By Scott Reid

Copyright scotsman

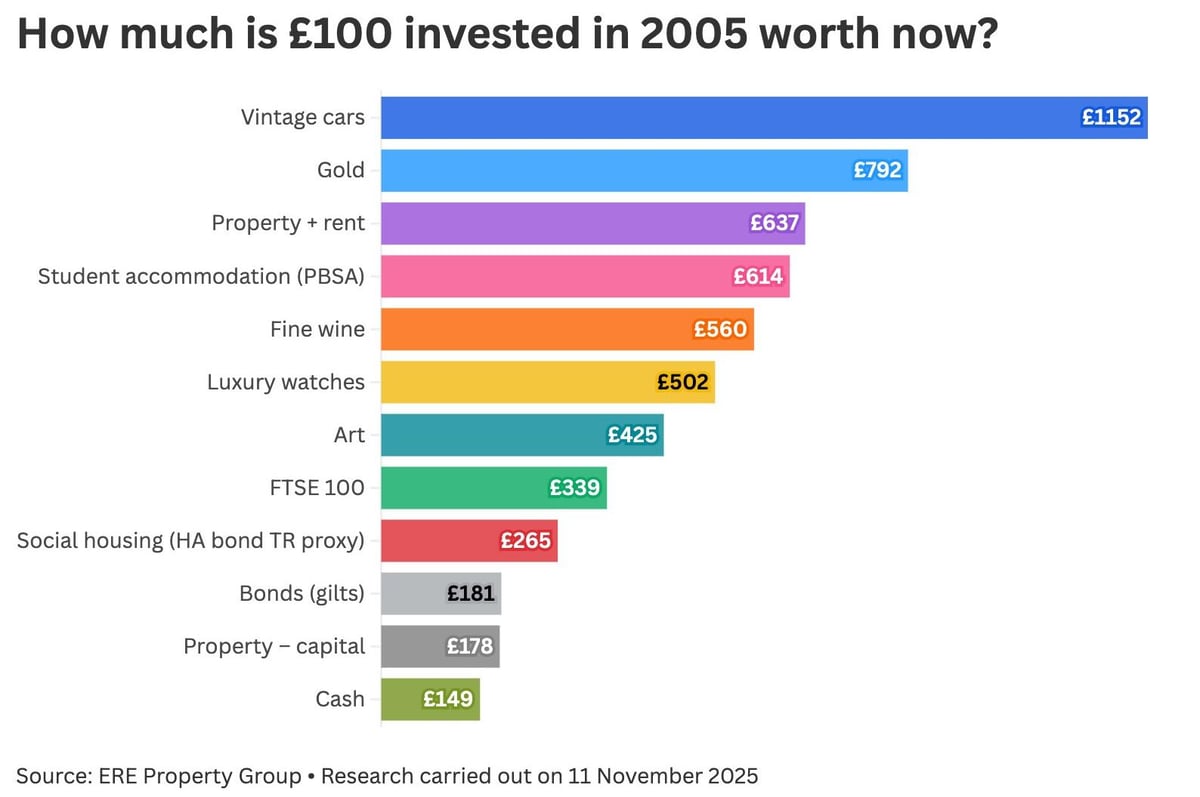

Alternative asset and “passion” investments have outstripped cash savings over the past two decades with vintage cars leading the charge, new research reveals. The analysis found that £100 invested in classic motors 20 years ago could be worth £1,152 today – a return of 1,052 per cent. Among the other big gainers are fine wine, with £100 back in 2005 now worth £560, and luxury watches, where that sum invested 20 years ago has risen to £502, according to the research by ERE Property Group. Inevitably gold is a strong performer, at £792, while investing £100 in student accommodation would now be worth £614. That same £100 in a regular easy access savings account, tracking the Bank of England’s base rate, would now be at about £150. A government bond would have done slightly better, at around £180. ERE co-founder Tim Morgan said: “People are looking for more from their money and there are some creative ways out there to see your money grow. But although these passion assets can have spectacular returns, they are risky, volatile and can be hard to actually cash in. “Property continues to be a great investment and, if you stick with UK housing, you can’t go far wrong. We have seen incredible growth since setting up ERE in a Leeds stationery cupboard 21 years ago.” The firm said student properties had been very strong, with demand outstripping supply. Investing that £100 in purpose-built student accommodation (PBSA) would now see it worth about £614. The same base sum invested into a combination of property and rent back in 2005 could now be worth £637. ERE stressed that its examples were for illustrative purposes only. The figures show hypothetical compounding of £100 over 20 years using fixed historical average annual rates from a range of sources. Some assets use total return with income reinvested. Collectibles (cars, wine, watches, art) use price-only indices and are affected by illiquidity, valuation uncertainty and selection bias, the firm added.