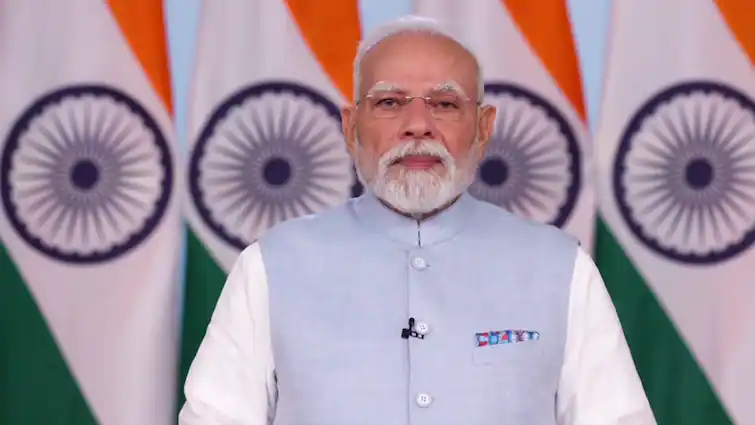

PM Modi Declares ‘GST Bachat Utsav’ Ahead Of Navratri, Says Tax Reliefs To Save Citizens Over Rs 2.5 Lakh Crore

By ABP Live News

Copyright abplive

Prime Minister Narendra Modi on Sunday declared that the start of Navratri will also mark the beginning of a “GST Bachat Utsav,” with revised Goods and Services Tax (GST) rates set to take effect from Monday. Addressing the nation, he said the reforms combined with the recent income tax exemption on annual earnings up to ₹12 lakh will allow citizens to save more than ₹2.5 lakh crore in just one year.

Extending festive greetings, Modi said the implementation of restructured GST rates symbolises a new phase for Aatmanirbhar Bharat. “From tomorrow, the festival of Navratri is starting. I extend my best wishes to you. From the first day of Navratri, the country is taking an important step towards Aatmanirbhar Bharat. Tomorrow, on the first day of Navratri, Next-Generation GST reforms will come into effect with sunrise,” he remarked.

Calling the initiative a celebration for every section of society, the Prime Minister added: “This Bachat Utsav will benefit everyone in our country—middle-class people, youth, farmers, women, shopkeepers, traders, and entrepreneurs.”

He also translated the festive metaphor into economic relief: “During this festive season, everyone will taste sweetness. GST reforms will bring happiness to every family… I extend my heartfelt congratulations and best wishes to millions of families across the country for the Next Generation GST reforms and ‘Bachat Utsav’. These reforms will accelerate India’s growth story, simplify business, make investment more attractive, and make every state an equal partner in the race for development.”

Modi emphasised that the government’s decision to make income up to ₹12 lakh tax-free has provided enormous relief to households. “This year, the government gave a gift by making income up to ₹12 lakh tax-free. Naturally, when income up to ₹12 lakh receives tax relief, it brings significant improvement and ease to the lives of the middle class. Now, it is also the turn of the poor and the new middle class. Both the poor and the middle class are receiving a kind of double benefit. If the relief in income tax and the relief in GST are combined, the decisions taken in a single year will save the people of the country more than ₹2.5 lakh crore,” he said.

The Prime Minister also linked the reforms to poverty alleviation, noting, “In the last eleven years, 25 crore people in the country have defeated poverty. Having emerged from poverty, a large group of 25 crore people, known as the neo-middle class, is playing a significant role in the country today… Now, the poor, the neo-middle class, and the middle class are receiving a double bonanza.”

New GST Rates From Monday

The GST Council’s decision to reduce tax rates across nearly 375 items takes effect on September 22, the first day of Navratri. Everyday staples such as ghee, paneer, butter, namkeen, ketchup, jam, dry fruits, coffee, and ice cream, along with aspirational products including televisions, washing machines, and air conditioners, will see lower prices.

Medical costs are also set to decline as GST on most drugs, formulations, and diagnostic equipment has been cut to 5 per cent. Cement will now attract 18 per cent GST instead of 28 per cent, providing relief to builders. Automobiles are among the biggest gainers, with taxes reduced to 18 and 28 per cent for small and large cars respectively.

Daily-use products like shampoos, soaps, hair oil, and toothpaste have also moved to the 5 per cent slab. Services such as salons, health clubs, fitness centres, and yoga sessions will now attract 5 per cent tax without input credit, compared to 18 per cent earlier.

Finance Minister Nirmala Sitharaman recently stated that the GST rationalisation will release around ₹2 lakh crore into the economy, putting more disposable income in the hands of consumers.