The Federal Trade Commission (FTC) and seven states sued Ticketmaster and its parent company, Live Nation Entertainment, on Thursday, for allegedly failing to crack down on ticket resellers and “engaging in illegal ticket resale tactics” by selling the “illegally harvested tickets at a substantial markup in the secondary market, causing consumers to pay significantly more than the face value of the ticket.”

Fast Company has reached out to Ticketmaster and Live Nation for comment and is awaiting their response.

The FTC press release alleged Ticketmaster used “deceptive pricing tactics” and earned “hundreds of millions selling tickets acquired illegally by brokers” which cost consumers “billions of dollars in inflated prices and additional fees.”

The agency further alleged in a complaint that California-based Ticketmaster and its parent company “deceived artists and consumers” by engaging in “bait-and-switch pricing” by advertising lower prices for tickets than what consumers must pay to purchase tickets; imposing “strict limits” on the number of tickets consumers could purchase for an event—even though ticket brokers “routinely and substantially exceeded those limits”—and sold millions of tickets on its platform, “often at much higher cost to consumers.”

Subscribe to the Daily newsletter.Fast Company’s trending stories delivered to you every day

Privacy Policy

|

Fast Company Newsletters

The FTC’s complaint alleged Ticketmaster’s practices violate the FTC Act’s prohibition on deceptive acts or practices in the marketplace and the Better Online Ticket Sales Act (BOTS Act)—and is seeking civil penalties, plus any additional monetary relief the court finds appropriate.

Ticketmaster is the leading provider of concert and event tickets. Founded in 2010, following the merger of Live Nation and Ticketmaster, Live Nation Entertainment, Inc. promotes, operates and manages ticket sales for live entertainment in the U.S. and internationally.

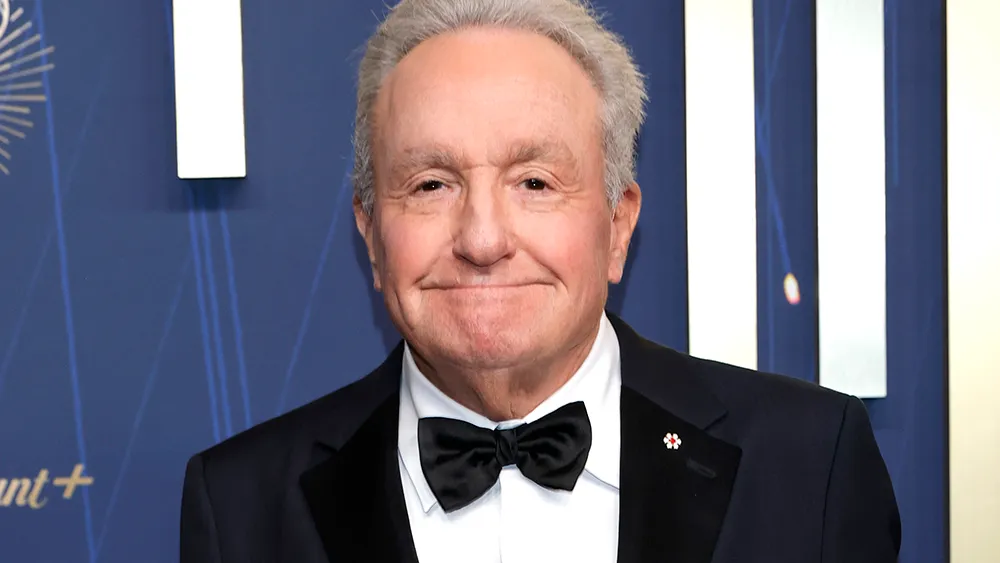

“President Donald Trump made it clear in his March Executive Order that the federal government must protect Americans from being ripped off when they buy tickets to live events,” FTC Chairman Andrew N. Ferguson said in a statement. “It should not cost an arm and a leg to take the family to a baseball game or attend your favorite musician’s show.”

Shares of Live Nation (LYV) were down over 2.5% in midday trading on Thursday at the time of this writing.

Fast Company previously reported the FTC filed a lawsuit over the summer alleging brokers illegally scooped up tickets for Taylor Swift’s Eras Tour and resold them for millions in profit; and on a backlash over Oasis ticket sales.

Live Nation Entertainment financials

For the second quarter for 2025, ending on June 30, Live Nation Entertainment reported revenue of $7 billion, up some 16%, an increase year-over-year with an operating income of $487 million, up 4%. It reported an earnings-per-share (EPS) of $0.41, which missed estimates of $1.08 by $0.67. It had a market capitalization of 38.74 billion at the time of this writing.