Joy Reid says Republicans want to abolish income tax and let people keep all their earnings to themselves

By Editor,Natasha Anderson

Copyright dailymail

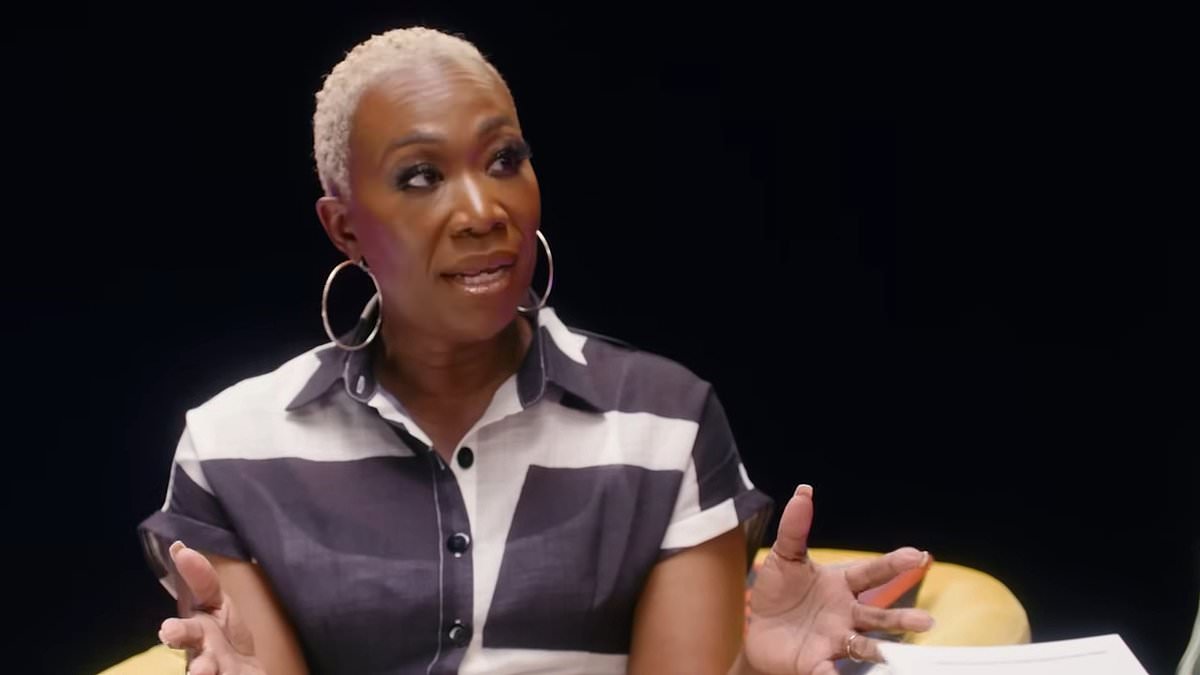

Ousted MSNBC host Joy Reid has claimed Republicans want to eliminate income tax so America can return to its ‘hierarchical past’.

Reid, during a BET Talks event Monday, said that ‘everyone is living in fear’ as the country experiences what she described as a ‘fascist moment’, which she further defined as a ‘right wing, white nationalist, white supremacist moment’.

She accused the GOP of wanting to rollback business regulations and restore racial hierarchy in the US that would see ‘white men at the top’ and ‘black people at the bottom, with women near the bottom’.

Reid argued conservatives are actively ‘building’ a society where the wealthiest earners no longer have to pay taxes or face regulation.

‘One of the reasons they’re so serious about it is that, if you go back before the 20th century, there were no income taxes,’ she told BET host Miabelle.

‘There were no regulations on business. You could earn as much money as you want, leave 100 percent of it to your children with no taxes.

‘That’s the world they want back –– and to get it back, they need society to change. They need people to be less modern. They need people to want fewer things. They need people to be satisfied just being workers.’

Reid further alleged that Republicans ‘don’t really believe that any of us have natural rights’.

Reid’s show The ReidOut was canceled by MSNBC earlier this year, with the host at the time claiming she was fired from the liberal network due to her race and ‘anxiety’ over President Donald Trump.

She also alleged her firing had nothing to do with the show’s cratering ratings and speculated her outspoken views on Trump and the war in Gaza may have played a role in her ousting.

Reid has a long history of accusing the GOP of racial injustice and just four years ago suggested the party would trade tax cuts to return to pre-civil rights era America.

‘I’ll say it again: people on the right would trade all the tax cuts for the ability to openly say the n-word like in “the good old days”,’ she tweeted in 2012.

‘To them, not being able to be openly racist and discriminatory without consequence is oppression. Trump is the avatar for this “freedom”.’

Her recent comments at the BET event seemingly echo this remark, with Reid suggesting the party now wants to eliminate the tax system altogether to achieve an alleged goal of restoring racial hierarchy.

The Daily Mail has approached the White House for comment.

The federal income tax system was introduced in 1913 with the ratification of the 16th Amendment.

The amendment gave Congress the power to collect taxes on income without having to apportion the funds among the states based on population.

It was ratified after decades of on-again, off-again efforts to collect income taxes, with the earliest dating back to the Civil War.

Income tax rates have varied over the years, with the highest federal income rate recorded in 1944 at 94 percent.

Lawmakers have continuously worked to cut taxes and today the highest marginal federal income tax rate is 37 percent.

Trump made slashing taxes and government spending a key part of his re-election campaign.

And new tax laws under his ‘One Big Beautiful Bill Act’ could allow millions to pay nothing in federal income tax when they file in 2026 for the 2025 tax year.

The share of households that do not pay income tax will climb from 40 percent to 42 percent, according to early estimates from the Tax Policy Center.

People who will benefit the most from the new tax law include parents, overtime workers, tip-makers, seniors aged 65 and up, and adoptive families.

But state legislators warn the federal tax cuts could reduce revenues for states that link their own income taxes to the federal code, starting with 2025 tax returns.

Federal spending reductions on Medicaid and food benefits also could cause states to spend more of their own money on social safety net programs.

But new Medicaid work requirements, which are among the most prominent changes, don’t begin until 2027.

Administrative cost shifts to states for food stamps begin in October 2026, with additional performance-based cost shifts in subsequent years.