By Iheanyi Nwachukwu

Copyright businessday

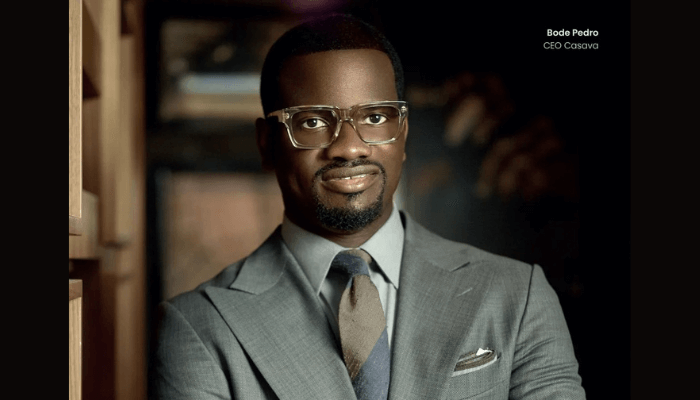

Bode Pedro, CEO, Casava Inc. has urged stakeholders in the insurance sector to leverage technology and innovation to deepen penetration and reach millions of underserved Africans.

Pedro disclosed this during a fireside chat with Per Lagerström, former McKinsey partner and insurtech pioneer, at the 4th annual Insurance Meets Tech (IMT) conference recently held in Lagos.

“We must leverage technology. We want to take insurance to the people where they are, whether through WhatsApp, SMS, USSD, or POS agents. Insurance should not be a product for the few; it should be accessible, affordable, and simple for everyone.”

Read also: Insurance sector contributions to GDP seen growing on new reform law

He revealed that Casava Inc., which is the parent company of Casava Microinsurance Limited, is pursuing partnerships with telecoms and fintechs to scale faster. “Most Nigerians already interact with telcos and POS agents daily. If those channels can also deliver insurance products, adoption will rise. Our goal is to make insurance as easy to buy as airtime,” he said.

For Lagerström, the challenge is deep and goes beyond technology, calling for the need to overhaul the models.

“Consumers don’t buy insurance products; they buy solutions to their needs,” he said. “The current models are outdated, and Distribution has to evolve. Platforms that are data-rich and trusted will dominate, not legacy intermediaries,” he said.

According to him, the session is expected to set the tone for the future of insurance innovation in Africa.

The event, convened by Odion Aleobua, CEO of Modion Communications, themed “Innovating for the New Trybe” gathered together regulators, innovators, and top executives to discuss how insurance can leverage technology to reach millions of underserved Africans.

Aleobua argued that regulation must support innovation rather than hold it back to achieve desired results.

Read also: Insurance sector posts record quarterly growth as premium jumps 63.4%

“We need sandbox environments where new models can be tested. If you blend outdated regulations with modern technology, you get a problem. The goal should be to protect consumers while allowing innovators to thrive.”

He also emphasised that IMT was designed to inspire both industry leaders and young professionals.

“From the C-Suite executives to the new generation of coders and hustlers, IMT is about conversations that matter. This year, we are bringing global voices like Per Lagerström alongside our Gen Z to create a balance of insight and action.”

According to him, IMT has become the meeting point for ideas that can transform the industry, adding that the next 25 years of insurance in Africa will be driven by trust, technology, and platforms.