By Adam S. Minsky,Andrew Harnik,Senior Contributor

Copyright forbes

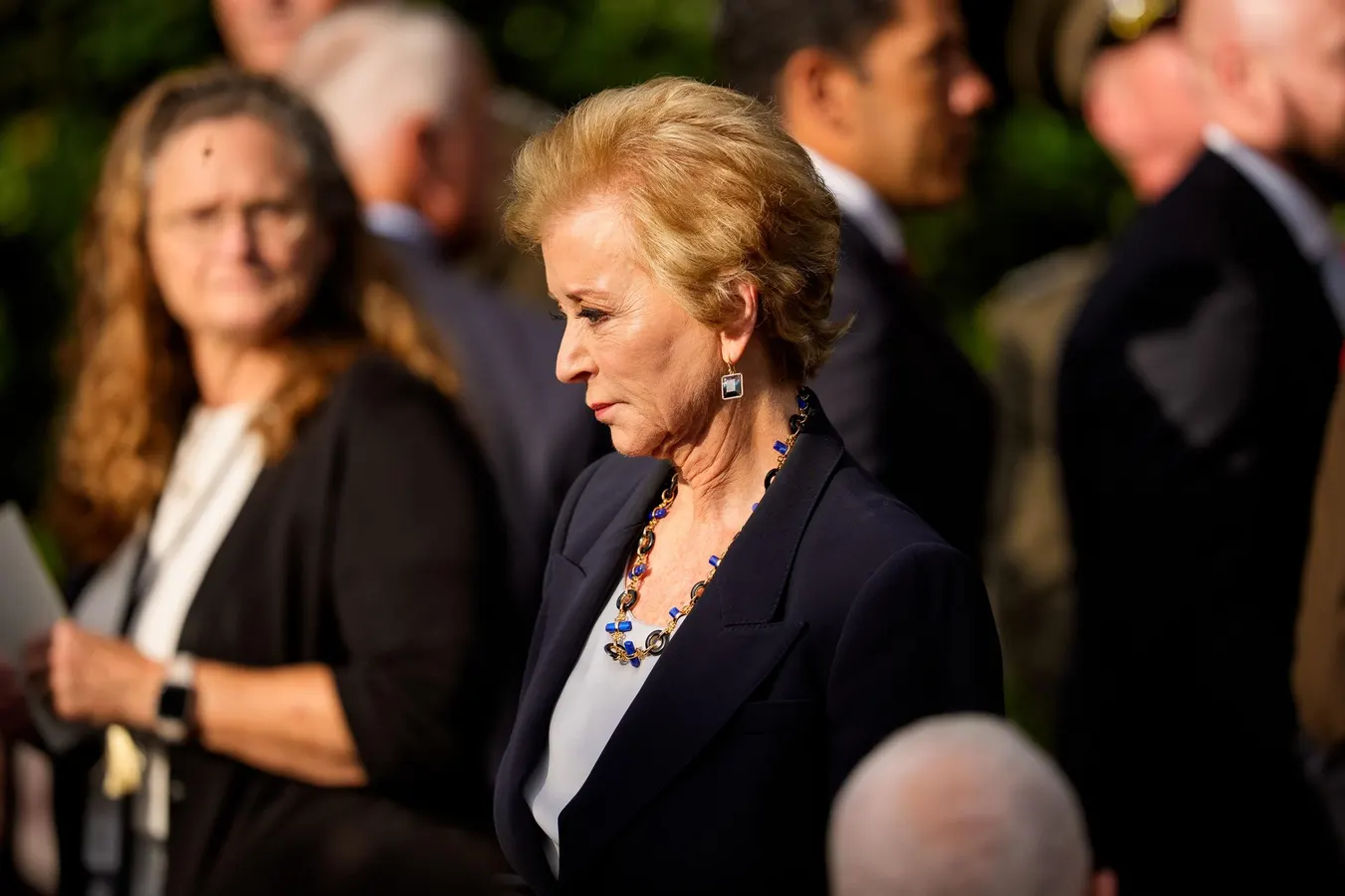

ARLINGTON, VIRGINIA – SEPTEMBER 11: Education Secretary Linda McMahon arrives for a September 11th observance event in the courtyard of the Pentagon September 11, 2025 in Arlington, Virginia. McMahon and the Education Department are facing a legal challenge over a backlog of student loan forgiveness and repayment applications. (Photo by Andrew Harnik/Getty Images)

Getty Images

The Department of Education posted a new update on Monday on massive application backlogs plaguing several federal student loan forgiveness and repayment programs. The latest filing reflects the department’s steady but slow progress working through hundreds of thousands of applications, and comes as borrowers are gearing up for major legal developments later this week.

The filing by Secretary of Education Linda McMahon, which is the department’s sixth consecutive monthly update, indicates that more than a million applications for multiple income-driven repayment, or IDR, plans remain unprocessed, leaving many unable to access affordable payment plans provided by federal law. And the application backlog for the PSLF Buyback program, which offers a pathway to student loan forgiveness for borrowers who are unable to receive Public Service Loan Forgiveness credit due to a deferment or forbearance period, continues to grow despite notably faster processing by the department in recent weeks.

In the meantime, a major national labor union that is currently suing the department over these issues is seeking to dramatically expand the scope of its legal challenge, with a significant update expected later this week. Here’s what student loan borrowers should know.

More Than A Million Student Loan Borrowers Still In IDR Backlog

This month’s status report filing on the Department of Education’s IDR application backlog reflects ongoing steady progress in processing applications. But the sheer volume of unprocessed applications continues to be daunting.

The original IDR backlog contained nearly two million applications earlier this spring, according to department data. The status report filed on Monday indicates that the backlog has now been reduced to 1,076,266 applications, with more than 300,000 applications processed during the month of August. The department’s processing rate held steady from the prior month.

MORE FOR YOU

Critics have argued that the department’s processing rate is insufficient to clear the IDR backlog within a reasonable timeframe, and some borrowers have been waiting six months or longer for a decision. Furthermore, media reports earlier this summer indicated that the department was preparing to summarily deny or reject more than 400,000 IDR applications, largely for those who applied for either SAVE plan (which is blocked due to a legal challenge) or who selected an option permitting their loan servicer to pick the IDR plan with the lowest monthly payment. Most of these borrowers will likely have to submit a new IDR application, which will further increase the size of the application backlog.

Application Backlog For Student Loan Forgiveness Through PSLF Buyback Grows Even Larger

Meanwhile, the application backlog for PSLF Buyback continues to grow larger for borrowers pursuing student loan forgiveness based on public service employment. The Department of Education’s latest status report filed on Monday indicates that the backlog has now grown to 74,510 applications, up from 72,730 the prior month. The PSLF Buyback application backlog has increased every month for each of the last six months, according to the department’s filings. The backlog stood at just under 50,000 applications in April.

If there’s any good news for borrowers, it’s that the rate that the PSLF Buyback application backlog is increasing appears to have slowed a bit compared to prior months. And the pace of application processing appears to have picked up, with 5,600 PSLF Buyback applications processed in August compared to 3,280 the previous month. Even so, it would take the department more than 13 months to get through the backlog at the current rate of processing, and that assumes that no additional PSLF Buyback applications get submitted. That’s unlikely to occur, given that borrowers in the SAVE plan forbearance continue to accrue no credit toward student loan forgiveness, even as the department touts PSLF Buyback as a potential workaround solution.

“Some borrowers may be eligible to ‘buy back’ months of PSLF credit for time spent in forbearance as a result of the court’s injunction,” says department web guidance. “Borrowers with 120 months of eligible employment can buy back (make payments to cover) past months that were not originally counted as qualifying payments because the borrower was in an ineligible deferment or forbearance status.”

Legal Challenge Over Stalled Student Loan Forgiveness Heats Up

The Department of Education’s latest status filing comes as the American Federation of Teachers prepares to expand the scope of its legal challenge.

The AFT, which is one of the nation’s largest teacher’s unions, sued the department in March after the Trump administration effectively halted all IDR applications following a new decision in the separate legal challenge over the future of the SAVE plan. Trump administration officials had argued that a systemwide IDR pause was necessary for the department to update the IDR application to comply with that new court order.

But the AFT and other student loan borrower advocacy groups disputed this, arguing that a systemwide IDR shutdown unnecessarily and unlawfully deprived borrowers of accessing affordable payments under IDR plans, and effectively prevented borrowers from pursuing student loan forgiveness under both IDR and PSLF. IDR plans typically allow for student loan forgiveness after 20 or 25 years in repayment, while PSLF can wipe out a borrower’s federal student loan debt after 10 years in repayment (and being in an IDR plan is typically required for PSLF borrowers). The department resumed processing IDR applications soon after the AFT filed suit, but has struggled to get through the resulting backlog.

The AFT paused its lawsuit after reaching a temporary agreement with the department in April that required monthly status report filings reflecting processing progress for IDR applications and the PSLF Buyback program. But last week, the AFT filed an amended complaint, arguing that the department’s progress during these last six months has been insufficient.

“Although the Department began to process pending IDR applications after this case was filed, the slow rate of processing and the lack of transparency with respect to whether processed applications are being correctly approved or denied do not meaningfully address the reality that borrowers are still being denied their statutory rights to affordable payment plans and to debt cancellation,” said the AFT in its amended complaint last week.

The AFT also sought to expand the scope of the lawsuit to include denials of student loan forgiveness under the IBR, ICR and PAYE plans. The union noted that IBR in particularly is not subject to any legal challenge or court injunction blocking the Department of Education from discharging borrowers’ student loans. The AFT is seeking class action status, and is expected to file a motion for a preliminary injunction later this week.

Editorial StandardsReprints & Permissions