COLUMBIA, Mo. (KMIZ)

A $14.3 million settlement with internet provider Brightspeed helped give the City of Columbia more flexibility in its 2026 fiscal budget.

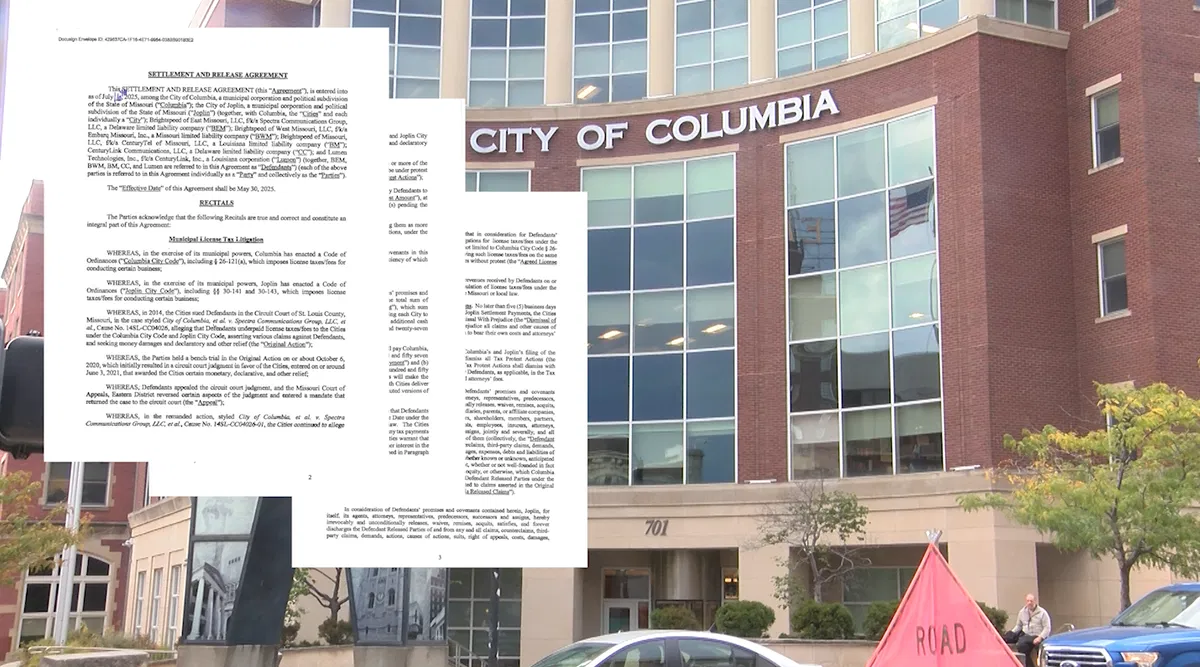

However, tough decisions remain over how to keep the budget balanced in the future. Brightspeed, which was previously CenturyLink, was sued by Columbia and Joplin in 2014 over unpaid license taxes and fees, according to court documents.

City officials said the dispute centered on fees tied to internet and streaming services that use the city’s right-of-ways, a significant source of revenue. Columbia argued that Brightspeed had not been paying its fair share, ultimately leading to the $14.3 million settlement.

“This lawsuit started two mayors ago. So this has been something that has been in conversation since 2014,” Columbia Mayor Barbra Buffaloe told ABC 17 News. “When I came on, you get a quick briefing as an elected official of the current litigation that is happening at the city. But you know, some of it is kind of far off and you don’t know if it’s ever going to be settled.”

The lawsuit was scheduled for a trial last summer, but the judge dismissed the case in July because of the settlement. Records obtained by ABC 17 News show that the settlement was reached on July 16, while the city was still in the process of shaping its budget.

“We didn’t actually get some money until later on in the budget process,” Columbia’s Director of Finance Matthew Lue said. “We’ve known about the lawsuit for a few years now, but we did not expect that we would receive a payment this soon. So basically what it did was it was buy us some time to figure out what we can do within the general fund to assess the revenue situation, because especially sales tax with this fiscal year, sales tax is flat, if not down slightly.”

The budget, which was approved by the City Council on Monday, sits at around $608 million.

However, the general fund, which covers daily operations such as roads, police and fire, sits in the red with revenue expected to be around $132 million and expenses expected to be around $135 million.

“It’s definitely something the city is monitoring moving forward. But I think the influence in cash kind of helped us along and helped us to be okay with this for the short term,” Lue said.

The deficit comes after expected tax revenue fell by around 3% last year. Because of this, the city dipped into its available cash reserves.

“If you look at our reserves, we have a requirement ourselves that we follow. We have at least 20% of our annual expenses that need to be held in reserves,” Buffaloe said. “We have over $20 million over what we need of that 20% in our reserves. And so when you look at it, I think it’s more of that we’re trying to make sure that we’re not having too much in savings and that we’re spending the money on what it is our community wants.”

The decision to dip into reserves happened before the city received the settlement money, because ensuring that city employees received raises was a priority for the council.

“Before we knew about the settlement coming in, we were having some tough conversations from council to our city manager and administration. Because when we were looking at our forecasted revenues for fiscal year 26, when we were looking at what it was looking like in the spring, it did not look good. It looked kind of a plateau with what we were seeing, and yet we knew that expenses were increasing,” Buffaloe said. “We also knew that we had made a promise to our city employees that we would continue doing cost-of-living adjustments. Those cost-of-living adjustments have really helped us out because we’ve had like record numbers in recruitment and retention for police officers, public works employees, and others. And so we knew we had to continue delivering on that promise.”

City Manager De’Carlon Seewood had tasked every department with making cuts from everything from travel to training services, though the budget remained tight. The money from the settlement went into the reserve fund and will help cover costs from the general fund. It also helped ease the burden of covering cost-of-living adjustments for city employees.

While the settlement helped, Buffaloe said the cost-of-living adjustments still would have happened without it.

“We were just not going to be as healthy of our reserves without it,” Buffaloe said. “But it did, thankfully, give us a little bit more time to figure this out.”

According to Lue, the city had an initial deficit of around $3.5 million but was able to get that down to $2.7 million.

“It just made it a little bit more manageable for staff knowing that we have around $20 million over the required reserve that we could balance the budget with,” Lue said.

Lue said that the three biggest-council priorities for the budget were public safety, personnel and housing, with one of the biggest challenges being trying to make the expenses match the revenue as much as possible. However, Lue did not rule out deficit spending in next year’s budget.

“Because of ongoing spending, we would be looking to most likely deficit spend again next year in the general fund only. So that is going to cause us to have to take a deep look at current and existing revenues and then maybe something different in the future,” Lue said.

As of now, Buffaloe said the city is not looking at tax hikes to help generate more revenue.