By Boluwatife Oshadiya

Copyright bizwatchnigeria

Tesla Inc. shares surged after Chief Executive Officer Elon Musk purchased approximately $1 billion worth of stock, a move seen as a strong signal of confidence in the electric vehicle maker’s long-term growth prospects despite market challenges.

According to a regulatory filing released on Monday, Musk acquired the shares on September 12 through a revocable trust. This marks his first open-market purchase of Tesla stock since February 2020, highlighting his renewed financial commitment to the company.

The purchase comes as Tesla’s board reviews an unprecedented compensation plan that could grant Musk stock options valued at around $1 trillion if the company achieves ambitious market capitalization and performance milestones.

Following the disclosure, Tesla’s stock rose 6.2% in early trading and closed at $417.89, pushing the automaker’s year-to-date gains to roughly 4%. The rebound follows a sharp decline earlier in 2025, when shares plunged by as much as 45% by April amid weaker vehicle sales and intensifying competition across the electric vehicle sector.

Musk, who sold more than $20 billion worth of Tesla stock in 2022 to finance his acquisition of Twitter, now X, appears to be reaffirming his commitment to Tesla shareholders at a time when investor sentiment has been under strain.

Tesla Faces Global Headwinds

Despite the positive market reaction, Tesla continues to confront several operational challenges. Global deliveries slipped by 13% in the first half of 2025, according to Cox Automotive, which also reported that the company’s share of the U.S. EV market dropped below 40% in August.

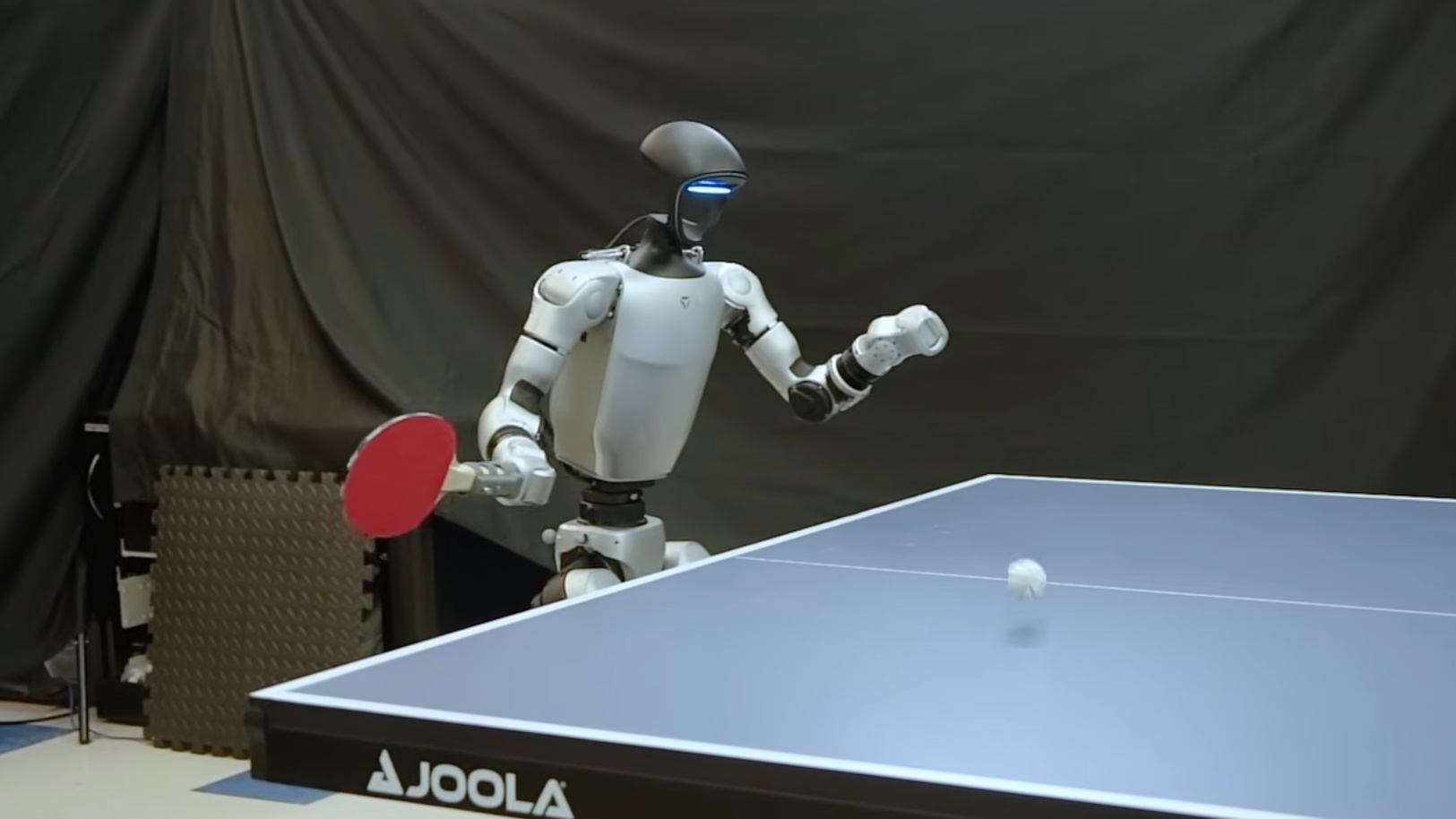

In Europe, Tesla’s sales have also slowed, while exports from its Shanghai plant declined through July and August. Adding further uncertainty, U.S. federal tax incentives for electric vehicle purchases are scheduled to end later this month. Musk has cautioned that the phase-out of subsidies could result in “a few rough quarters” before Tesla’s investments in autonomous driving and humanoid robots begin to yield meaningful revenue streams.

Board Maintains Support for Musk

Tesla’s board has remained steadfast in its support of Musk despite ongoing challenges. Chair Robyn Denholm described him as a “generational leader,” underscoring his role in steering Tesla’s evolution from a carmaker into a diversified technology company.

Denholm also dismissed concerns regarding Musk’s political activities, insisting that his personal views should not be conflated with Tesla’s corporate strategy.

Still, Musk’s recent appearance at a London rally hosted by far-right activist Tommy Robinson sparked criticism in the United Kingdom. His remarks predicting violence were labeled “inflammatory and dangerous” by a spokesperson for Prime Minister Keir Starmer.

Wealth and Market Impact

Musk remains the world’s wealthiest individual, with Bloomberg’s Billionaires Index estimating his net worth at $419 billion. His latest stock acquisition not only strengthens his personal stake in Tesla but also reassures investors that he remains committed to guiding the company through near-term turbulence.

By making a multibillion-dollar purchase, Musk has sent a clear signal of confidence in Tesla’s future within the increasingly competitive global electric vehicle market.