By Holly Williams

Copyright standard

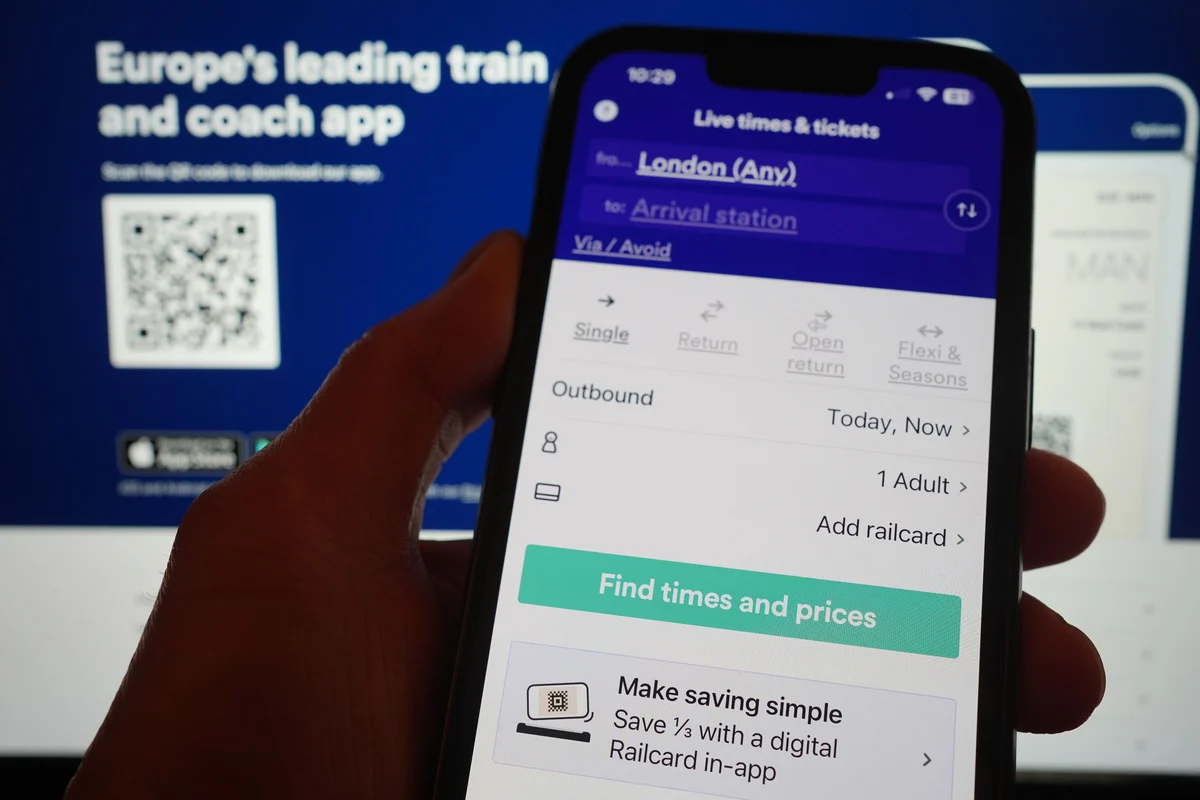

Trainline has seen shares surge higher after it boosted its earnings outlook despite a hit from the Government’s move to expand “tap-in and tap-out” contactless payment across more UK stations.

The online ticketing platform notched up an 8% rise in UK net consumer ticket sales to £2.1 billion in the six months to the end of August, thanks to a bounce back in demand for leisure travel and commuting, and as year-earlier trading was impacted by strike action.

But it said it took a hit from the first phase of the Department for Transport’s rollout of the contactless payment network to more stations, allowing passengers to tap-in and tap-out with bank cards and pay the guaranteed best fare available at that time of day.

Consumer revenues were flat at £107 million, it added.

In spite of this, London-listed Trainline said it now expects full-year underlying earnings at the top end of its previous guidance, for between growth of 6% and 9%.

Shares in the FTSE 250 firm soared as much as 13% on Thursday morning trading, as it also cheered investors with plans to bolster returns with up to another £150 million in share buybacks.

Jody Ford, chief executive of Trainline, said: “Trainline has delivered a robust performance in the first half and today announces improved guidance for the full-year alongside an enhanced £150 million share buyback programme.”