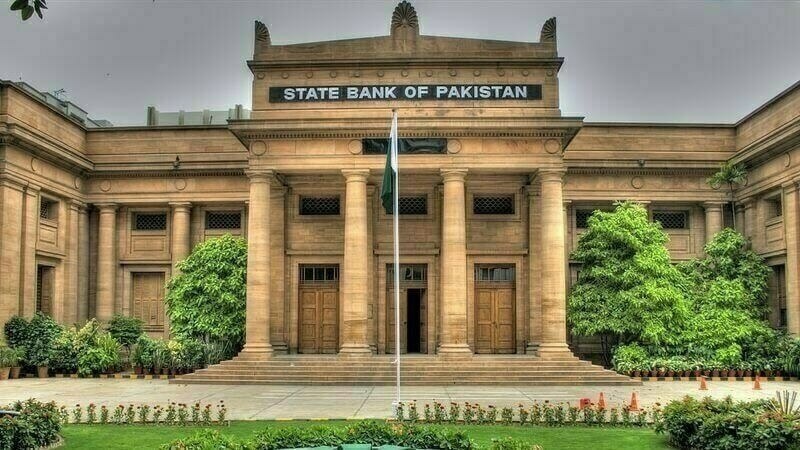

EDITORIAL: State Bank of Pakistan (SBP) released the banking sector report titled Mid-Year Performance Review of the Banking Sector January-June 2024 or, in other words, the data shared in the report pertains to calendar year 2024. The report highlights four prevailing factors.

Firstly, asset base expanded by 11 percent January-March 2025 supported by increase in investments while advances contracted witnessed in public and private sectors reflective of seasonal factors, reversal of substantial increase in lending towards end of calendar year 2024 and improvements in macro-financial conditions.

Investment is defined as assisting corporations, governments and other institutions raise capital by underwriting and selling securities.

Disturbingly a footnote in the report explained that the rise in investment was mainly in federal government securities plus public sector advances, reflecting a rise in borrowing while advances posted a “contained growth.” Additionally, the report noted that the pace of expansion was lower compared to 14 percent growth in the comparable period of 2024.

The report noted that net retirement of consumer financing was 15.8 billion rupees January-June 2024 with auto financing being the major driver.

Agriculture witnessed an increase of 25.4 billion rupees in advances, mainly under Farm Mechanisation Scheme and Prime Minister’s Youth Business & Agriculture Loan Scheme. An increase of 30.5 billion rupees in private sector commodity financing was primarily on account of sugarcane advances.

However, the government has pledged to the International Monetary Fund (IMF) in the ongoing programme approved in October 2024 that monetary incentives would be discontinued as they have not led to enhanced output in the past.

Secondly, deposits grew at 11.7 percent, lowering banks’ reliance on borrowings, lower than the 14.2 percent rise in the comparable period of last fiscal year with the disturbing acknowledgement that reliance on borrowing from financial institutions increased by 13.1 percent during the first half of 2024.

Advances to deposits continued to decline reflective of “persistently weak private sector demand for bank credit amid subdued economic conditions as well as government’s high demand for bank financing to meet the budget deficit.”

Thirdly, the slowdown in profitability was attributed to (i) growth in advances and (ii) falling returns on earning assets as the market interest rates began to factor in the declining inflation.

The solvency position of the banking sector remained steady as Capital Adequacy Ratio stood at 21.4 percent at end June-2025 — well above the regulatory benchmark of 11.5 percent.

And finally, with respect to Systemic Risk Survey, conducted in June 2024, geopolitical risk was considered the top most risk by the independent respondents.

What requires to be further highlighted is the report’s statement that “the rise in Non-Performing Loans of the energy sector was concentrated in a few borrowers which faced idiosyncratic issues.” This trend is unlikely to be reversed in the second half of the 2025 calendar year, given that the government has given the green signal to procure 1.225 trillion rupees to retire the circular debt, which is projected to reduce tariffs with lower interest payable (the discount rate has been reduced from 21 percent in June last year to 11 percent in June 2025); however, there are concerns echoed by the IMF, which led to the pledge on removal of the 10 percent cap on Debt Service Surcharge to ensure full cost recovery.

That the fact that banking sector’s performance should be a source of concern, especially after the government’s decision, approved by the IMF, to raise the exposure of banks to the appallingly poorly performing energy sector, cannot be over-emphasised, so to speak.

Copyright Business Recorder, 2025