EDITORIAL: Despite exuberantly high tax rates amid abysmally low development spending, public debt is growing both in absolute terms and relative to GDP. The debt burden is increasingly skewed towards domestic sources as foreign funding dries up.

Traditionally, foreign debt sources have remained concessional—dominated by Western multilaterals, Middle Eastern friendly countries, and China. Market-based debt is either unavailable or unaffordable. As a result, it is drying up: in terms of GDP, external public debt has declined from 26.3 percent in FY23 to 20.4 percent in FY25. Its share in total debt has decreased from 35 percent to 29 percent.

On the other hand, however, the share of domestic public debt is rising. Its servicing cost remains high. It is important to note that although interest rates have halved, they are still in double digits. Domestic debt has increased by 40 percent in the past two years, and its servicing burden has grown even faster.

Real interest rates today are well in positive territory, and that is deliberately suppressing economic growth. In turn, this limits tax revenue growth at existing rates from an already thin tax base.

To counter that, the government has kept increasing tax rates—especially on income tax. Super tax rates are excessively high and are being imposed retrospectively, raising legal ambiguities. Taxation on salaried and non-salaried individuals is among the highest in the world, while service delivery remains among the poorest. In many cases, minimum taxes have been raised and are being withheld.

The tax liability in some instances reaches 70 to 80 percent, choking the economy. Despite this, FBR (Federal Board of Revenue) is still failing to meet its tax revenue targets. The buzz is that a mini-budget, which is purportedly being disguised as a response to exaggerated flood losses, is in the offing.

That new tax proposals mainly target so-called luxury items and measures where taxes had been reduced in the budget under the new tariff policy is a fact. The strategy is perhaps aimed at pressuring the IMF (International Monetary Fund) to undo the tariff policy. Another consideration is to reduce the import bill, which has been growing as signs of recovery emerge in the manufacturing sector.

With exports stagnating (partly due to high taxation) and remittances losing steam, imports must be curtailed to maintain external account stability. To this end, the SBP is keeping policy rates high, which increases the government’s debt servicing costs.

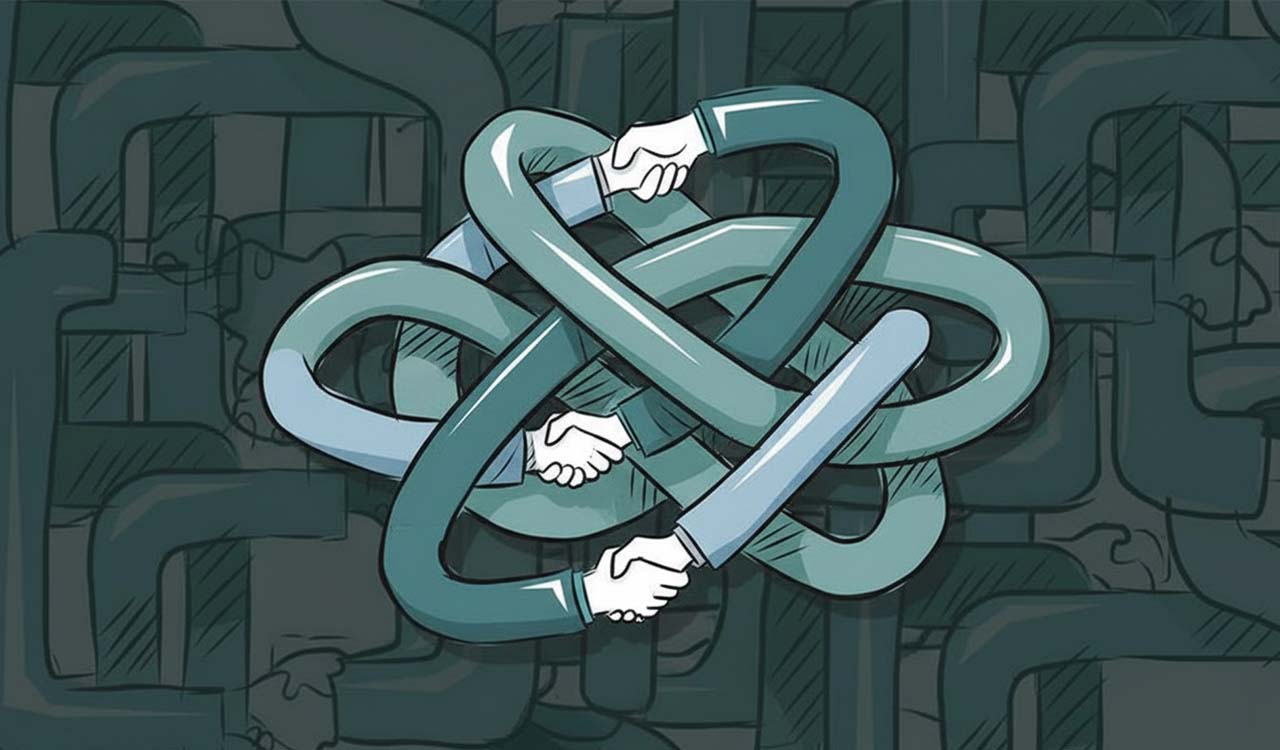

To finance that burden, FBR is imposing more taxes on imports. It is a self-defeating cycle—a loop that will trap the economy in a low-growth equilibrium unless the government cuts its size and broadens the tax base. How ironic, however, it is that we have been steadfastly ignoring the elephant in the room.

Copyright Business Recorder, 2025