By Brand Ave. Studios contributing writer,Sponsored Content By Tom Connor

Copyright omaha

Bank customers are just that: customers. When they make deposits, take out loans or engage in other banking activities, someone else profits. But credit union members are different. They own part of the institution and hold a share of its value. So the elevated service, excellent rates and overall satisfaction they experience come as no surprise.

“When someone opens an account with us, they are not just a customer. They’re an owner of the credit union, and that changes the whole dynamic,” said Robin Larsen, president and CEO of Cobalt Credit Union, based in Papillion, Nebraska. “We’re not here to maximize profits for outside shareholders. We’re here to provide value back to the people who use our services.”

Membership is easy

Cobalt Credit Union welcomes individuals 18 years or older who have a Social Security number and a government-issued identification. You simply open a “share” account — basically a savings account — with at least $5, which establishes eligibility for a wide range of financial products and services. These include checking accounts, credit cards, CDs, money market accounts, mortgages, loans, commercial lending and financial counseling. Auto loans are particularly popular with members and can be initiated through a dealer or at any of the credit union’s locations, often at lower rates than offered elsewhere. Cobalt has 23 branch locations in Nebraska and Iowa, providing access to a vast network of approximately 30,000 ATMs.

A leader in technological advancements

Last August, Cobalt launched a new digital banking platform to enhance ease of use, while increasing security for members. The credit union has also added live chat and texting capability alongside its video banking service.

A leader in financial education for adults and students

Today’s consumers expect financial guidance and solutions beyond basic banking services. Cobalt is way ahead of the game, offering not only investment services but also comprehensive financial counseling to all members.

Notably, Cobalt has affiliations with Papillion public schools and Creighton University, which enable it to educate students and offer Student Spend Accounts with no minimum balance and no monthly service fee. The company backs its belief that financial success begins early with innovative programs such as the Baby Bundle Savings Plan and the Dollar Dog Kids Club.

“We are trying to teach students, from elementary school through college, how to apply for credit, how to balance their accounts — then support them through their life events,” Larsen said. “It’s really neat to see them go from opening their first checking and savings accounts to buying their first home, opening a business and planning for retirement.”

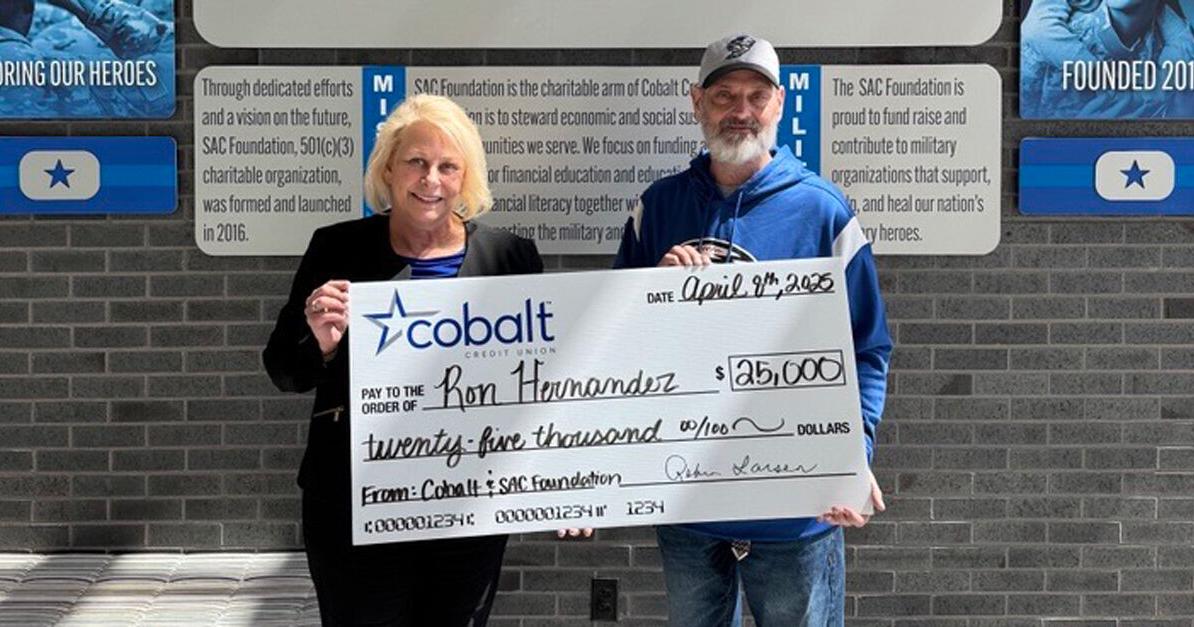

A leader in U.S. veteran services

In June, the SAC Foundation, which is the charitable arm of Cobalt Credit Union, raised over $36,000 from its annual golf charity event to support veteran initiatives. Two months earlier, the foundation and Cobalt together donated $25,000 to local veteran Ron Hernandez to help him and his family remain in their longtime home. Hernandez is a U.S. Air Force veteran and founder of Moving Veterans Forward, an organization that helps veterans in Iowa and Nebraska who are unhoused to find housing. In April, he faced losing his own home while battling stage 4 pancreatic cancer. The SAC Foundation’s help is just another example of Cobalt’s dedication to the people it serves.

“Our commitment to veterans and the military community goes beyond banking — it’s about doing what’s right when it matters most,” Larsen said. “Ron has given so much to others. It was our honor to help give back to him.”

To learn more about Cobalt Credit Union or to apply for membership, visit cobaltcu.com. To find a branch or ATM near you, visit cobaltcu.com/branches.

Cobalt Credit Union is Federally Insured by the NCUA and is an Equal Housing Lender.

This content is for informational purposes only and should not be construed as financial advice. Please consult a finance professional for financial advice. The views, thoughts and opinions expressed in this content belong solely to the advertiser and do not represent the views of Brand Ave. Studios or its parent company.

This content was produced by Brand Ave. Studios. The news and editorial departments had no role in its creation or display. Brand Ave. Studios connects advertisers with a targeted audience through compelling content programs, from concept to production and distribution. For more information contact sales@brandavestudios.com.