By Our Reporters

Copyright indiatimes

Explore other editions

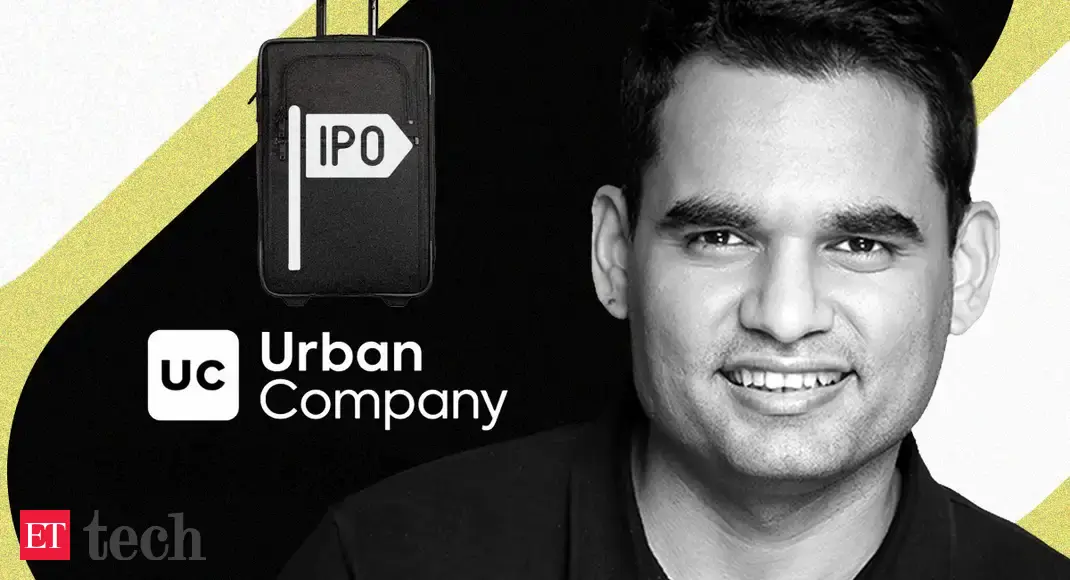

ETSA Startup of the Year winner Urban Company; Groww files IPO papers

Want this newsletter delivered to your inbox?I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning DispatchWe’ll soon meet in your inbox.

Happy Wednesday! Public listing bound Urban Company’s CEO Abhiraj Singh Bhal details the startup’s plans. This and more in today’s ETtech Morning Dispatch.Also in the letter:■ VCs go independent■ IT contracts up for grabs■ Vaishnaw on Arm in IndiaET Startup Awards 2025: 100X IPO subscription is a responsibility, not a victory lap: Urban Company CEO At-home services platform Urban Company, which won the prestigious Startup of the Year category at this year’s ET Startup Awards, saw its initial public offering (IPO) subscribed over 100 times. However, founder and CEO Abhiraj Singh Bhal told us this was not a victory lap for the Gurugram-based startup.Competitive landscape: Urban Company has long fought off rivals, Bhal said, and is now preparing for a new battle in the venture capital-driven instant help segment, where it holds the lead. After consolidating, it is once again pouring capital into InstaHelp, its 15-minute house-help brand that Bhal described as “strategic” for growth over the next four to five years. “Over the past decade, we’ve seen waves of competition. We were quick to recognise it as a strategic opportunity and moved fast and aggressively. We believe this category (instant home help) can drive significant strategic growth for Urban Company over the next four to five years”.Long-term vision: Regarding the company’s broader goals, Bhal said Urban Company aims to be a “backend, operating system” for households. “Services are at the core of that, whether daily, weekly, or specialised at-home needs. Our goal is to build the foundation that enables high-quality, convenient services. Native will add a devices layer, and over the next decade, we’ll expand into one or two more categories that naturally fit with our platform,” he added. Growth trajectory: Bhal noted that, unlike product marketplaces, Urban Company is unlikely to experience “hockey-stick” growth even with heavy investment, but expects steady gains over time. “It’s not a hockey-stick growth business. Trust does not compound overnight. You can grow systematically for a long time, steadily,” he said.Also Read: Urban Company posts Rs 240 crore profit in FY25, revenue rises 38%Groww files revised IPO papers for Rs 6,000–7,000 crore issue (L-R) Harsh Jain, Neeraj Singh, Lalit Keshre and Ishan Bansal, founders, GrowwOnline investment platform Groww filed updated papers with the Securities and Exchange Board of India (Sebi) for a Rs 6,000–7,000 crore initial public offering (IPO).Details:Fresh issue: Rs 1,060 croreOffer-for-sale (OFS): 574 million shares worth Rs 5,000–6,000 crore.OFS participants: Peak XV Partners, Y Combinator, Ribbit Capital, Tiger Global and Kauffman Fellows Fund.Founders Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal will each offload one million shares in the OFS.Founder shares: The quartet collectively holds 26.64% of the company.Background: Bengaluru-headquartered Groww filed its draft red herring prospectus (DRHP) on May 26 and received Sebi’s approval last month. As ET reported earlier, a listing is expected in November, with a target valuation of $7 billion to $9 billion.This IPO will mark a milestone for the company, which will become one of the first fintechs to list in India after reversing its overseas holding structure and relocating its parent entity to India.Since its inception, Groww has raised approximately $393 million, including a $200 million pre-IPO round that valued the company at $7 billion.Also Read: Groww triples FY25 profit to Rs 1,819 crore; closes fresh funding at $7 billion valuationIndian VCs go independent amid wider churn in early-stage investing (L-R) Shailesh Lakhani, Ashish Dave, Sameer Brij Verma, Harshjit SethiA change of guard is underway in Indian venture capital, as seasoned general partners (GPs) exit marquee funds to launch leaner, nimbler firms, ushering a generational churn in early-stage investing.Driving the news:Shailesh Lakhani, an 18-year veteran with Peak XV Partners (formerly Sequoia India), is setting up a new early-stage fund.He may join hands with Harshjit Sethi, who recently announced his departure from Peak XV.Nexus Venture Partner’s Sameer Brij Verma has raised $150 million for his fund, Northpoint Capital.Ashish Dave, who ran Mirae Asset’s India VC unit, is also in fund-formation mode.Another alumnus, Piyush Gupta, founded Kenro Capital last year.Track record:Lakhani backed Truecaller, Quickheal, Zetwerk, Ixigo, and 1mg. Three of his portfolios have gone public, and Capillary Technologies is in the pipeline.Dave’s bets included Zomato, BigBasket, Shadowfax and Unacademy. He is currently meeting potential limited partners (LPs) for a multi-stage fund.Significance: Investors point to multiple reasons. Large funds now struggle to deliver outsized returns. Economics tend to favour older partners, leaving mid-level GPs with limited upside. At the same time, LPs are increasingly backing focused, smaller teams.This also comes amid a broader reset in venture investing. The AI boom may be lighting up global markets, but exits in India remain far and few between. IT contracts worth $13 billion up for renewal in coming quarters Indian IT majors are eyeing a fresh wave of high-stakes deals as contracts worth $13 billion are set to come up for renewal in the second half of 2025. Over 600 engagements are in play between now and December, according to industry data. That’s a hefty pipeline and could even outstrip the $14 billion in renewals seen in 2024. Some marquee partnerships up for grabs include:TCS: Star Alliance and NielsenInfosys: Daimler AG and GE AppliancesHCLTech: Ericsson and UK-based insurer ChesnaraWipro: E.ON (Germany), Fortum (Finland), and Petrobras (Brazil).As of June 2025, approximately $1.3 billion worth of mega deals were already under renegotiation, according to data from advisory firm Information Services Group (ISG). That chunk alone accounted for nearly 70% of global IT deal activity.Other Top Stories By Our Reporters Vaishnaw on Arm’s Bengaluru office: British semiconductor company Arm’s new Bengaluru facility will focus on designing cutting-edge chips, including advanced two-nanometre (2nm) nodes, union electronics and IT minister Ashwini Vaishnaw told reporters in Bengaluru on Tuesday.Ecosoul raises $20 million: Sustainable home essentials brand Ecosoul Home has raised $20 million in a funding round led by Accel and Bajaj Financial Securities Limited. Existing backer Singh Capital Partners also participated. Hyperbound raises $15 million: Hyperbound, an AI sales tech startup, has raised $15 million in funding led by Peak XV Partners. Founded in January 2024 by Sriharsha Guduguntla and Atul Raghunathan, Hyperbound helps companies create a practice arena for their sales teams.Global Picks We Are ReadingOpenAI ramps up robotics work in race toward AGI (Wired)Salesforce launches ‘Missionforce,’ a national security-focused business unit (TechCrunch)Meta struggles to decouple from Chinese supplier of AI smart glasses (FT)

Explore other editions

Want this newsletter delivered to your inbox?I agree to receive newsletters and marketing communications via e-mailThank you for subscribing to Morning DispatchWe’ll soon meet in your inbox.