watch now

This is CNBC’s Morning Squawk newsletter. Subscribe here to receive future editions in your inbox.

Here are five key things investors need to know to start the trading day:

1. Border patrol

American companies and foreign workers were left scrambling over the weekend after President Donald Trump announced plans for a $100,000 fee on H-1B visas on Friday. The fee would be a seismic shift for the U.S.’ technology and finance sectors, which rely on the program for highly skilled immigrants.

Here are more details:

A White House official said the charge would apply to new applicants, not current holders or renewal applicants. They also said it would not be an annual charge, and it would not apply to 2025 visa lottery winners.

Some companies rushed to get current visa holders traveling abroad back to the U.S. following Trump’s announcement, while others warned visa holders not to leave the country.

Amazon had the most H-1B visa recipients in 2025, totaling over 14,000 as of the end of June. Here is a searchable list of firms that have been H-1B recipients this fiscal year.

Countries such as India, whose citizens make up about 71% of H-1B visa holders in the U.S, said they were assessing the impacts of the proposed policy change.

California — home to tech’s Silicon Valley — had the most new visa recipients at more than 13,000 through the end of June.

2. Riding high

NYSE

Vibes are good for the stock market heading into a new week.

All three of the major indexes recorded gains last week, after the Federal Reserve cut interest rates by a quarter percentage point. The Dow and S&P 500 both ended the week at record highs.

Mark your calendar for Friday: The personal consumption expenditures price index — the Fed’s preferred inflation gauge — for August is due before the bell. Follow live markets updates here.

3. News feed

Vcg | Visual China Group | Getty Images

While the U.S. and China failed to come to a formal agreement on TikTok’s U.S. business on Friday, the White House over the weekend offered details about what that deal could look like.

White House press secretary Karoline Leavitt said that a a seven-person board would control the platform’s U.S. arm, with six of those seats being held by Americans, NBC News reported. Leavitt also said the app’s algorithm would be managed by the U.S., and that Oracle would oversee its data and privacy.

Meanwhile, Trump dropped some hints about who could be involved in buying the business. The president said yesterday that conservative media mogul Rupert Murdoch and son Lachlan may be partners in the deal. A person familiar with the matter told CNBC that the younger Murdoch is unlikely to participate in the deal as an individual, but Fox Corporation might be involved.

4. Welcome to the club

Cheng Xin | Getty Images

Shoppers are — quite literally — joining the club. As CNBC’s Melissa Repko reports, membership-based warehouse clubs are opening new stores and bringing in more consumers.

High inflation revved up interest in chains like Costco , Sam’s Club and BJ’s in recent years. At the same time, the retailers have gained favor with younger shoppers through digital options, strong private label products and popular menu items.

Costco and BJ’s in particular have run circles around other retailers since mid 2018. Here’s why.

5. Bear-y good

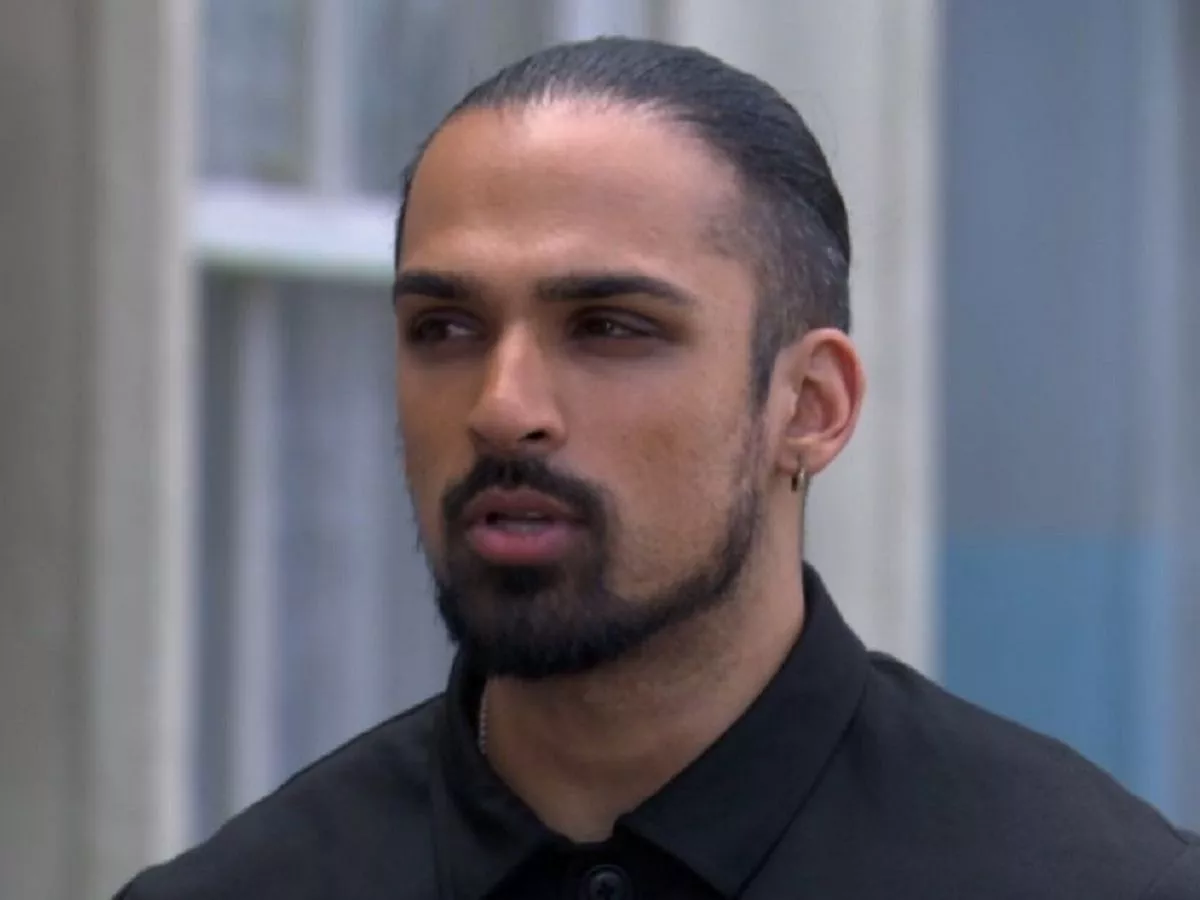

Laya Neelakandan | CNBC

There’s little reason to be bearish on Build-A-Bear Workshop.

While other retailers have struggled with tariffs and recession fears, the DIY stuffed animal business has seen record revenue and growth over the past year. Shares of Build-A-Bear have rallied around 60% this year, bringing the company’s market cap closer to the $1 billion milestone.

Build-A-Bear has benefited from nostalgia and diversification, experts say. The company is now looking at international expansion and a line of smaller, pre-stuffed toys.

The Daily Dividend

Here are some of the key reports we’re watching this week:

Tuesday: Micron earnings (after the bell)

Thursday: Second-quarter final GDP; CarMax earnings (before the bell); Costco earnings (after the bell)

Friday: August PCE price index; University of Michigan’s final consumer sentiment reading for September

CNBC Pro subscribers can see a full rundown for the week here.

— CNBC’s Laya Neelakandan, Melissa Repko, Sarah Min, Pia Singh, Erin Doherty, Yun Li and Gabriel Cortes, as well as NBC News, contributed to this report. Josephine Rozzelle edited this edition.