By Sarah Sharples

Copyright news

An ATO loophole saw 57,000 Australians take part in the country’s largest GST fraud where a simple phone call or online lodgement saw money paid out from the government agency within days.

At least 126 people have been charged and sentenced since the fraud was uncovered in 2022 under Operation Protego, according to the ATO.

But financial counsellors are sounding the alarm that many caught up in the scam are actually victims who were exploited by unscrupulous characters and never saw a cent.

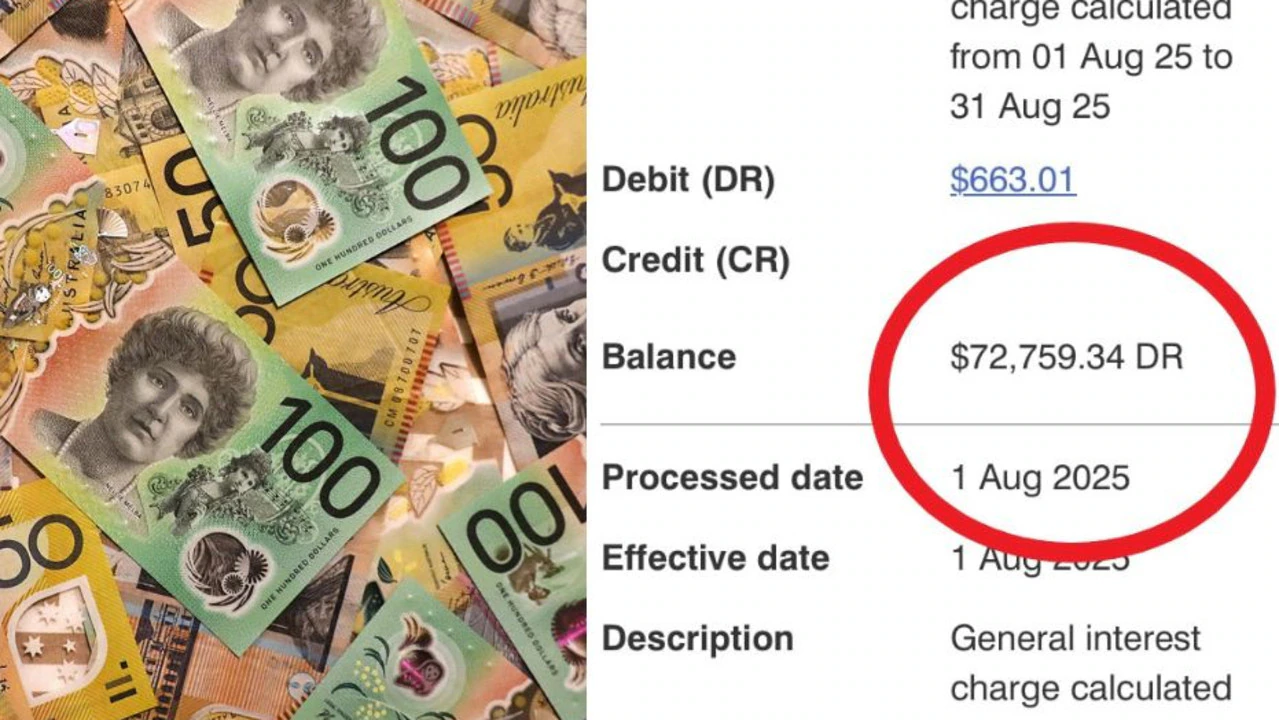

Greg* is one of these victims who has no hope of paying off the debt which has ballooned to $72,000.

He has an acquired brain injury, which he said makes him flustered and more trusting of people, while he faces other health battles.

The 62-year-old said he feels like an “idiot” and “ashamed” that he was conned – handing over $42,000 to the scammers.

“It’s the mental torment of having a debt and I’ve done nothing wrong,” he told news.com.au. “I don’t have a flash car or $10,000 lounge suite or a new king size bed with all the bells and whistles. I live in a commission house. I’m on a disability pension.”

He was targeted during Covid lockdowns when he was trying to help the community with isolation.

The Melbourne man was approached by “white knights” who flattered him with the voluntary work he was doing, selling him the dream of setting up a business by covering the costs upfront. Greg said he was lured in “hook, line and sinker”.

He was told to pay them back via the ATO funds deposited into his account, which saw him “pulling all this money out of the bank” as soon as it hit, particularly as the scammers were “knocking on his gate”, he said.

“Once they got the money out of me I never saw them again,” he said, adding the contact number he was given was disconnected.

“I went around to the alleged address where they had the factory and it didn’t exist. It was a paddock and empty block,” he revealed.

But by the time he realised it was a “giant rort” he was left with an enormous debt that keeps climbing.

Do you have a story? Contact sarah.sharples@news.com.au

Consumer Action Law Centre’s assistant director of its financial counselling practice Claire Tacon said the ATO has a “very intractable response” for people who have been caught up in this scam and see it all as fraud.

“We have had a lot of calls from people, who are really scam victims themselves, as they had no idea about how it all worked and how they came to get this money,” Ms Tacon told news.com.au.

“They were often duped by a third party and often they were really scared of that third party, so there was an imbalance of power.”

She said a lot of vulnerable people were caught up including those with acquired brain injuries, victims of domestic violence and young kids who face being stuck with this debt forever.

“They have been difficult calls for our financial counsellors as we have had to refer a lot of people to Lifeline as we have been concerned about their wellbeing,” she added.

Ms Tacon said it was “completely impossible” for people to pay off the debt while she labelled the ATO’s pursuit of them as “aggressive”.

“The ATO is still sending him demand letters and he can see the debt growing and all he can pay is $20 a week. He is wracked with guilt that he has ripped off Australian taxpayers and how stupid he was to believe these people,” she said.

This aggressive action has even included taking people who are on welfare all the way to bankruptcy court with Ms Tacon questioning why taxpayers money is being spent on these measures when it “seems particularly punitive and questionable”.

“There is a lot of really sad stories and it does remind us of the Robodebt days. We are having to tell people they could actually go to jail for these debts if the ATO decides to pursue them,” she revealed.

“The ATO is bankrupting people who have nothing, even though they are saying bankruptcy won’t extinguish debts. We can’t get a straight answer out of what they are trying to do.

“It feels like they are going for low hanging fruit and not thinking of the consequences of pursuing people who have nothing.”

Meanwhile, the interest on Greg’s debt is climbing between $550 and $660 a month.

“I didn’t know the extreme or how big this thing was with billions of dollars taken,” he said. “This is why I’m so ashamed of myself – I’ve hardly slept over this as I’ve been tossing and turning.”

Greg disputed the debt with the ATO but this was rejected.

The cancer sufferer turned to the Consumer Action Law Centre’s financial counsellors who told him to stop paying the debt as he had “done nothing wrong”.

Greg believes the ATO should take some responsibility for the GST fraud as they “created this monster”. The government agency was alerted to the loophole and still paid out hundreds of millions of dollars before it was shutdown.

He said the ATO should “cease chasing people and causing bloody misery” and offer an amnesty for victims.

“I used my own name, own address, I didn’t hide from anyone as I thought I was providing a community service,” he said.

“The tax department should say you have been stiffed and let it go. The masterminds who are behind ripping people off they should go after but poor bastards like me they should wipe the debt.

“The tax department are f**king ruthless. I told them I’m on a pension, I live in housing commission, I don’t have any material assets.”

Greg’s debt has been put on hold while the ATO commissioner examines the issue.

Ms Tacon is also calling on the ATO to waive debts for people who are clearly victims particularly where there was no financial gain.

“The commissioner is looking at these people and these cases and is due to make a decision but we’ve been waiting months about how they will respond,” she added.

In other cases where people were experiencing poverty and desperate, Ms Tacon said the ATO is rejecting payment plans and will only accept arrangements that see the debt wiped in two to three years.

“The approach they have across the board is everyone is trying to rip off the ATO and there isn’t anything they will do to adjust that approach based on a person’s circumstances and it’s really bad at the moment,” she said.

“None of these stories are completely black and white. It’s not these people were bad and criminals – there was a lot more too it. The ATO should accept a payment arrangement for the amount the person took.”

Ms Tacon said financial counsellors have even spoken to debt collectors who are frustrated they don’t have the same options such as with bank arrears.

“The ATO is paying money to recoveries and not accepting that the money isn’t with these taxpayers – you can’t get blood out of stone,” she said.

Reports state that is took 18 months for the ATO to contain the GST fraud scam particularly as crimes weren’t identified until after the money had been paid.

An ATO spokesperson said Operation Protego was its response in April 2022 to a rapid proliferation of GST fraud.

“We worked hard to contain the fraud, stopping $2.7 billion in false refunds and raising nearly $2 billion in liabilities. This fraud was contained by mid 2022 and we are continuing the process of collecting amounts owed,” they said.

“The ATO knows the identity of the 57,000 Operation Protego GST fraudsters. We have corrected the assessments of every single one of these fraud participants.”

Collecting amounts owed is not just an exercise in debt collection — committing GST fraud has significant and enduring consequences, they added.

“GST fraud is not a victimless crime – it is an illegal activity that actively takes away funds that would otherwise be used for essential services such as healthcare, infrastructure, and education,” they said.

“While the ATO does not generally have the power to waive debts, there have been a small proportion of cases where we have been able to establish that a taxpayer was the victim of identity takeover, where they were not involved in the fraud and received no financial benefit. In these limited circumstances, we have removed the debt against that taxpayer.”

*Name has been changed

sarah.sharples@news.com.au