New Friction Index reveals how operational barriers are reshaping Asia Pacific’s $131B real asset boom

By ieyenews

Copyright ieyenews

The Index tracks sources of “friction” across markets, highlighting sector shifts and emerging strategies for investors.

Singapore, 9 September 2025 – Vistra, a leading global fund services provider, in partnership with the Asia Pacific Real Assets Association (APREA), today announced the findings of their inaugural Vistra Fund Solutions Friction Index 2025, a comprehensive white paper on investment opportunities and operational hurdles in Asia Pacific (APAC) real assets.

The report, drawing on insights from over 100 industry leaders across more than 10 core markets, uncovers a defining market paradox: the sectors and geographies with the highest investment potential also present the most severe operational challenges, or “friction,” that are reshaping investment strategies.

Investment soars, but capital shifts decisively

APAC real estate investment surged 23% year-on-year in 2024 to a historic US$131.3 billion. However, this capital is decisively shifting away from traditional assets. Data centres, logistics and industrial sectors are the undisputed top picks for investment upside, driven by digitalisation and AI. Data centre transaction volume exploded to US$1.1 billion in Q2 2025 alone, a nearly 7x increase from US$157 million in Q2 2024. Conversely, traditional office and retail assets are consistently ranked lowest by investors.

Value-add and opportunistic strategies dominate as investors seek alpha to offset friction

The pursuit of returns capable of overcoming operational hurdles is driving capital towards more complex strategies. Opportunistic (30%) and value-add (29%) approaches dominated global fundraising in H1 2025. This aligns with the Index’s finding that investors are pivoting to active management, a trend evident in APAC with Japan’s focus on living/hospitality assets and MSCI data showing a rise in office conversions (45% in 2024, up from 41%). These strategies, while high-friction, are seen as a primary path to alpha.

Growth friction: the brake on returns

The report identifies “growth friction” – including regulatory complexity, tax regimes, and a lack of data transparency – as the critical factor separating successful investors from the rest.

Regulatory hurdles: The top frustration for investors (62% of whom operate across multiple markets) is navigating complex and unclear regulations, political risk, a lack of transparency and deal-sourcing difficulties.

Data transparency: 49% of investors find obtaining reliable real-time performance data across APAC portfolios “difficult” or “very difficult.”

Outsourcing demand: 62% of investors want to outsource regulatory reporting, with 59% seeking help for SPV management, signaling widespread frustration.

Surprising friction in “safe haven” markets

The Index challenges stereotypes, revealing significant operational friction in developed markets often perceived as low-risk:

Singapore: While 88% of firms operate there for its stability, 21% cite talent shortages in fund administration.

Australia: Contradicting its “easy” reputation, 37% of investors flag its tax regime as a major barrier to entry.

Navigating the paradox: AI, ESG, and local expertise

Investors are adapting by leveraging new tools and strategies:

AI as an enabler: 65% of investors see AI having the greatest impact on overcoming friction in deal sourcing and market intelligence.

ESG integration: 65% view ESG as “important” to “extremely important,” confirming its move to a core investment mandate.

The strategic shift: The traditional fund model is breaking down. Investors are increasingly pursuing direct acquisitions, joint ventures, and investments in real asset operating companies to gain control and mitigate operational risks.

A new framework for APAC investment

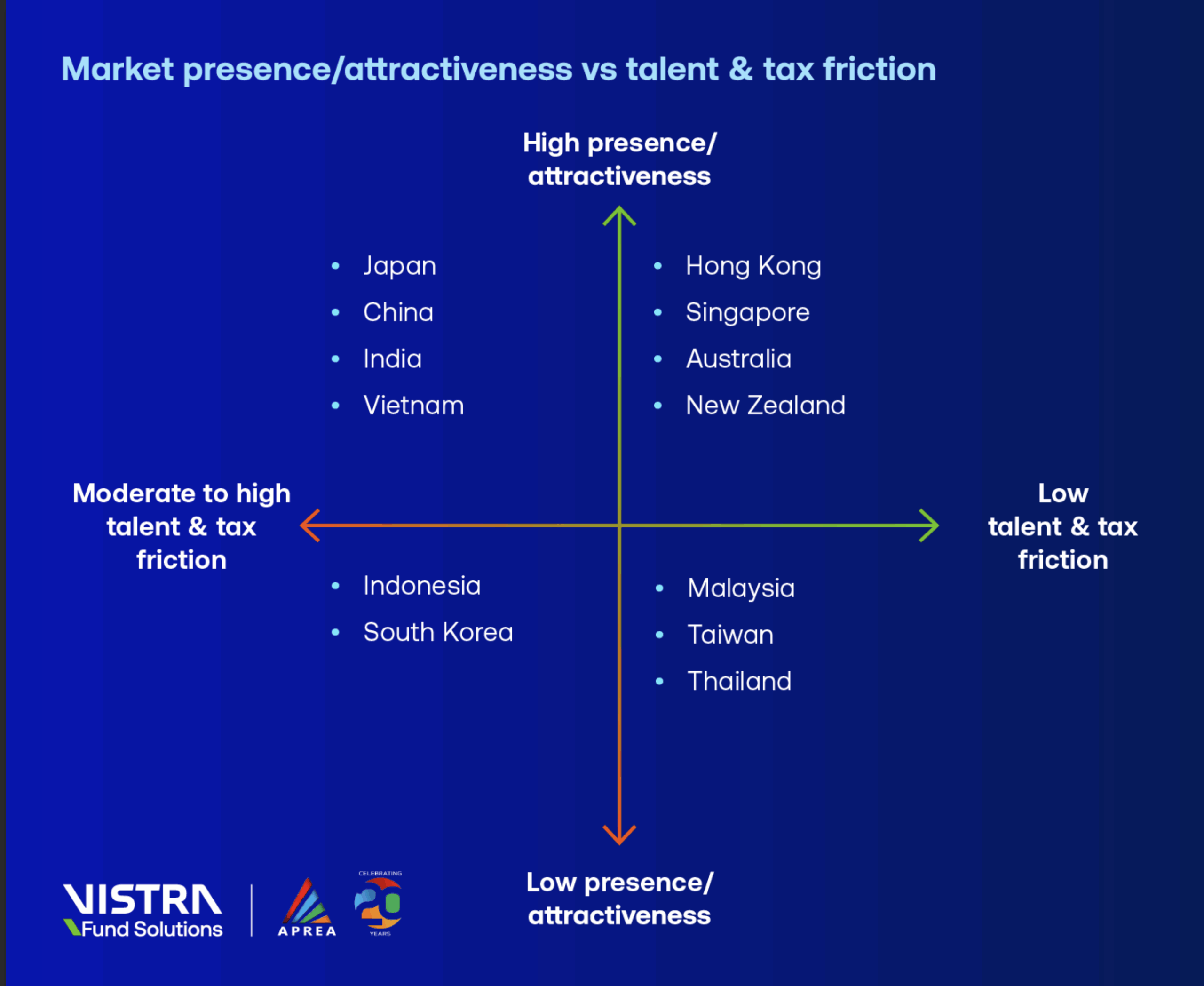

A unique output of the Index is the “Opportunity-Friction” quadrant, which classifies markets not by traditional developed/emerging lines, but by their potential versus their operational complexity (e.g., Hong Kong = High Opportunity, Low Friction; India = High Opportunity, High Friction). This provides a nuanced guide for capital allocation based on an investor’s risk tolerance and operational capability.

“While investment volumes are hitting record levels, our Index reveals that operational frictions are driving sector shifts and emerging strategies for investors,” said Abdel Hmitti, President, Vistra Fund Solutions. “Success is no longer just about picking the right asset; it’s about having the expertise to navigate the complex operational landscape that comes with it. For investors equipped with the right insights and partners – local expertise, technology, and adaptive fund structures – operational friction can be turned into a competitive advantage. The growth potential is extraordinary.”

Sigrid Zialcita, Chief Executive Officer, APREA, said: “The Friction Index 2025 provides a practical view of the dynamics shaping real asset strategies and a critical playbook for those in the investment ecosystem. It moves the conversation beyond sheer opportunity to the practical execution challenges that defines investment success. As APREA marks its 20th year in 2025, this Index underscores our commitment to empowering our members and the industry to navigate an increasingly complex investment landscape.”

Download the full report: The complete Vistra Fund Solutions Friction Index 2025: Investment opportunities and hurdles in Asia Pacific real assets white paper is available for download here.

About Vistra

Vistra is a leading provider of essential business services to help companies and private capital funds grow across the entire business and investment lifecycle.

Here at Vistra, our purpose is progress. As a close ally to our clients, our role is to remove the friction that comes from the complexity of global business. We partner with companies and private capital managers along the corporate and private capital lifecycle. From HR to tax and from legal entity management to regulatory compliance, we quietly fix the operational and administrative frustrations that hamper business growth. With over 9,000 experts in more than 50 markets, we can accelerate progress, improve processes, and reduce risk, wherever your ambition takes you.

For more information about Vistra, visit vistra.com

About APREA

2025 holds special significance for the Asia Pacific Real Assets Association (APREA), as we mark 20 years of championing the institutional real assets industry across APAC. Over the past two decades, APREA has grown into the pre-eminent regional representative for the industry, with active members spanning global institutional investors and asset managers, developers, real estate investment trust (RElTs), pension, insurance, and sovereign wealth funds, family office platforms, and consultants. We have seven chapters that encompass the region, covering Singapore, China, India, Japan, Hong Kong, Australia, and other markets. Collectively, our members manage more than USD 20 trillion of real assets and utilise the APREA platform to promote real estate and infrastructure as the preferred investment asset class across APAC and beyond.

For more information about APREA, visit aprea.asia

Our Privacy Notice can be found at https://www.vistra.com/privacy-notice