Over a week, have gone up almost 20%, currently priced at $419.70 against its average 52-week price of $317 per share. The culprit is none other than Elon Musk himself, as he disclosed a purchase of 2.57 million shares worth ~$1 billion. These rare open market buys, not seen since early 2020 according to Verity, transpired last Friday, but were disclosed this Monday. Suffice to say, this is a signal to investors that Musk is confident in Tesla’s future. Holding 413 million shares, Elon Musk now owns 12.8% of the 3.5 billion outstanding stock, which is an increase of nearly 1%. The question is, why would Musk be confident?

What Is Tesla’s Board Incentive Structure for Musk?

On September 5th, Tesla’s Board of Directors, chaired by Robyn Denholm, introduced a massive upgrade for Elon Musk’s compensation package worth $900 billion. But for him to become the world’s first (official) trillionaire, Tesla would have to upscale its profitability by 24x, raising the company’s valuation from the present $1.3 trillion to over $8.5 trillion.

Divided into 12 tranches, Elon stands to gain 423.7 million shares if he fulfills 12 operational targets, starting with getting Tesla’s market cap to $2 trillion. The company’s valuation would have to be sustained between a 30-day and a 6-month trailing average. Tesla’s key deliveries include:

20 million Tesla EVs delivered in total, up from 7.2 million cumulative as of this August.

10 million Full Self-Driving (FSD) subscriptions, excluding free trials, over a 3-month period on average.

1 million driverless robotaxis in commercial deployment over a 3-month period on average.

1 million humanoid robots (Optimus) sold.

Elon Musk would have to be at the helm for a total of 10 years to complete these targets. After the first five years, earned shares would be vested at 7.5 years of the program, while the other half would be vested at the 10th year.

Previously, Cathie Wood’s ARK Invest tagged Tesla to a potential $10 trillion value by 2029, under the condition that the company successfully scales its robotaxi deployment. Under Wood’s projections, Tesla could generate $1.2 trillion in annual revenue in that scenario.

Although competing with Alphabet’s Waymo, Tesla does have a data-driven advantage to achieve Level 5 autonomy owing to its HydraNet multi-task learning network, Occupancy Network, and the Neural Network planner. All of these systems crunch data from millions of Tesla cars compared to Waymo’s mere thousands.

Examining Elon Musk’s Political Vulnerability

During the year, we covered in-depth how Musk’s political exposure has negatively affected Tesla sales, particularly in Europe. Musk’s social media postings appear to clash with the totality of legacy media space.

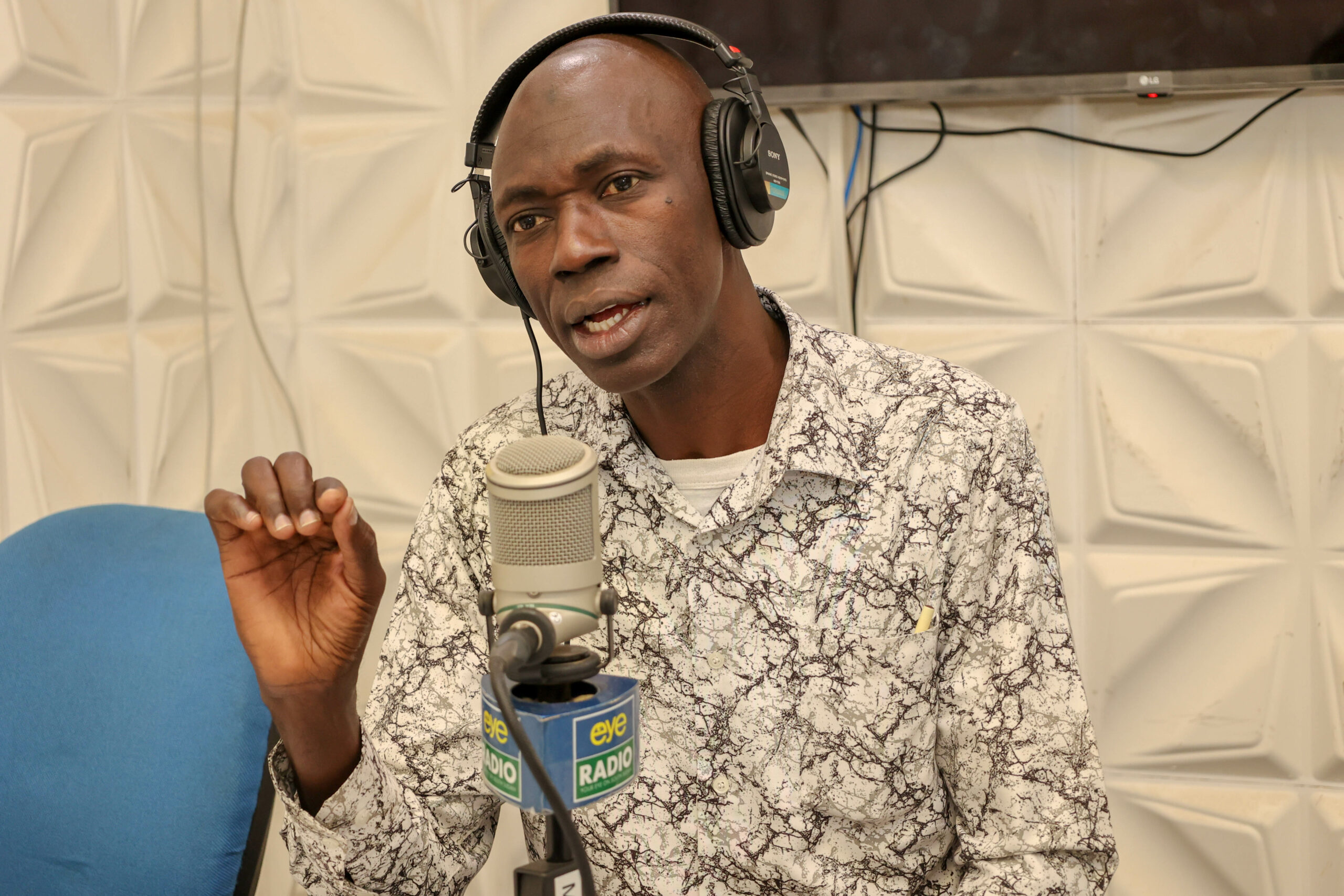

Specifically, his Department of Government Efficiency (DOGE) revealed a highly centralized apparatus via USAID that influences nearly 5,000 media outlets. In turn, from many DOGE revelations, it is safe to say that much of the culture is artificially generated and directed by unseen bureaucrats, commonly referred to as the deep state.

However, those who are influenced view their beliefs as genuine and act upon them as such, typically through trigger words. Another way to phrase it is that a centralized media apparatus, just like in the heavily-controlled EU, employs “stochastic terrorism” but in an inverted manner.

“The public demonization of a person or group resulting in the incitement of a violent act, which is statistically probable but whose specifics cannot be predicted.”

Dictionary.com

While various think tanks developed this concept as a justification to deplatform regime enemies, they themselves deploy stochastic terrorism as a matter of routine.

Case in point, when a narrative proliferates to demonize Elon Musk, all of Tesla car owners are at risk to have both their vehicles and persons attacked by extension. This drastically influences purchasing decisions of future buyers and puts Tesla at a disadvantage, which is the point.

And when even judicial institutions, presumably under ideological capture, signal that such attacks are tolerated, the power of stochastic terrorism is enhanced.

However, a major cultural shift occurred recently with the assassination of mainstream conservative activist Charlie Kirk. Stochastic terrorism was deployed against him in the same way it was against Tesla car owners.

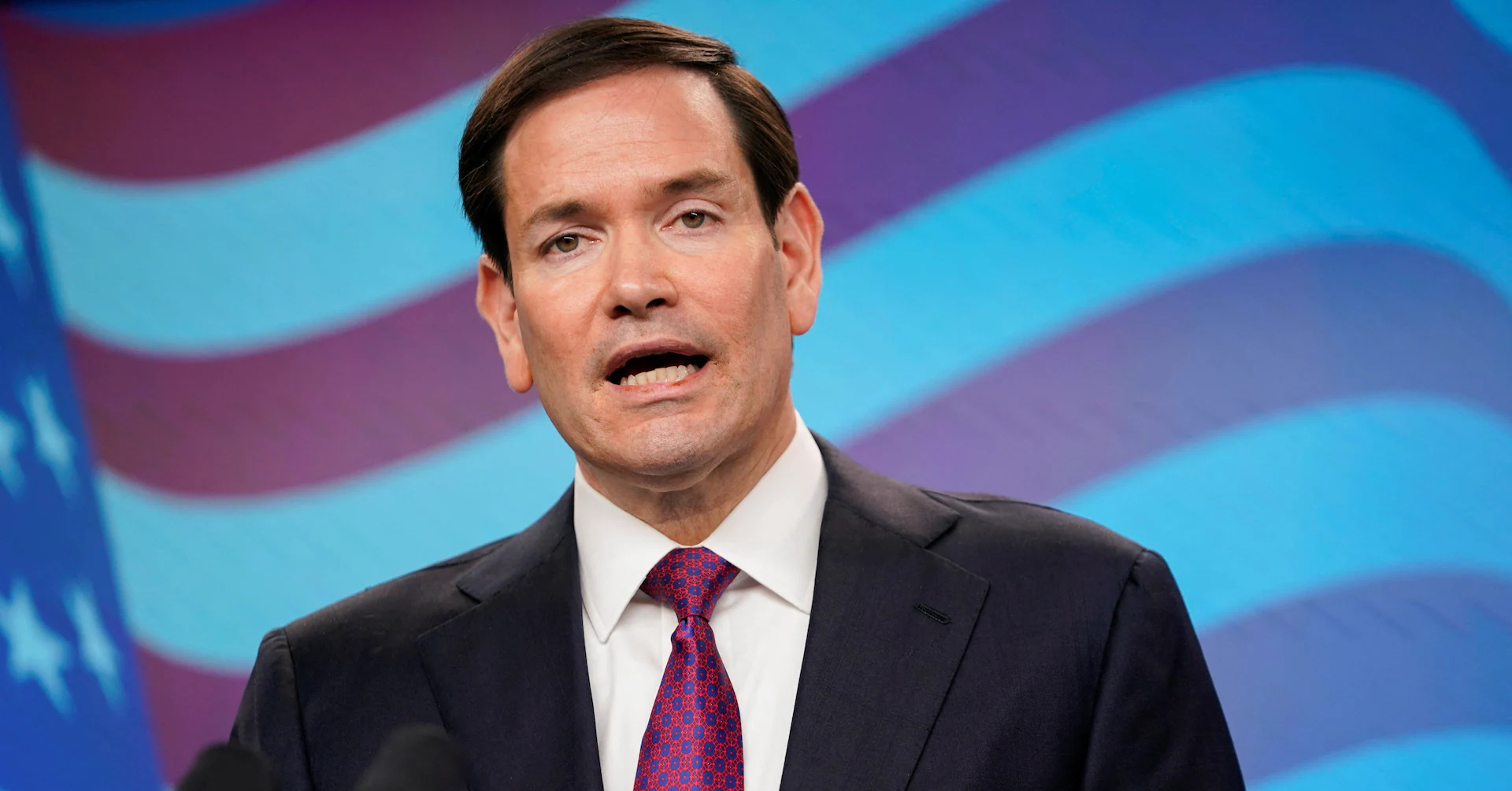

Yet, in the aftermath of the killing, stochastic terrorism is now in the public spotlight, with many Representatives vowing not only to fire gloating government employees but also to implement sweeping deplatforming across social media.

In short, it is very likely that the power of stochastic terrorism will be diminished after this cultural turning point, which ultimately benefits Elon Musk’s ventures and his public perception. It may very well be that the closeness between the assassination and Musk’s rare stock purchase is a result of just such speculation.

Could Musk Actually Fulfill These Compensation Targets?

No doubt, Elon Musk made a huge strategic blunder by pursuing Cybertruck, instead of working on a more penetrative EV model in akin to the compact or Renault 5. This decision diverted precious engineering resources into a niche luxury product of dubious quality rather than scaling Tesla into the mass-market segment where the next 10 million vehicles will come from.

Without a true $25,000 EV, hitting 20 million deliveries looks more like wishful thinking than a roadmap. In last October’s earnings call, Musk noted that “having a regular $25K model is pointless. It would be silly.” – referencing the incoming rollout of robotaxies.

If Tesla cracks regulatory approval in just a handful of jurisdictions, robotaxi services could snowball into a self-reinforcing adoption cycle. And they would do so in the cultural climate of blunted stochastic terrorism, if various politicians including President Trump follow through on their promises.

Optimus, however, is the true wildcard. Even to experts, it is unclear how it would stack against Hyundai’s heavyweight Atlas. As recently as early September, Musk also noted that “~80% of Tesla’s value will be Optimus.” Yet, if Tesla positions Optimus not as a household gadget but as an industrial labor solution in warehousing, logistics, and eventually elder care – the million-unit target may not be as outlandish as it first appears.

At the end of the line, Musk could stumble into these milestones rather than glide through them. Cybertruck is definitive proof of his vulnerability to chasing moonshots that don’t scale. But if robotaxis and FSD subscriptions reach critical mass, Tesla’s valuation could skyrocket irrespective of whether 20 million EVs or a million Optimus units ever materialize.

After all, Musk’s latest pay package is structured less as a reflection of Tesla’s present capacity and more as a bet that Musk will keep forcing improbable outcomes into reality.

***

Looking to start your trading day ahead of the curve?

Get up to speed before the bell with Bull Whisper—a sharp, daily premarket newsletter packed with key news, market-moving updates, and actionable insights for traders.