By Sai Keerthi

Copyright yourstory

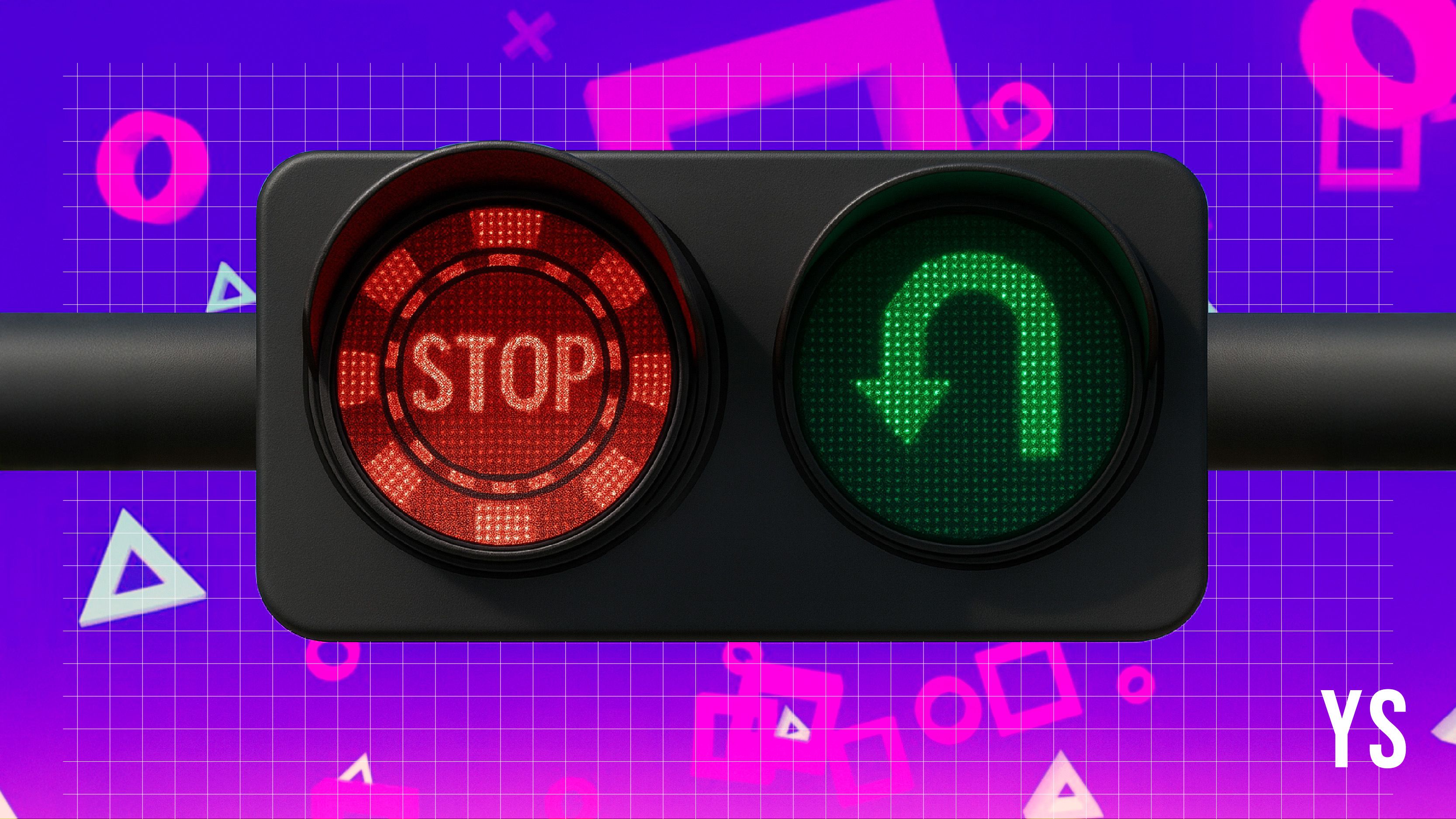

“Nobody saw this coming.” That is what an industry executive told YourStory when the new Promotion and Regulation of Online Gaming Bill, 2025, was making its rounds in the Parliament in late August. The bill triggered a knee-jerk reaction across a sector that was generating approximately $3.2 to $3.7 billion in revenue.

The bill was passed by the Parliament on August 21, banning all games where financial stakes are involved, whether based on chance, skill or a combination of both.

In a matter of days, Dream11 stepped away from its glitzy India cricket team sponsorship and Head Digital Works, the parent company of gaming platform A23, resorted to legal measures to question the ban.

According to an Economic Times report, nearly 2000 employees at real money gaming firms have lost their jobs, and around six firms have reduced their workforce.

On September 11, a report from ASK Private Wealth Hurun India Unicorn and Future Unicorn Report 2025 removed all real-money gaming companies from its list, noting that the short-term ramifications of the ban have been significant.

Almost a month in, these companies have laid out a roadmap for how their future would look like, be it doubling down on other verticals or even expanding to new ones.

Here is a look at how six major real-money gaming players are faring after the ban:

In FY23, the parent company of fantasy gaming company Dream11, Dream Sports, was clocking in Rs 6,400 crore in revenue, a major chunk of which was fuelled by platform fees received from users for participating in contests.

Cut to now, the company will see about a 95% loss in its revenue after the ban. And when it rains, it pours. The company had to discontinue its Team India sponsorship, double down on the free-to-play model and deal with no money coming in from contests.

However, Dream11 has weathered the storm. The company, after shutting down its paid contests, pivoted to ad-supported free-to-play social games with non-cash rewards, which, according to reports, includes iPhones.

Unlike other gaming companies, Dream Sports had other ventures that were generating revenue, though not on the scale of Dream11. These include sports streaming platform FanCode, sports travel service DreamSetGo, and its game development arm, Dream Game Studios.

The firm has also forayed into personal finance with Dream Money—a personal money management app which offers investments in gold, fixed deposits, and expense tracking.

Notably, Dream11 is one of the few RMG companies that have not announced any layoffs. CEO Harsh Jain, in a statement, affirmed that no job reduction was planned.

Mobile Premier League, which competed with Dream11 in the fantasy sports segment, had around 90 million users, according to the ASK Private Wealth Hurun India Unicorn and Future Unicorn Report 2025.

In FY24, the company’s revenue climbed 22% to $130 million (~Rs 1,144 crore) on the back of rising gross gaming revenue—the total amount of money earned by a gaming operator from players’ losses over a specific period—and an uptick in cash-paying monthly active users.

The company will not see revenue from either of these streams, going forward, after the ban. MPL’s CEO, Sai Srinivas, informed its employees that due to the ban, it would generate “zero revenue from India in the future.”

Unlike Dream11, which could redeploy its resources across other verticals, MPL had to resort to significant layoffs. According to reports, the company has let go of about 60% of its India-based workforce, which is expected to affect 300 out of 500 employees. The remaining number of employees has reportedly been relocated to support its international operations.

Currently, the firm has a presence in the United States and Europe through its acquisition of Germany-based GameDuell and in Brazil.

The Delhi-based company had seen a 150.7% rise in profit in FY24 to Rs 315.12 crore and a 70.4% jump in revenue to Rs 1055.2 crore. Much of this growth was attributed to a growing user base. However, the ban might have thrown a wrench in this growth.

Since shutting down its real money games, WinZO has ventured into short-form video content with ZO TV, which will focus on micro-dramas and short video content, which is currently available on a freemium model with free initial episodes and subsequent episodes behind a subscription, reportedly starting at Rs 2.

The company had set up international operations, foraying into Brazil in 2023 and the US this year. This launch was announced right after the real money gaming ban, providing the firm a cushion against the repercussions that followed.

Like Dream11, the company has not announced any layoffs and is instead redeploying its employees to new business areas such as sports, AI, fan engagement and ZO TV.

Ludo game platform Zupee is the latest company to announce layoffs. On September 11, the company said that it was letting go of about 170 employees, which accounts for about 30% of its workforce.

Notably, the company had increased its workforce by over 10% during FY24, hiring talent across product development, data science, technology and operations to support growth.

The company had reported its first-ever annual profit of Rs 146 crore in FY24 on the back of an expanding user base, beyond its core North Indian markets.

It has since expanded its free-to-play segment and has also forayed into short-form video content with Zupee Studio. The monetised platform will feature 1-3 minute mini-episodes across various genres, such as drama, romance, thriller, and comedy. It will be rolled out first on select Android devices and then expanded to iOS soon.

On September 15, the company also announced its entry into the eSports segment and is looking to democratise competitive gaming in India through traditional Indian games like Ludo, carrom, and chess into eSports formats.

Head Digital Works

Head Digital Works, which operates the A23 gaming platform that used to offer real-money card games, including rummy and poker, became one of the first online gaming firms to legally challenge the new ban.

According to multiple reports in late August, it filed a writ petition in the Karnataka High Court arguing that the Promotion and Regulation of Online Gaming Act, 2025, was unconstitutional.

After petitions were filed in different high courts, the Supreme Court ordered all online gaming ban cases to be consolidated and transferred to the apex court for a joint hearing.

Meanwhile, the company suspended its real-money gaming options to avoid legal prosecution.

In FY24, the company had reported a 24.1% rise in profit after tax to Rs 72 crore compared to Rs 58 crore in FY23. While the company reported an increase in its consolidated gross revenue from operations by 31%, the firm’s expenses saw a 33% jump due to the higher Goods and Services Tax (GST) rate of 28% which was effective from October 1, 2023.

The ban is expected to squeeze the company’s top and bottom-line numbers, just as that of its peers. To deal with the blow, Head Digital Works also resorted to layoffs, letting go of about 500 employees that made up two-thirds of its workforce, marking one of the biggest layoffs seen since the ban was put into effect.

The company, which operates RummyCircle and My11Circle, immediately suspended all money-based gaming on its platform and was quick to disable deposit functions and allow its users to withdraw their existing account balances.

According to reports, the company, just like many of its peers, is looking to strategically pivot to non-money online social games and e-sports, which are promoted and encouraged under the new legislation.

Games24X7 has also laid off about 500 employees, which accounts for 70% of its workforce, according to reports. The company was reportedly already facing setbacks from the higher 28% GST that was imposed on the industry in late 2023.

(Edited by Affirunisa Kankudti)