Hello! Ever feel like you’ve got nothing to eat at home? This story will make you feel a bit better. We asked young tech founders what was in their fridge. What we found was … not much.

In today’s big story, President Donald Trump wants to change how often companies report earnings. Market experts are split on whether the benefits outweigh the disadvantages. What do you think? Vote here.

What’s on deck:

Markets: How Tesla has turned around its share price this year.

Tech: Amazon hires two new executives as it readies its agentic AI debut.

Business: Now scooping: a fast-track to business ownership that’s too sweet to pass up.

But first, don’t worry about reporting for duty.

If this was forwarded to you, sign up here.

The big story

Earnings miss

President Donald Trump’s next target: revamping a Wall Street tradition.

The president said US companies should be required to report earnings every six months instead of every three. Trump, who raised the idea on Truth Social, said doing so would save companies money and allow managers to spend more time running their business.

Meanwhile, market experts were split on the idea, highlighting the benefits the change would bring to companies along with the challenges it would pose for investors, writes BI’s William Edwards.

How and when companies report earnings has become a topic of debate in recent years. High-profile executives like BlackRock’s Larry Fink, JPMorgan’s Jamie Dimon, and Warren Buffett have all criticized parts of the earnings process, saying it incentivizes short-term thinking among investors. Trump first suggested a change in 2018.

As companies stay private for longer, anything that softens the blow of becoming a public company could also convince more businesses to make the jump.

Still, Fink, Dimon, and Buffett didn’t suggest reducing the number of earnings reports. Their earnings issues revolve around the forecasting that executives provide. Future projections can lead to knee-jerk reactions from investors that send a stock skyrocketing or plummeting. That can incentivize management to chase short-term wins rather than a more sustainable long-term strategy.

But tweaking earnings and disclosures also raises questions about transparency. That’s particularly concerning for retail investors, who don’t have the same resources as their professional counterparts that are willing to shell out big for all kinds of wonky datasets.

One CFO I spoke to shared an illuminating reason quarterly earnings likely aren’t going anywhere.

As annoying and expensive as earnings reports can be for companies, they represent big business for those facilitating the trading they spark.

Banks, broker-dealers, and exchanges earn fees from trading, and nothing sparks a market feeding frenzy quite like a big earnings beat or miss. Earnings forecasts, as painful as they are for companies, can also give investors more reasons to trade, which is good for business.

So while public companies might want a break from earnings, others view them as a key catalyst keeping people trading.

Think of it like the weekly injury report in the NFL. (Stay with me here.)

Coaches hate having to disclose their players’ injuries publicly. In a show of protest, Bill Belichick famously listed Tom Brady on the injury report for years despite him being healthy.

Still, the league requires it. Why?

Because it’s key information that gambling sites use to accurately set betting lines for games. Without knowing who is or isn’t playing, sportsbooks wouldn’t feel comfortable taking bets on games.

I’m not suggesting that investing and sports gambling are an apples-to-apples comparison. (One is clearly more serious; I’ll let you decide which.)

However, it’s easy to see how earnings and injury reports both provide information that’s crucial to keeping the market built around their industries running.

3 things in markets

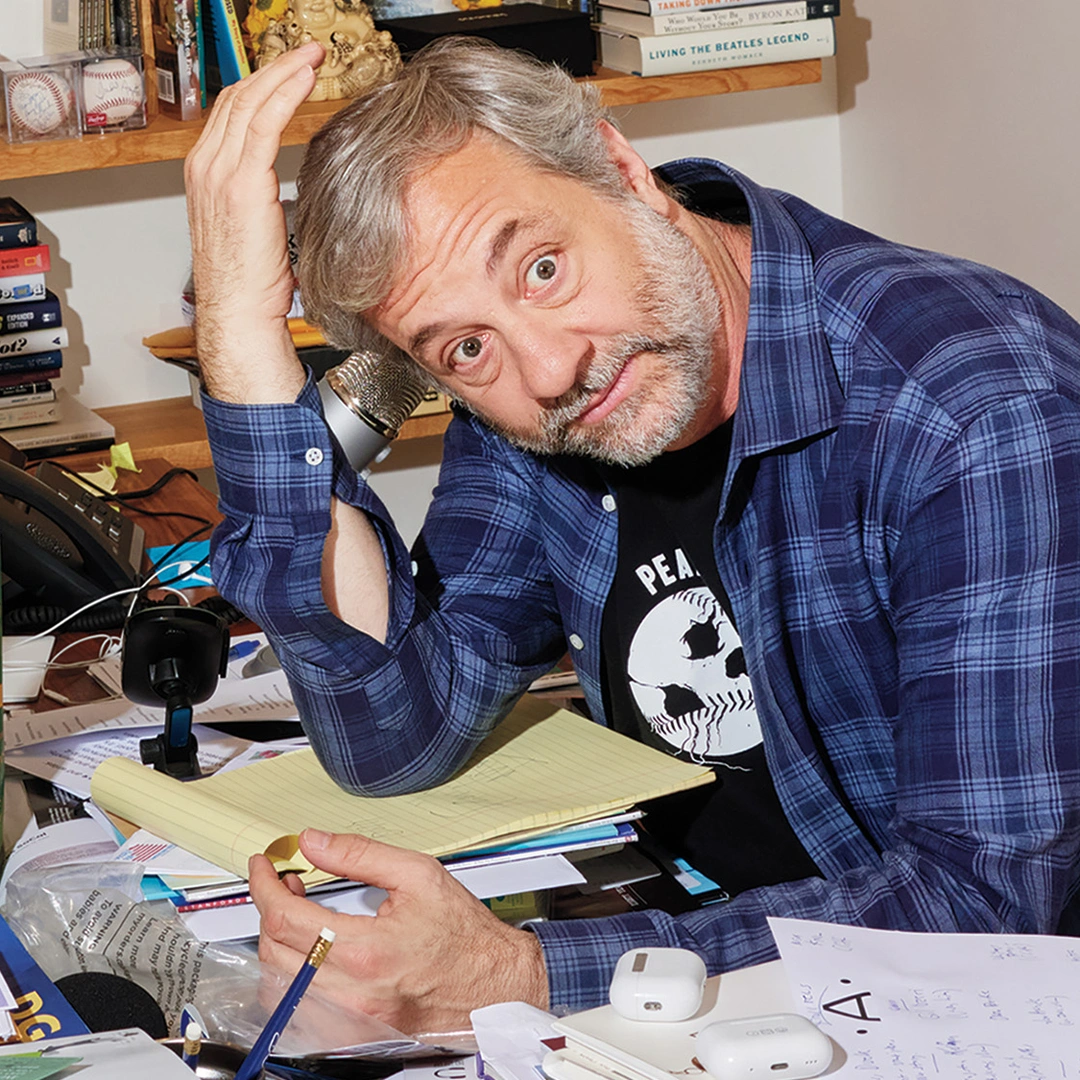

Retail investing icons see things going up and to the right. At the Independent Investor Summit in New York, retail favorites like Anthony Pompliano and Jon Najarian spoke optimistically about the market. Everyday traders at the event told BI they left feeling more confident about their stocks and crypto.

Meanwhile, at BofA the outlook isn’t so cheery. A top technical strategist at Bank of America indicated three signs the market’s rally might be about to reverse course. Timing is one issue — the end of September is typically the worst time of year for the S&P 500 — while the proportion of stocks rising versus those falling doesn’t look great either.

Tesla is back in the green. Year-to-date, the stock is positive again after plunging 45% at one point. These five key events explain its round trip. CEO Elon Musk also recently bought $1 billion worth of Tesla shares, but he’s still a long way from acquiring the 25% ownership stake he wants.

3 things in tech

Amazon hired two new leaders for its agentic AI push. AWS appointed David Richardson and Joe Hellerstein to executive roles working with different agentic offerings, BI’s Alistair Barr exclusively reports. Internal memos detail the projects they’ll be leading.

AI is running out of clean training data — but Googlers may have a fix. A large portion of the data scraped to train AI models isn’t used because it’s deemed toxic, inaccurate, or personally identifiable. DeepMind researchers, however, think a new method that rewrites and essentially purifies the unusable data could make it safe enough to be used for training.

“If it flies, it dies.” Defense tech companies like Palantir and Anduril are betting on quippy T-shirts and selling merch to court new fans. It’s a sign that working in defense, once taboo in tech, is now mainstream.

3 things in business

Want to run an ice cream shop? This could be your chance. Jeni’s Splendid Ice Creams, which has about 90 company-operated scoop shops around the country, is looking for franchisees to run stores in the South and Midwest. The company told BI it sees franchising as part of its path to long-term growth.

Lessons from the tennis court. Goldman partner Sara Naison-Tarajano learned important career lessons by playing sports as a kid. She says dealing with losing and focusing on the things you can control helped her succeed on Wall Street.

Trump continues his media battles. On Monday, the president’s lawyers filed a defamation-focused lawsuit in Florida against The New York Times, some of its reporters, and a book publisher. In a Truth Social post, the president said he’s looking for $15 billion.

In other news

Appeals court rejects Trump’s attempt to remove Lisa Cook ahead of Fed meeting.

Microsoft is close to getting a giant new equity stake in OpenAI. It could be worth at least $150 billion.

Alphabet just became the 4th-ever company worth $3 trillion.

A top economist says there’s an ‘uncomfortably high’ chance that the US is heading into a recession in the next year.

Mortgage regulator Bill Pulte has posted at least 13 agency orders on his personal X account.

Apple’s iPhone 17 appears to be off to a strong start in China.

What’s happening today

President Trump begins visit to the UK, where he’ll meet with King Charles.

Federal Open Market Committee meeting begins, with interest rate decision tomorrow.

Suspect in Charlie Kirk shooting appears in court.

Court hearing for Luigi Mangione.