community College Public Schools, School District No. JC-18, of Said County and State, do hereby certify that at a meeting of the Governing Body of the said District begun at the time provided by law for districts of this class and pursuant to the provisions of 68 O. S. 2001 Section 3003, the foregoing statement was prepared and is a true and correct condition of the Financial Affairs of said District as reflected by the records of the District Clerk and Treasurer. We further certify that the foregoing estimate for current expenses for the fiscal year beginning July 1, 2025 and ending June 30, 2026, as shown are reasonably necessary for the proper conduct of the affairs of the said District, that the Estimated Income to be derived from sources other than ad valorem taxation does not exceed the lawfully authorized ratio of the revenue derived from the same sources during the preceding year. The Estimate of Needs shall be published in one issue in some legally qualified newspaper published in such political subdivision. If there be no such newspaper published in such political subdivision, such statement and estimate shall be so published in some legally qualified newspaper of general circulation therein; and such publication shall be made, in each instance, by the board or authority making the estimate.