By Giulia Carbonaro

Copyright newsweek

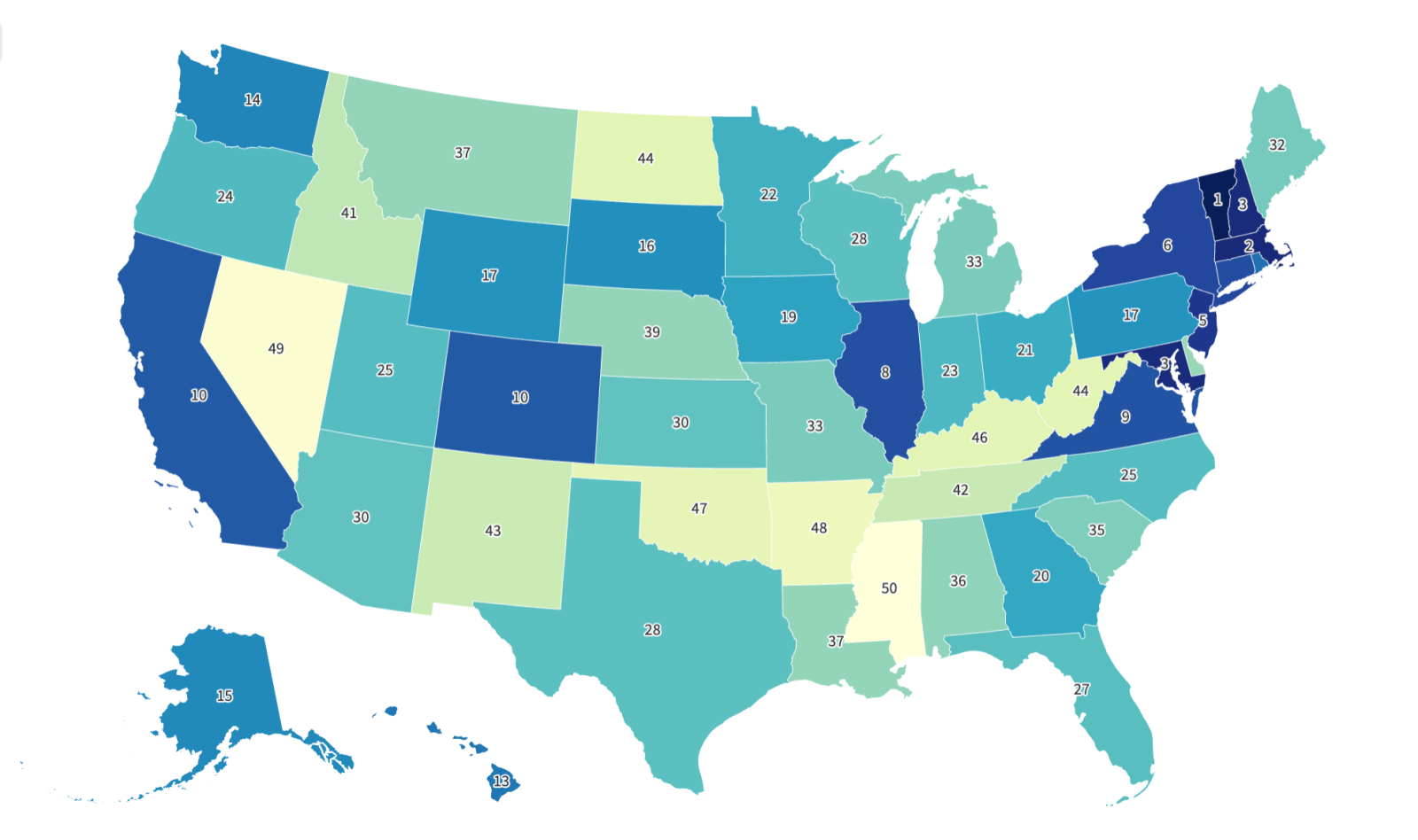

Student loan borrowers in Vermont face the highest repayments in the nation, according to a new study by WalletHub, with the average debtor owing a median $248 per month.

That is $106 more than what the average student loan borrower in Mississippi, the state with the lowest payments, owes.

Nearly 43 million Americans—nearly one in six adults in the country—had federal student loan debt by the end of 2024, according to data by the Department of Education, owing a combined $1.6 trillion.

That was 42 percent more than what they owed a decade earlier, showing that more Americans are going to college, and higher education is getting more expensive. It sums up to an average of more than $39,000 per person.

But the amount of student loan debt carried by borrowers—and how much they have to repay—varies widely depending on where in the country they are based.

Where Are Student Loan Payments Higher—And Where Are They Lower?

According to WalletHub’s analysis, the five states with the highest student loan payments are Vermont, with a median payment of $248 per month, followed by Massachusetts ($241), Maryland ($240), New Hampshire ($240), and New Jersey ($235).

The states with the lowest student loan payments are concentrated in the South and the Midwest, with the exception of Nevada. Mississippi has the lowest student loan payment of the nation, at $142 per month. It was followed by Nevada ($145), Arkansas ($153), Oklahoma ($157), and Kentucky ($158).

WalletHub made its estimates based on their latest data on consumers’ finances. This data was used to determine the median student loan payment per user by state.

The sum that borrowers need to repay depends on several factors, including how expensive the colleges are, and whether borrowers had enough savings to pay tuition up front. Other factors, like how expensive the cost of living is where borrowers live, or the job they do, can impact their capability to repay their debt.

What Is Happening With Student Loan Repayments?

Former President Joe Biden spearheaded a nationwide student loan forgiveness effort during his administration, managing to cancel student loans for more than 5 millions Americans. While he fell short of realizing his full plan, which was debated and fought against by Republican lawmakers, Biden and his administration managed to waive $183.6 billion in student loans.

President Donald Trump, once he returned to the White House, took a different approach to student loan forgiveness.

Back in July 2024, the Trump administration and the Department of Education announced the pausing of a student loan forgiveness program—the Income-Based Repayment—as their “systems” were being updated—though a timeline for these changes to be completed was not immediately offered.

Earlier this week, the Department of Education resumed the program after nearly a yearlong pause, e-mailing borrowers with notices confirming whether they had met the timeline required for loan forgiveness.

Students gather on the campus of UMass Lowell after a shelter in place order was lifted at the university in Lowell, Massachusetts, on September 3, 2025, following reports of an active shooter. (JOSEPH PREZIOSO/AFP via Getty Images)

The department has also started to work on how to implement Trump’s recent overhaul of student loan repayments as included in the One Big Beautiful Bill (OBBB) that the president signed into law in early July.

The details of the changes still need to be discussed, but the goal is to eventually phase out three income-driven repayment plans—the Income-Contingent Repayment, the Pay As You Earn and President Joe Biden’s Saving on a Valuable Education plans.

These plans will be replaced by a new plan called the Repayment Assistance Plan (RAP), which will set monthly repayments at 1 to 10 percent of a borrower’s annual adjusted gross income from the previous tax year.

These changes are not expected to be implemented before July 2026.

A map showing the highest and lowest student loan payments across the country, by state. (WalletHub)