By News18,Sanju Verma

Copyright news18

The cornerstone of GST 2.0 is its simplified two-tier tax structure, which replaces the previous four-slab system with rates of primarily 5 per cent and 18 per cent, alongside a special 40 per cent slab for “sin” and luxury goods only. This restructuring addresses long-standing concerns of the GST’s complexity and aims to make the tax regime more transparent and equitable. This slab of 5 per cent covers daily essentials, including packaged food, clothing, footwear, bicycles, medicines, medical equipment, and personal care items like toothpaste, toothbrushes, soap bars, shampoos and hair oil. Approximately 99 per cent of items previously taxed at 12 per cent have been shifted to this lower 5 per cent bracket, significantly reducing costs for households. The 18 per cent slab includes most goods and services, such as consumer durables (televisions, air conditioners, refrigerators, washing machines), small cars (petrol engines

The GST 2.0 framework, approved during the 56th GST Council aims to simplify the tax structure, reduce tax burden on the common man, boost consumption and enhance ease of doing business. The 40 per cent rate on “sin” goods (e.g., tobacco, cigarettes, zarda, pan masala) and luxury items (e.g., high-end cars), ensures that non-essential and harmful products bear a higher tax burden, aligning with public health and fiscal objectives. GST 2.0 exempts several essential items from taxation, including Indian breads (roti, paratha), paneer, ultra-high temperature (UHT) milk, chhena, and 33 life-saving drugs, including anti-cancer medicines. Notably, individual life and health insurance policies (including family floater plans), previously taxed at 18 per cent, are now zero-rated, making healthcare and financial security more accessible.

GST reforms introduce pre-filled GST returns, faster refund processes, and streamlined registration for Micro, Small, and Medium Enterprises (MSMEs). These measures reduce the compliance burden, particularly for small traders and businesses unfamiliar with digital filing systems. GST 2.0 also addresses the inverted duty structure, where input taxes exceed output taxes, leading to Input Tax Credit (ITC) accumulation. By aligning input and output tax rates, the reforms free up working capital, particularly for manufacturers, enhancing domestic value addition and supporting the Atmanirbhar Bharat (Self-Reliant India) initiative. The compensation cess, previously levied to support States’ revenue losses post-GST implementation, will cease with the new rates, except for tobacco products. This move simplifies the tax system further and reduces administrative complexities.

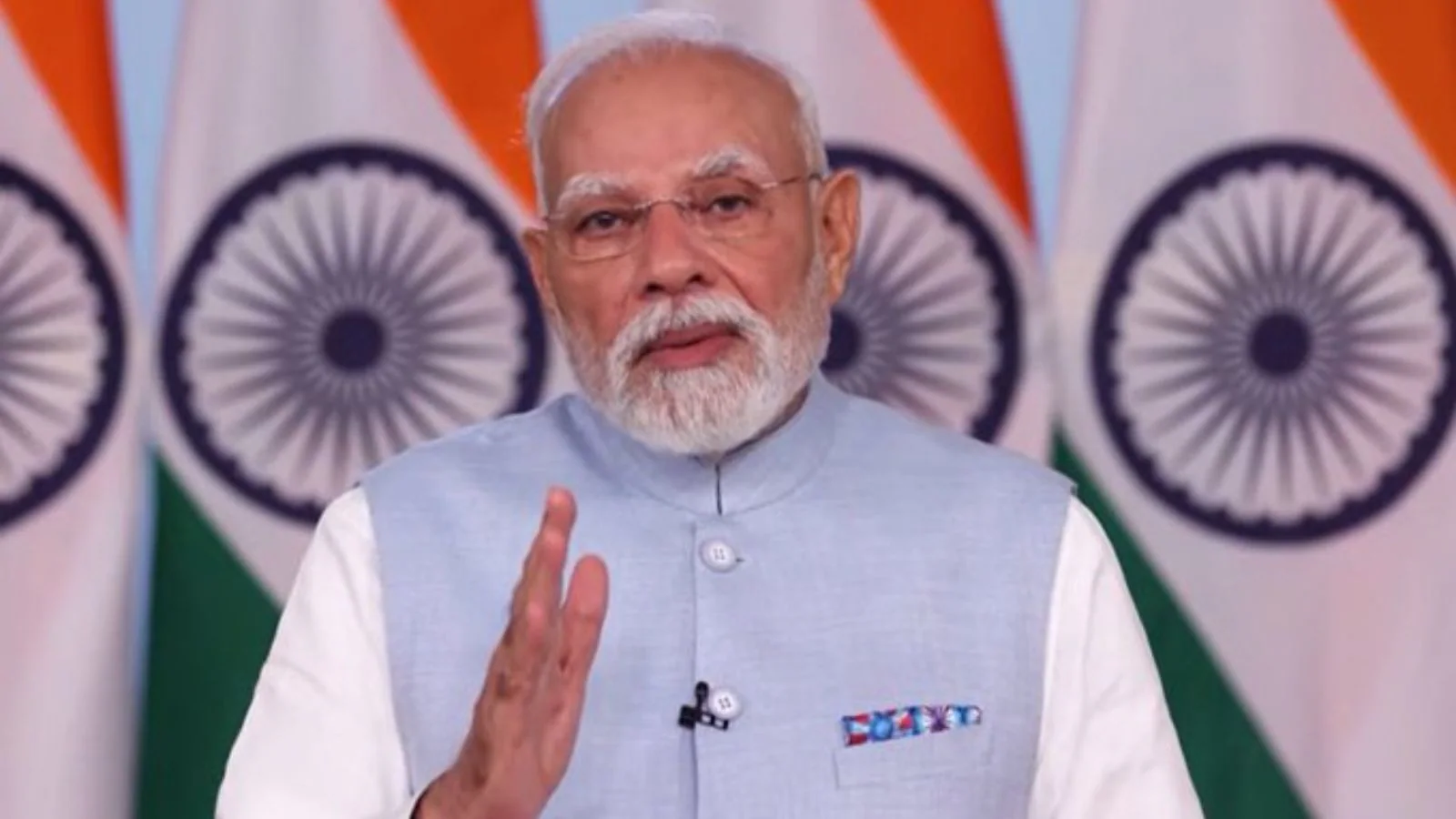

The new rates have taken effect from September 22, 2025, coinciding with the start of Navratri, a culturally significant period that marks the beginning of India’s festive and shopping season. This strategic timing aims to maximise consumer savings and stimulate economic activity during a peak consumption period. Prime Minister Modi has articulated these reforms as adding “Panch Ratna” (five gems) to India’s economy:

(1) Simpler Tax System: By reducing the number of tax slabs and eliminating classification complexities, GST 2.0 makes compliance easier for businesses and ensures transparency for consumers.

(2) Improved Quality of Life: Lower taxes on essentials and aspirational goods reduce household expenses, freeing up disposable income for other needs and improving living standards.

(3) Boost to Consumption and Growth: Rate reductions on consumer goods, durables and small cars are expected to spur demand, driving production and economic activity across sectors.

(4) Ease of Doing Business: Simplified compliance, faster refunds, and lower input costs encourage investment and job creation, particularly in MSMEs, which are the backbone of India’s economy.

(5) Strengthening Cooperative Federalism: The reforms were developed through consensus with State governments, reflecting a collaborative approach to fiscal policy and reinforcing India’s federal structure.

These objectives align with the broader vision of Viksit Bharat, aiming to position India as a developed nation by 2047. By addressing global economic challenges, such as US tariffs, through domestic reforms, GST 2.0 underscores India’s resilience and commitment to self-reliance. GST 2.0 reforms are poised to have a transformative impact across various sectors, benefiting consumers, businesses and the broader economy. The reduction of GST rates on daily-use items such as hair oil, toothpaste, soap, biscuits, namkeen, corn flakes, and instant noodles from 18 per cent or 12 per cent to 5 per cent directly lowers household expenses. Zero-rating essentials like paneer, Indian breads, and UHT milk provides significant relief to low- and middle-income families, particularly in rural areas where food constitutes a large share of expenditure. These changes are expected to act as a buffer against inflation, enabling families to stretch their budgets further. MSMEs, which employ millions and drive economic growth, benefit from simplified compliance, pre-filled returns and faster refunds. Lower tax rates on inputs reduce working capital constraints, enabling small businesses to compete more effectively. The reforms also encourage formalization of the unorganized sector, expanding the tax base and fostering inclusive growth. Zero-rating agricultural products like paneer and UHT milk, coupled with lower taxes on food items, supports farmers and dairy cooperatives.

Prime Minister Modi has repeatedly highlighted the role of dairy farmers in strengthening India’s rural economy, noting that GST 2.0 makes dairy products more affordable and boosts value addition in the sector. GST reductions on renewable energy devices encourage adoption of sustainable technologies, supporting India’s climate goals. By making green energy products more affordable, GST 2.0 contributes to environmental sustainability and energy security. The GST 2.0 reforms are expected to have a net fiscal impact of approximately Rs 48,000 crore. The government anticipates long-term gains through increased consumption, higher production, and improved compliance. The reforms are designed to stimulate demand, particularly in sectors like automobiles, consumer durables, and FMCG, which are expected to ramp up production and create jobs. The elimination of the compensation cess (except for tobacco) simplifies the fiscal framework and reduces the burden on States, fostering cooperative federalism. The GST Council’s unanimous approval of the reforms, with participation from Chief Ministers and Finance Ministers of various states, underscores the collaborative spirit behind GST 2.0.

GST 2.0 has been met with widespread optimism from citizens, industry leaders, and political figures. Prime Minister Modi described the reforms as a “double dose of support and growth,” emphasising their role in enhancing ease of living and powering India’s growth trajectory. The Modi government’s focus on cooperative federalism has been a big catalyst in addressing State-specific concerns and ensuring smooth implementation. Looking ahead, GST 2.0 sets the stage for further reforms, including potential inclusion of petroleum products and real estate under the GST framework. By reducing tax slabs, exempting essentials and simplifying compliance, the GST 2.0 reforms empower the common man, support businesses and strengthen India’s economic resilience. Clearly, one of the most significant highlights of GST 2.0 is the exemption of individual life and health insurance policies from GST, previously taxed at 18 per cent. This move addresses India’s limited insurance penetration (3.8 per cent of GDP in 2024, according to Swiss Re Institute) and supports the government’s “Insurance for All by 2047” mission. Zero-rating 33 life-saving drugs, including anti-cancer medicines and reducing taxes on medical items like thermometers and glucometers to 5 per cent further enhances healthcare affordability, aligning with initiatives like Ayushman Bharat and Jan Aushadhi Kendras. The shift of aspirational goods like televisions, air conditioners, refrigerators, washing machines and small cars from the 28 per cent slab to 18 per cent makes these products more affordable for the middle class. The reduction in GST on cement from 28 per cent to 18 per cent also boosts affordability in construction and real estate, supporting housing aspirations.

Rahul Gandhi and his coterie of sycophants can keep indulging in false bravado at how GST was “their idea”. But finally, an idea is only as good as its implementation. So while the Congress built flaky castles in the air by sitting on the Kelkar committee recommendations for ten long years, kudos to the Modi government, for eventually making GST 1.0 a reality on 1st July 2017 and GST 2.0 a big-bang reform in September 2025. In fact, it is time for the Congress to stop playing the ‘martyr’ and churlishly blaming the BJP for ‘snatching’ their idea, which never was their idea in any case, to start with. In a democracy, an idea is worth its weight in gold only if executed effectively. And clearly, despite multiple hurdles, it is thanks to Prime Minister Narendra Modi’s courage of conviction, his boundless determination and his tireless commitment, that the next generation GST reforms have come to fruition.

Sanju Verma is an Economist, National Spokesperson of the BJP and the Bestselling Author of ‘The Modi Gambit’. Views expressed in the above piece are personal and solely those of the author. They do not necessarily reflect News18’s views.