The move: AgriFORCE Growing Systems stock surged as much a 254% on Monday.

Shares of the microcap agricultural technology company have struggled in 2025, down over 60% despite the surge to start the week.

Why: AgriFORCE announced plans for a dramatic shift in its business on Monday. The agritech company had already ventured into bitcoin mining in 2020, but now it’s diving even further into crypto with plans to start buying digital tokens issued on the Avalanche.

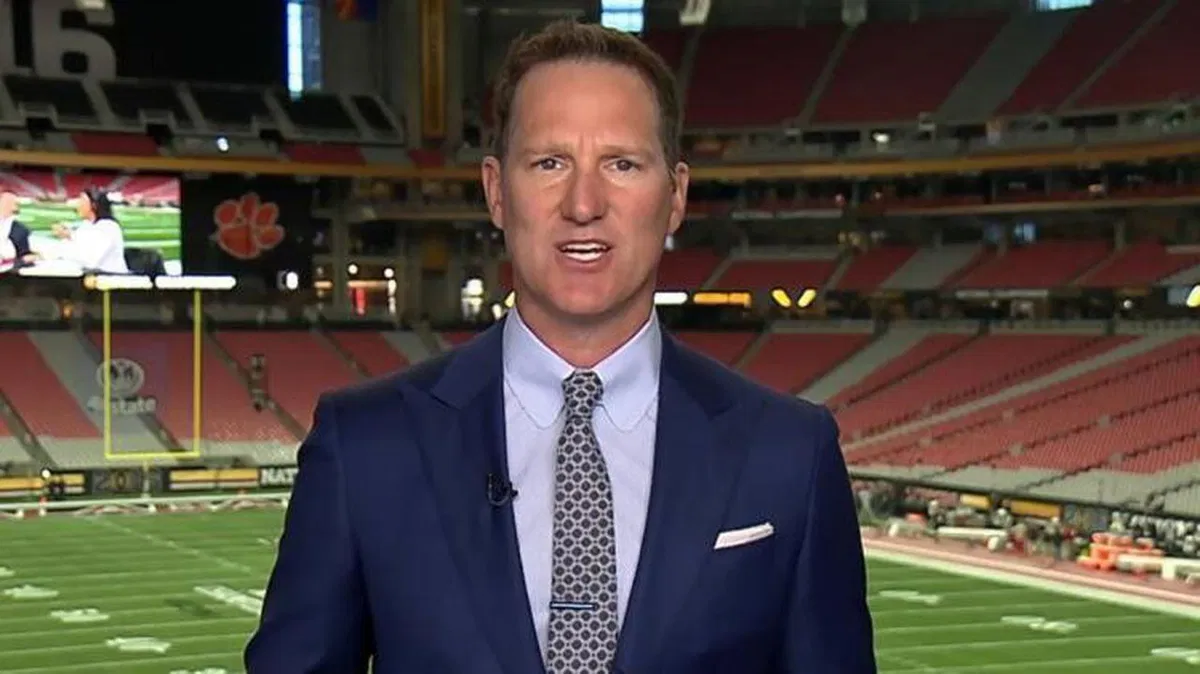

The company will be renamed AVAX One and will be the first Avalanche treasury company to trade on the Nasdaq. AgriForce plans to raise $550 million, with investors so far including hedge fund manager Anthony Scaramucci and blockchain-focused investment firm Hivemind Capital.

Scaramucci will lead the company’s advisory board.

The native crypto token of the decentralized Avalanche blockchain network, AVAX, has been on a hot streak recently, up 30% in a month.

In its statement on its new strategy, AgriFORCE said that it plans to own $700 million worth of AVAX tokens and also aims to tokenize other assets that can be traded on the Avalanche blockchain.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

What it means: AgriFORCE is the latest in a long line of non-crypto companies to expand into the crypto treasury space. Numerous other small-cap companies have opted to switch their focus to digital assets, often sparking huge gains in their stock price overnight.

Last week, shares of sports holding company Brera Holdings announced that it would pivot to operate as a Solana treasury, sending shares up 450% in two days.

Even after switching its focus to bitcoin mining, AgriFORCE struggled to remain competitive in the crypto infrastructure market. Now, however, it’s attracted the attention of some big-name investors that it hopes will boost its position in the market.

“The tokenization of assets is the single biggest theme for the next decade of finance,” Scaramucci said in a statement put out by the company.