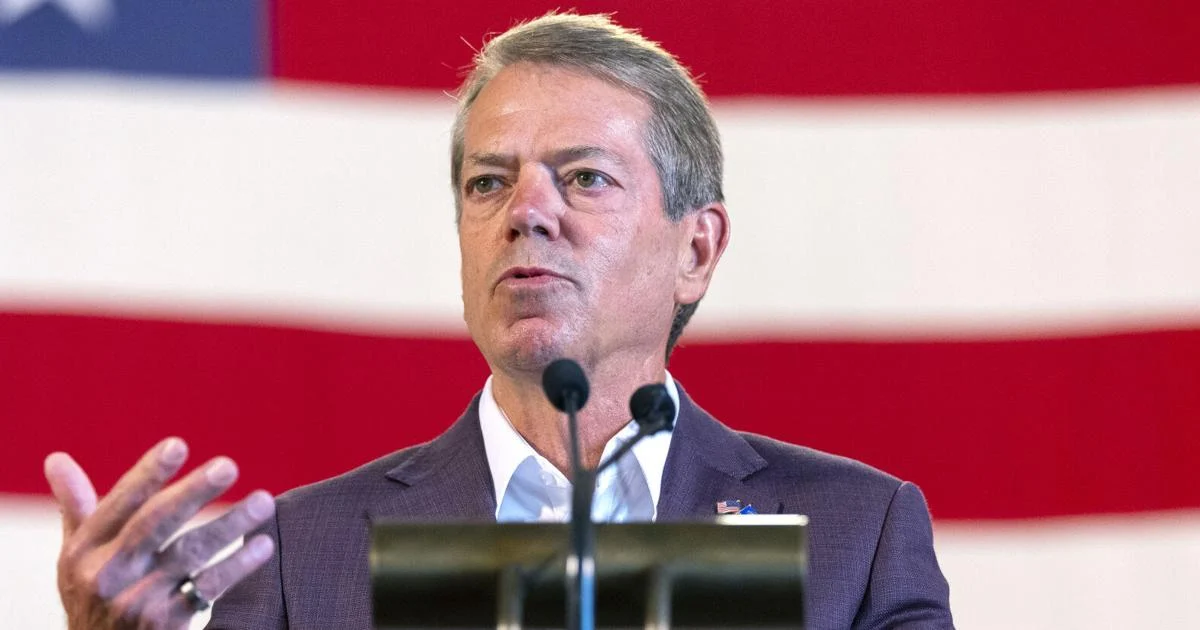

Nebraska Gov. Jim Pillen on Monday ordered a state employee to send $20 million more than lawmakers earmarked for property tax relief back to local school districts and other tax-collecting subdivisions in a move critics called “blatantly unconstitutional.”

When the Legislature passed the state’s two-year budget earlier this year, senators directed a combined $1.24 billion to local subdivisions through a pair of property tax relief programs known as the Property Tax Credit Act and School District Property Tax Relief Credit Fund.

But thanks largely to higher-than-anticipated tax revenue from casino gambling, the two funds had an extra $20 million in them as of Monday’s annual deadline for the state to certify the fund balances and determine how much will be sent to each county.

So Pillen signed an executive order Monday calling on the state’s property tax administrator to certify and distribute the full amount of each fund — a combined $1.26 billion — rather than the $1.24 million appropriated by lawmakers, according to a copy of the order his office released Tuesday.

“As governor, fixing our broken property tax system is my top priority,” Pillen said in a news release announcing the move Tuesday. “Whenever possible, we must get bureaucracy out of the way and ensure that Nebraskans receive the full amount of property tax relief possible. By signing this executive order, we are ensuring that all money in these funds is fully given to taxpayers.

“This is a common-sense, good government measure that will help Nebraska families across the state.”

But the move raised immediate alarm among Democratic lawmakers, including Sen. Danielle Conrad of Lincoln, an attorney who said the state’s constitution and “an almost unbending line of Nebraska Supreme Court precedent makes clear” that the Legislature, not the governor, has the power to direct state dollars.

“You don’t have to be a constitutional scholar or a state senator to understand that,” Conrad said. “Kids learn this in civics 101. There’s a separation of powers, and the power of purse belongs to the legislative branch — the people’s branch — not the executive branch, and not to the governor.”

Pillen’s allies, though, defended the Republican governor’s move and dismissed Conrad’s concerns, casting the tension as more of a timing issue than one of constitutionality.

Lee Will, Nebraska’s chief operating officer and a member of Pillen’s cabinet, acknowledged the governor had “taken unprecedented action” in pursuit of property tax relief but maintained the order did not amount to a violation of the state’s constitution.

He said Pillen would work with lawmakers next year to ensure the money is properly allocated through the budget process, but said Pillen had to issue his executive order prior to Monday’s deadline to certify the amount to be dispersed to counties.

Since the second of two payments to counties won’t be sent until April 1, he said the state ultimately won’t expend more than what lawmakers appropriate.

Sen. Rob Clements, a Republican from Elmwood who chairs the Legislature’s Appropriations Committee, said he has “no reason to dispute what the governor is doing.”

He noted that the additional gambling revenue flowing into the Property Tax Credit Fund in particular — which accounts for about $3 million of the extra $20 million Pillen has sought to send to the counties — is specifically designated for property tax relief and “has to go to property tax sometime.”

Facing questions over the constitutionality of the governor’s order to move the money without the consent of lawmakers, Clements said speaking to constitutional lawyers is the job of the press.

“I’m supportive of the governor, and I don’t see anything wrong with this, because the money could not have been spent anywhere else,” he said.

Two other Republican leaders in the Legislature, Speaker John Arch of La Vista and Sen. Ben Hansen of Blair, the chairman of the body’s Executive Board, did not return phone calls seeking comment Tuesday.

An aide to Arch indicated he was unavailable because he was out of the country for a leadership conference.

Conrad said Pillen’s order is “essentially aspirational.” She said the governor is welcome to call on lawmakers to direct more money to property tax relief — and “perhaps the Legislature will decide” to do so.

“But he doesn’t get to decide that unilaterally,” she said. “That’s the bottom line on it.”

Reach the writer at 402-473-7223 or awegley@journalstar.com. On Twitter @andrewwegley

Love

0

Funny

0

Wow

0

Sad

0

Angry

0

Get Government & Politics updates in your inbox!

Stay up-to-date on the latest in local and national government and political topics with our newsletter.

* I understand and agree that registration on or use of this site constitutes agreement to its user agreement and privacy policy.

Andrew Wegley

State government reporter

Get email notifications on {{subject}} daily!

Your notification has been saved.

There was a problem saving your notification.

{{description}}

Email notifications are only sent once a day, and only if there are new matching items.

Followed notifications

Please log in to use this feature

Log In

Don’t have an account? Sign Up Today