By Giulia Carbonaro

Copyright newsweek

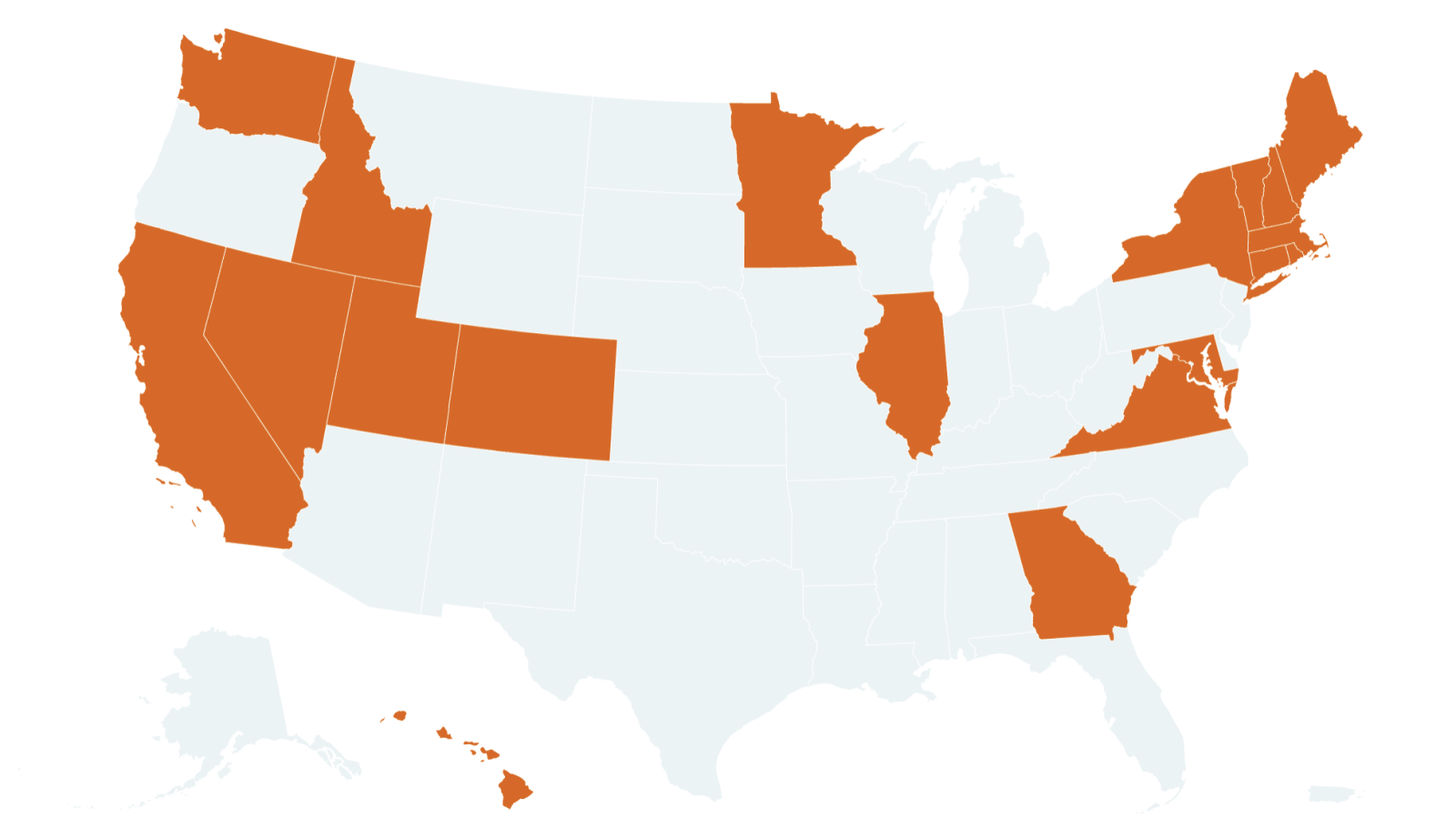

The nationwide, bipartisan movement to eliminate so-called “junk fees” for renters has reached Massachusetts, where landlords are now forced to share the total price of what they are renting out with a future tenant before asking for any personal information.Massachusetts is only the latest in a series of states which have introduced similar legislation against hidden fees in the rental market in recent years, including California and Colorado, as Americans struggle with a housing affordability crisis.What Are Junk Fees?All hidden, misleading, or deceptive fees which conceal the complete cost of an item or service—including rent—before its purchase are usually considered “junk fees.”This is an issue that lawmakers have tried to crack down on for years now. A legislative proposal advanced by the Federal Trade Commission (FTC) in 2023 and called the Junk Free Prevention Act aims at banning junk fees at the national level, increasing transparency for consumers.While the act has not yet been passed, several states have taken matters into their own hands already, passing laws limiting or banning junk fees—including for the rental market.In the context of renting out a property, junk fees can refer to any additional charges put on top of a tenant’s base rent—what are often called “tenant fees”—which can include the cost of services—like pest removal and package delivery—and amenities—like the use of a garage—which used to normally be included in the rent. Over the past decade or so, this has been a way for landlords to boost revenues amid rising costs.But rental “junk fees” are increasingly under scrutiny across the country, especially after the FTC sued rental giant Greystar in January, accusing the Charleston, South Carolina-based company of charging millions of dollars in unnecessary fees for services that should be included in the base rent.Which States Have Introduced Laws Against Them?At least 19 states have introduced protections for renters limiting hidden fees from landlords, according to data compiled by the National Low Income Housing Coalition.These include California, Colorado, Connecticut, Georgia, Hawaii, Idaho, Illinois, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Hampshire, New York, Rhode Island, Utah, Vermont, Virginia, and Washington. Several of these states have joined the list this year.In April, Colorado Governor Jared Polis signed a new law banning commercial property owners from charging tenant fees along with their monthly rent payments, while apartment landlords must advertise the total cost for renting a unit instead of a lower base rate. The law, which will come into effect at the start of 2026, also allows renters to reuse background checks for up to 30 days to avoid multiple fees.In the same month, Illinois’ House of Representatives passed a bill that would prohibit landlords from charging a move-in fee and limit late fees. The bill, however, was heavily written by the Senate, and has not come up for a vote yet.As of September 2, Massachusetts started applying its new law banning junk fees—including tenants’ application fees.”We’ve all been there: booked a hotel room, purchased concert tickets, or paid for a service that was advertised at one price and then charged for one exponentially higher—all because of hidden junk fees,” said state Attorney General Andrea Joy Campbell.”These regulations seek to keep more money in residents’ pockets by combatting these unnecessary fees and ensuring consumers understand exactly how much and what they are paying for.”Rhode Island and Maine also bar landlords from charging prospective tenants application fees. Other states like Nevada, Virginia, Washington and Vermont have introduced laws that cap some tenant fees or eliminate them altogether.Under a 2023 law, Connecticut landlords and property owners cannot charge a tenant more than $50 for a tenant screening report or charge a tenant any special fees beyond a security deposit, first months rent, and any charges for keys or special equipment.In Maryland, a 2024 law limits the imposition of excessive rental fees, including fees charged for rental applications, late fees, pet fees, lost key fees, lock out fees, storage unit fees, internet or cable fees, and parking fees. Under a law introduced the same year, Minnesota protects renters against certain rental fees, including fees for service animals and late fees for nonpayment of rent.A law that came into effect on January 1 in New Hampshire requires landlords and property owners to disclose all fees, and their purpose, to prospective tenants, banning hidden fees. A similar law in Utah, introduced in 2021, requires landlords and property owners to disclose all applicable fees to a tenant before the start of the lease.How Bad Are Junk Fees for Renters?A study by the National Consumer Law Center found that junk fees cost American tenants hundreds of millions of dollars a year, disproportionately impacting the lowest-income and marginalized renting households, who spend a higher share of their wages on these hidden costs.According to U.S. Census Bureau data, over 21 million renter households—the equivalent of about half of all renter households—spent more than 30 percent of their monthly income on rent in 2023, enough to be considered cost-burdened.While laws restricting or eliminating junk fees are aimed at helping renters, some fear that they could end up bringing up the cost of rent, as landlords find other ways of keeping costs in check.Recent data from the housing market show that asking rent prices are climbing back across the country as supply dwindles while demand remains strong. For renters, this could mean facing higher costs after years of flat or declining prices. The U.S. median rent rose by nearly 3 percent last month to $1,790, according to the latest data by Redfin, the highest increase since December 2022.