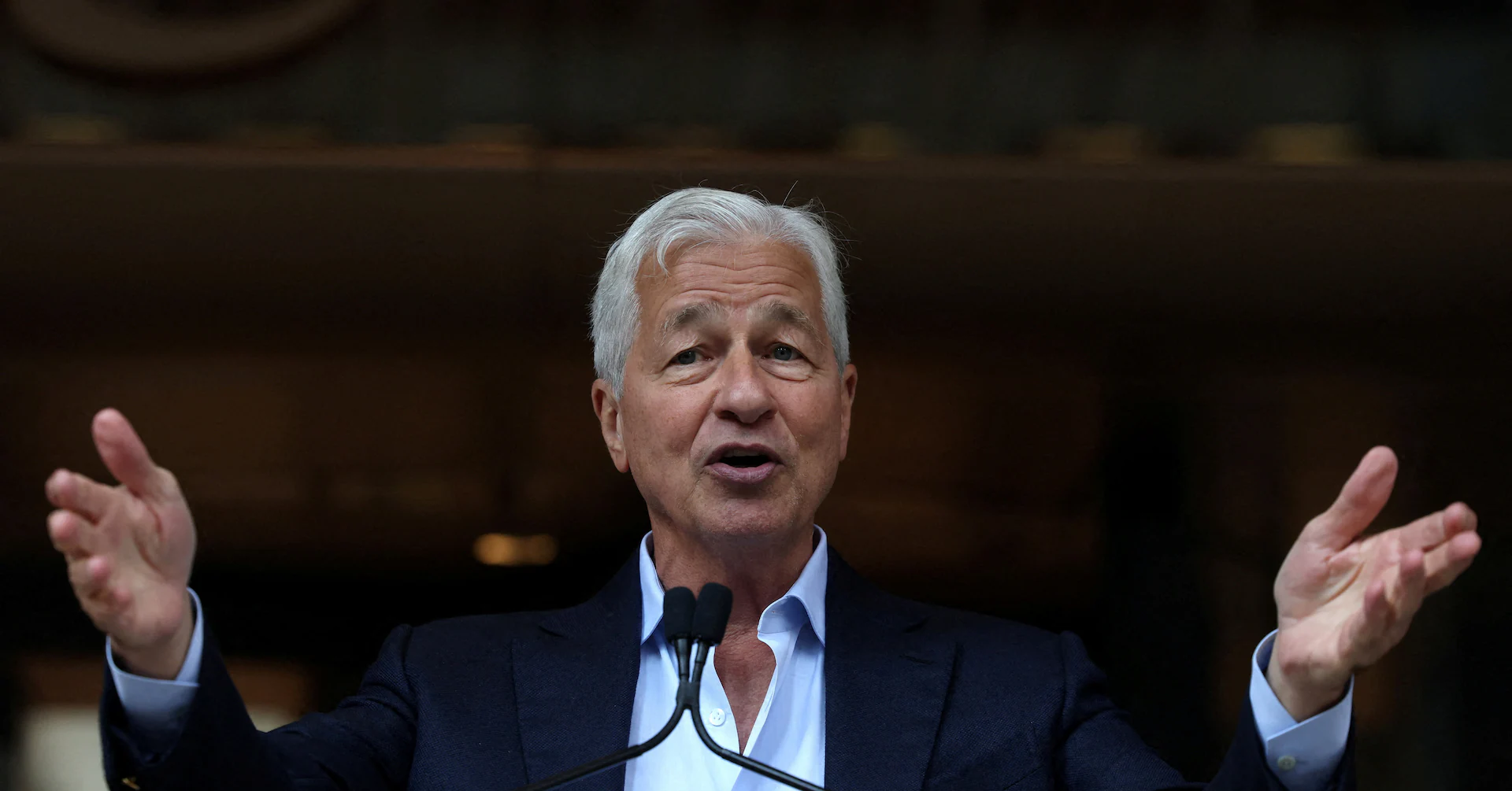

Dimon made his remarks during an interview on Bloomberg TV, where he also touched upon the bank’s yearly AI spends.

Sign up here.

Last month, U.S. President Donald Trump had renewed his call, first made in 2018, that U.S. companies should be allowed to report earnings every six months instead of on a quarterly basis, saying the move would save money and allow managers to focus on running the companies.

Paul Atkins, chairman of the U.S. SEC, said last week that the regulator is fast-tracking Trump’s push, sparking transparency concerns around the potentially major shift for U.S. companies.

“The bigger problem wasn’t just reporting quarterly. It was forecasting, where CEOs get their back up against a wall. They have to meet these things — earnings — and then they start doing dumb stuff to meet earnings, and that kind of public pressure,” Dimon said in the Bloomberg interview.

Dimon, who has been outspoken about regulations hindering public markets, said the bank would continue to provide investors with quarterly updates but with “much less stuff,” even if it were no longer required to do so.

In the interview, Dimon also said that JPMorgan spends $2 billion annually on developing artificial intelligence technology, and saves almost the same amount yearly from the investment.

“We know that it’s got to billions of cost savings and I think it’s the tip of the iceberg,” Dimon said.

Reporting by Pritam Biswas in Bengaluru; Editing by Shailesh Kuber