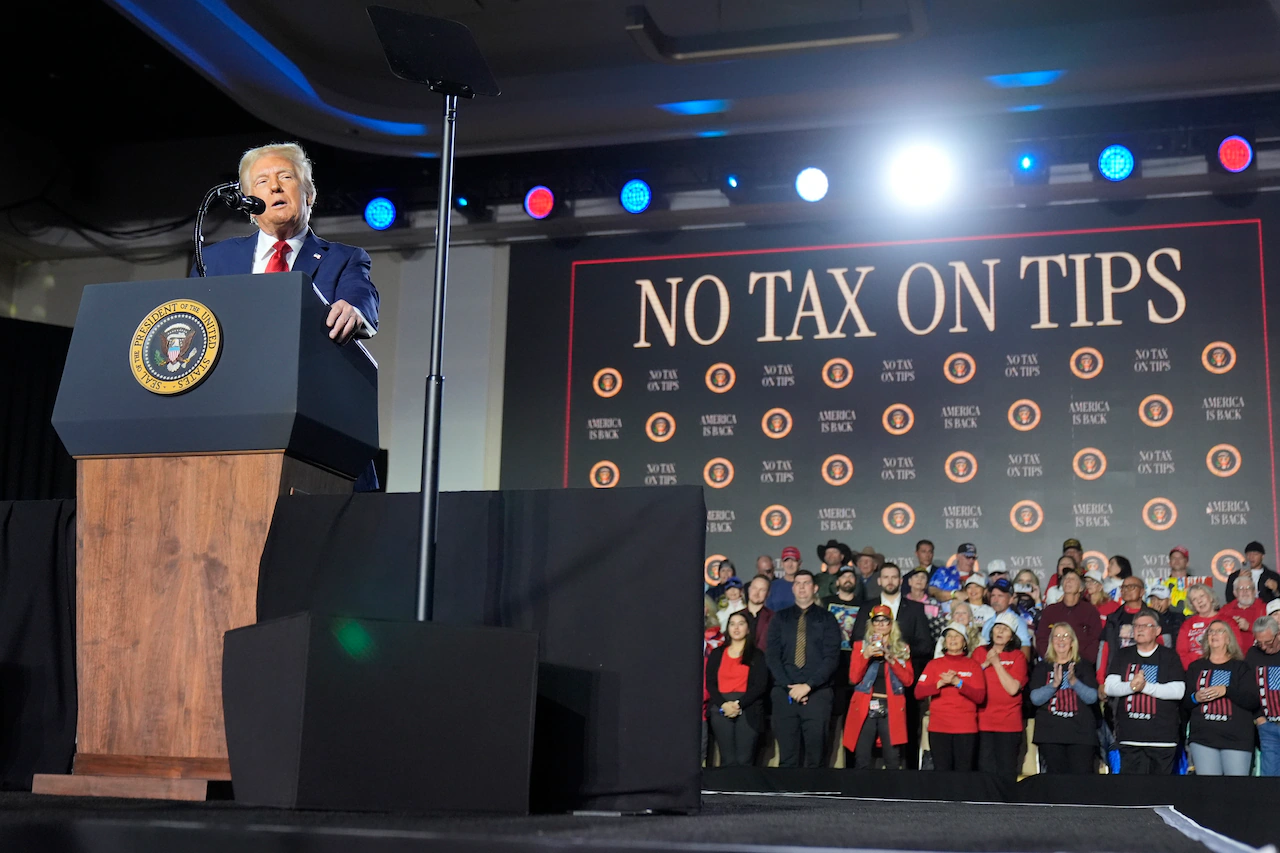

Millions of Americans working dozens of different jobs may soon be able to keep more of their hard-earned cash thanks to President Donald Trump’s “Big Beautiful Bill.”

The legislation included the creation of an above-the-line deduction for tips earned in traditionally tipped occupations, meaning those workers can now deduct tips from their taxable income, exempting those earnings from federal income taxes.

Workers can deduct up to $25,000 per year in qualified tips, which includes cash tips, tips paid by card and tips earned through tip-sharing arrangements.

The legislation defines qualified tips as “tips received by an individual in an occupation which customarily and regularly received tips.”

The U.S. Department of the Treasury recently released a preliminary list of 68 jobs that may qualify for the deduction, with an official proposed list expected to be published in the Federal Register for public comment in the near future.

Here’s a look at the preliminary list.

Beverage and food service

Bartenders

Wait staff

Food servers, non-restaurant

Dining room and cafeteria attendants and bartender helpers

Chefs and cooks

Food preparation workers

Fast food and counter workers

Dishwashers

Host staff, restaurant, lounge and coffee shop

Bakers

Entertainment and events

Gambling dealers

Gambling change persons and booth cashiers

Gambling cage workers

Gambling and sports book writers and runners

Dancers

Musicians and singers

Disc jockeys, except radio

Entertainers and performers

Digital content creators

Ushers, lobby attendants and ticket takers

Locker room, coatroom, and dressing room attendants

Hospitality and guest services

Baggage porters and bellhops

Concierges

Hotel, motel and resort desk clerks

Maids and housekeeping cleaners

Home services

Home maintenance and repair workers

Home landscaping and groundskeeping workers

Home electricians

Home plumbers

Home heating and air conditioning mechanics and installers

Home appliance installers and repairers

Home cleaning service workers

Locksmiths

Roadside assistance workers

Personal services

Personal care and service workers

Private event planners

Private event and portrait photographers

Private event videographers

Event officiants

Pet caretakers

Tutors

Nannies and babysitters

Personal appearance and wellness

Skincare specialists

Massage therapists

Barbers, hairdressers, hairstylists and cosmetologists

Shampooers

Manicurists and pedicurists

Eyebrow threading and waxing technicians

Makeup artists

Exercise trainers and group fitness instructors

Tattoo artists and piercers

Tailors

Shoe and leather workers and repairers

Recreation and instruction

Golf caddies

Self-enrichment teachers

Recreational and tour pilots

Tour guides and escorts

Travel guides

Sports and recreation instructors

Transportation and delivery

Parking and valet attendants

Taxi, rideshare drivers and chauffeurs

Shuttle drivers

Goods delivery people

Personal vehicle and equipment cleaners

Private and charter bus drivers

Water taxi operators and charter boat workers

Rickshaw, pedicab and carriage drivers

Home movers

More on the deduction

The deduction begins to phase out for single-filers earning more than $150,000 and joint-filers earning more than $300,000, with the deduction decreasing by $100 for each additional $1,000 in earnings beyond the aforementioned thresholds.

While workers won’t have to pay federal income tax on qualified tips, the tips will still be subject to the federal payroll tax, as well as state and local income and payroll taxes.

The Yale Budget Lab estimates that there were four million regularly tipped workers across the country in 2023, representing about 2.5% of all workers.

The Tax Policy Center said that roughly 60% of households with tipped workers will see a tax cut under the new legislation, with an average savings of about $1,800 per year.

The new deduction is temporary and will expire after 2028 barring any future legislation to extend it.