Want more stock market and economic analysis from Phil Rosen directly in your inbox? Subscribe to Opening Bell Daily’s newsletter.

Money falls from the sky when Nvidia does a deal.

Indeed, as I wrote last week about Oracle, only in the age of AI can a 57-year-old company jump more than 30 percent in a single day.

Intel added roughly $27 billion in market cap on Thursday after Nvidia announced it took a $5 billion stake in the company.

Featured Video

An Inc.com Featured Presentation

After the initial spike, shares of Intel closed about 23 percent higher in the session.

Nvidia, meanwhile, finished up 3.7 percent.

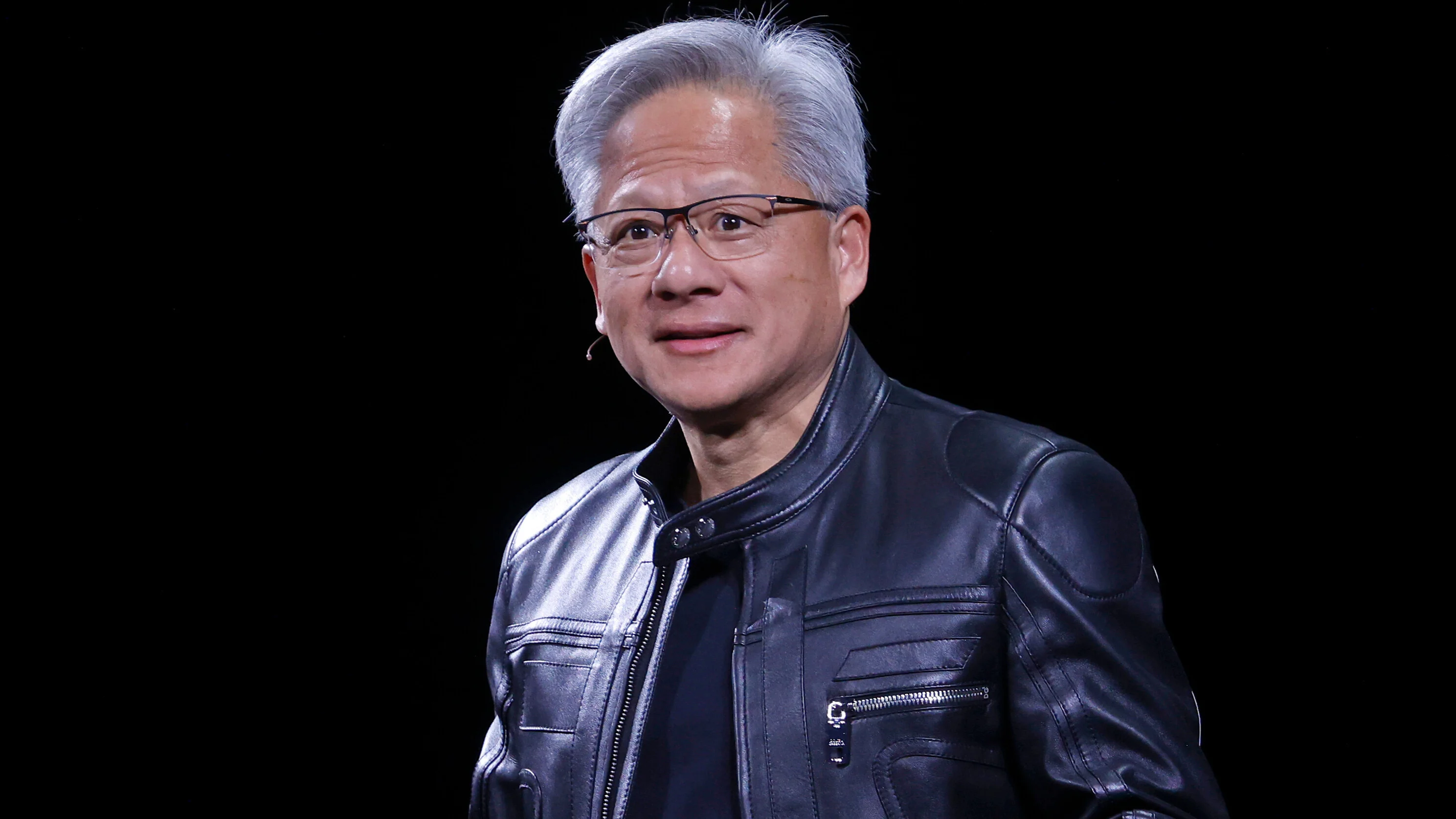

“This historic collaboration tightly couples NVIDIA’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem — a fusion of two world-class platforms,” said Nvidia CEO Jensen Huang in a statement.

“Together, we will expand our ecosystems and lay the foundation for the next era of computing.”

Investors seem optimistic about not only Nvidia’s partnership with Intel, but those of the US government and SoftBank.

In August, the government deployed $8.9 billion into the chipmaker for 433.3 million shares, while SoftBank invested $2 billion.

As of Thursday, Intel is suddenly a top-performing AI investment in 2025, ahead of Nvidia and lagging only Oracle. Angelo Zino, equity analyst at CFRA Research, maintained his “hold” rating on Intel after the news.

Nvidia’s involvement, he said, should be taken as a vote of confidence for Intel investors.

“The expanded partnership is solely for products, which has completely missed the AI boat, and we question whether this will significantly improve Intel’s data center prospects and drive earnings upside,” Zino wrote in a note, adding that he would “avoid chasing shares.”

Nancy Tengler, CEO and CIO at Laffer Tengler Investments, said the private sector should be able to resolve Intel’s technology issues.

In her view, Nvidia, Broadcom, AMD, and Lam Research will be the winning stocks as a result of the deal.

“This may be the first step of an acquisition or break-up of the company among U.S. chip makers though it is entirely possible the company will remain a shadow of its former self but will survive,” Tengler said.