PARIS — Finnish spacecraft developer ReOrbit has raised 45 million euros ($53.3 million) to increase spacecraft production to meet growing demand from government customers.

The company billed the recent Series A round as the largest all-equity round for a Finnish company. Springvest, a Finnish venture capital fund, led the round with participation from several other investors.

Sethu Saveda Suvanam, chief executive of Helsinki-based ReOrbit, said in an interview that 85% of the funds came from Finland, with most of the rest from investors in other Nordic countries. That was a deliberate move by the company.

“Space and defense have merged, and in that geopolitical environment, what we are hearing is that every country wants to modernize their own space capabilities and thereby their defense capabilities,” he said. “In that sense, a lot of countries are looking at geopolitically neutral companies, and the Nordics have largely been seen as such.”

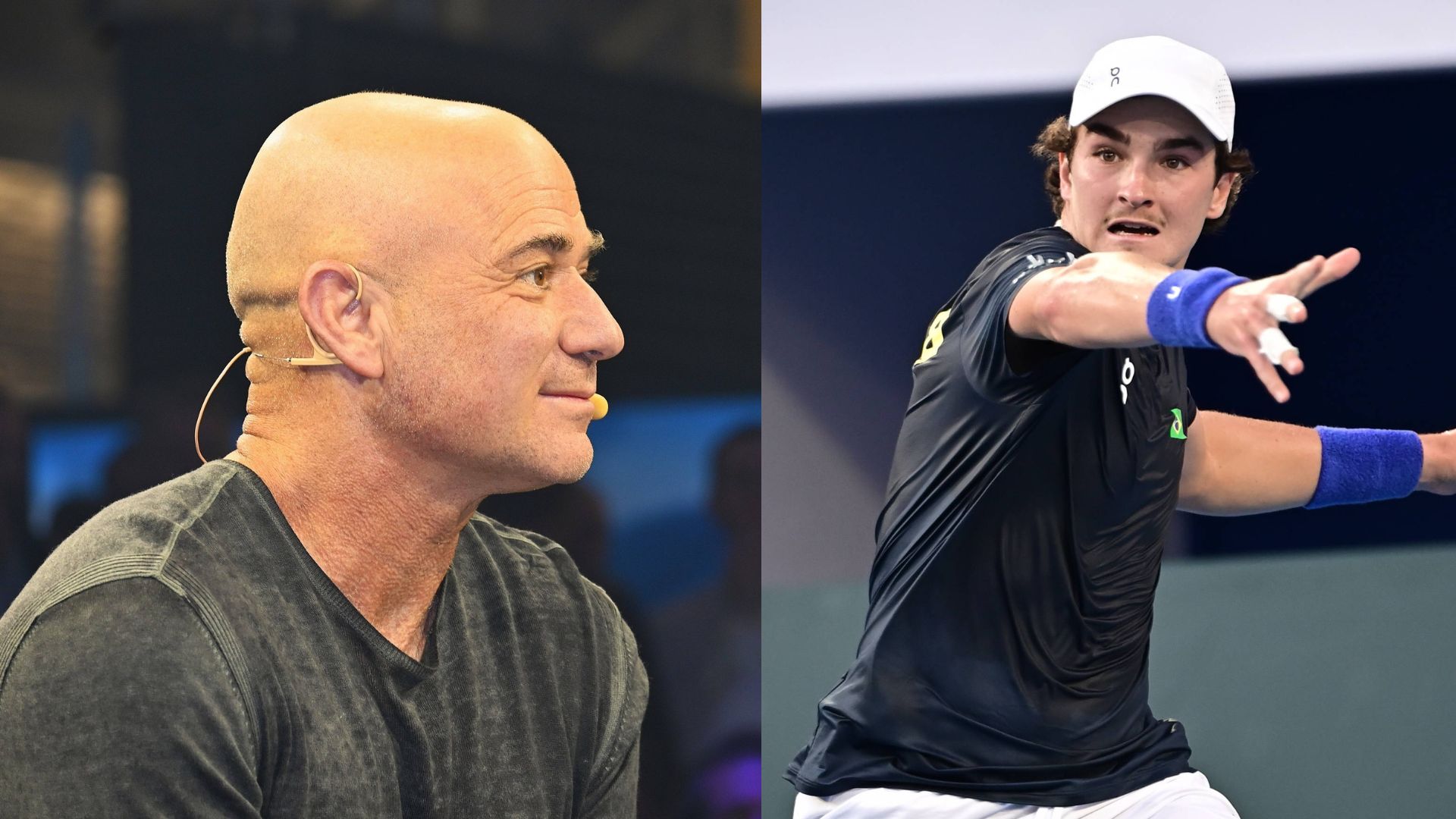

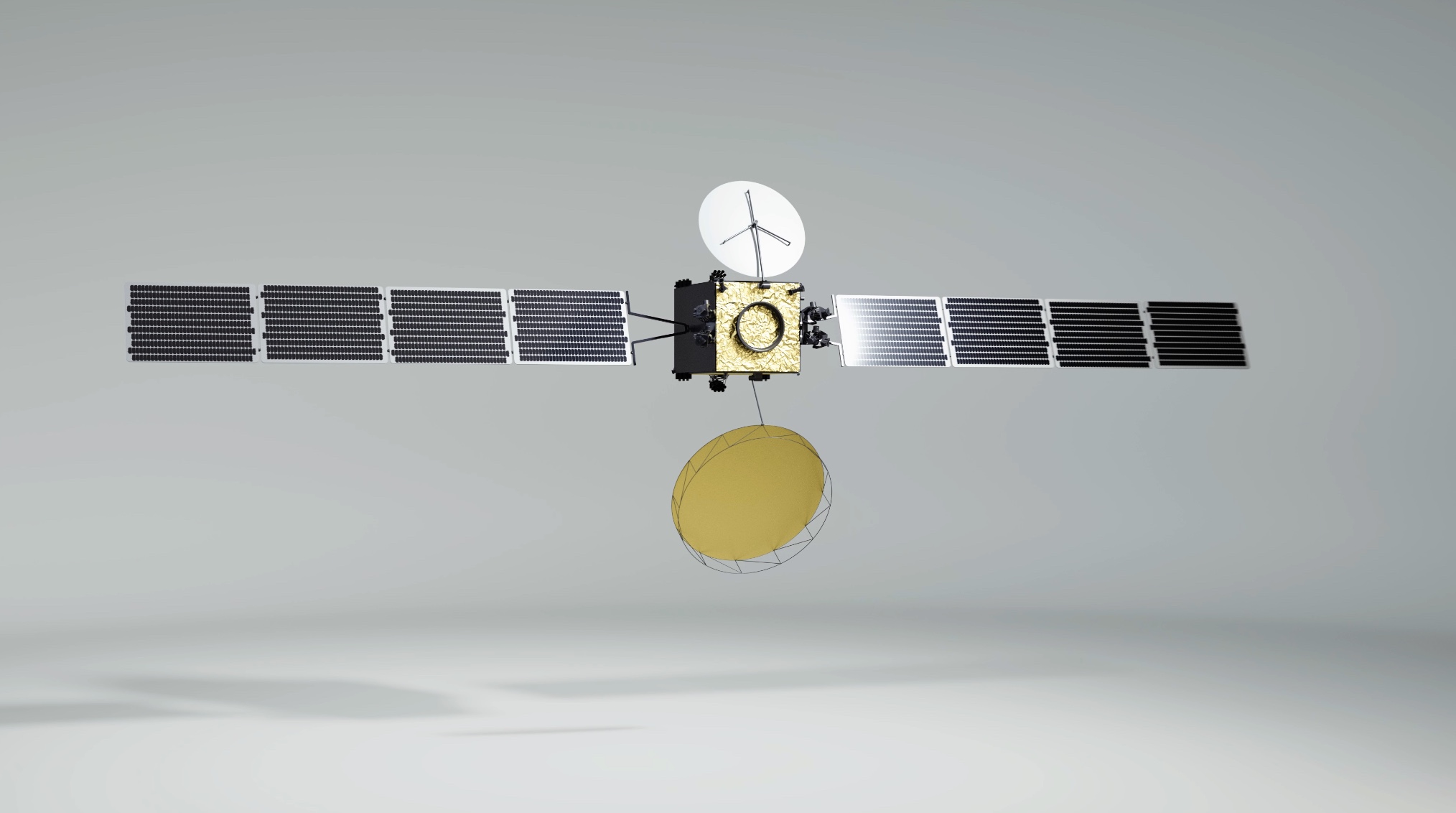

The funding will allow ReOrbit to scale up production of its two major lines of satellites: Silta, a small geostationary orbit communications satellite, and Ukko, a low Earth orbit smallsat for Earth observation and communications.

Suvanam said the company is moving into a Helsinki building originally built 100 years ago by the Ford Motor Co. to produce cars. Once fully operational, the building will allow ReOrbit to work on eight small GEO satellites in parallel. The company, with about 80 to 90 employees now, expects to grow to 200 to 250 people by the end of 2026. The goal is to be what Suvanam called a “sales unicorn,” or generating one billion euros in sales, in four years.

ReOrbit’s business model, he noted, is not just selling satellites. “We are trying to sell sovereign capacities,” he said, which goes beyond the spacecraft themselves to giving customers more control over supply chains and data.

The company has developed an underlying software architecture called Strawberry that Suvanam compared to a computer operating system. The spacecraft would run on that system, which could be extended to other hardware, such as drones. That gives customers more control over how spacecraft are developed and operated, he argued.

ReOrbit sells systems worldwide but is seeing a “huge increase” in demand for its space systems in Europe. The company sees its approach as a way for individual European countries to procure their own satellite systems but operate them in concert with those from other European countries.

“What we are proposing would be a very interesting solution where you can bring together a system of systems and then build it around a common software framework,” he said. “You can still have your own small boxes but you could also connect those boxes in a larger framework.”

ReOrbit has also bucked the space industry trend toward vertical integration, opting instead to outsource manufacturing of all its components. “We are fully horizontally integrated,” he said. “We only do the software, system architecture, system integration and testing.”

That approach allows ReOrbit to use preferred supply chains of individual customers. Suvanam was also skeptical about the perceived benefits of vertical integration.

“We believe vertical integration is a myth. Today, if you remove SpaceX, there has been no success story of being fully vertically integrated,” he claimed, arguing that other space companies have not matched SpaceX’s scale. “You can never be vertically integrated because you are, at some point, dependent on someone.”

“It’s best actually to be horizontally integrated so that you could always be in the circle of innovation,” he concluded. “We can then see what’s the best available on that particular day, and then we build a system out of it.”