Nvidia NVDA is in advanced talks to make a $500 million investment in the U.K. autonomous driving startup Wayve, signaling a strategic expansion of its influence in the thriving artificial intelligence sector.

This potential deal, first reported by the Financial Times on Friday, is a key component of the U.S. chipmaker’s broader 2 billion pounds pledge to support British startups.

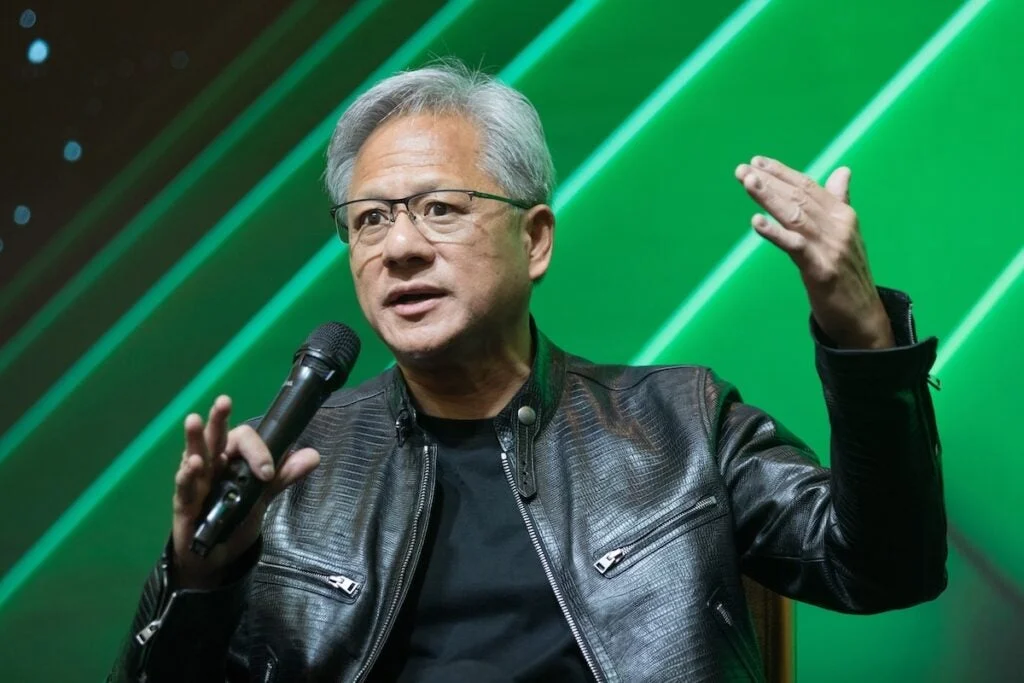

The announcement was made by CEO Jensen Huang in London, where he appeared alongside Prime Minister Sir Keir Starmer following President Donald Trump’s state visit.

Also Read: Nvidia’s Bold Move Catapults Intel To The Heart Of AI Innovation

Speaking to an audience of tech entrepreneurs, Huang underscored Nvidia’s commitment to the U.K. tech ecosystem, revealing plans to back several other firms, including fintech group Revolut. In a bold declaration, he stated, “the first trillion-dollar company in the U.K. will be an AI company.”

Founded in 2017, London-based Wayve has rapidly emerged as a leader in autonomous driving, notably securing a $1 billion investment from SoftBank SFTBY in 2024 and partnering with Nissan NSANY in April. The startup already leverages Nvidia’s processors for its technology.

This move follows Nvidia’s earlier pledge of a 500 million pounds investment in Nscale, a London-based AI cloud provider. These commitments are part of a larger 2 billion pounds equity and infrastructure initiative, which will see more than 120,000 Nvidia processors deployed in the U.K. by Nscale and U.S. firm CoreWeave CRWV to support clients like OpenAI and Microsoft MSFT.

While Nvidia solidifies its position in the U.K., it is navigating significant challenges in China. The company’s stock, which had gained over 31% year-to-date, outperforming the Nasdaq 100’s over 16% returns, briefly dipped on reports that China’s internet regulator banned its AI chips.

Huang expressed disappointment, emphasizing Nvidia’s long-standing role in China’s tech ecosystem.

The Financial Times detailed that Beijing has ordered major tech companies like ByteDance and Alibaba BABA to cease purchasing Nvidia’s RTX Pro 6000D, a model specifically tailored for the Chinese market.

This decision exacerbates Nvidia’s issues in a market that accounts for 20-25% of its revenue, already hampered by repeated U.S. export restrictions on its H100, A100, and H20 chips.

Earlier, in August, Huang had brokered a deal with President Trump to secure export licenses by funneling 15% of Chinese H20 sales to Washington, yet Nvidia has still advised analysts to exclude China from their financial forecasts.

Adding to the regulatory pressure, China’s market regulator this week launched an antitrust probe into Nvidia’s $6.9 billion Mellanox acquisition.

Price Action: At last check Friday, NVDA stock was trading lower by 0.20% to $175.89 premarket.

Read Next:

Uber Bets On Drones With Flytrex Deal To Speed Up Deliveries And Cut Costs

Image by jamesonwu1972 via Shutterstock